01

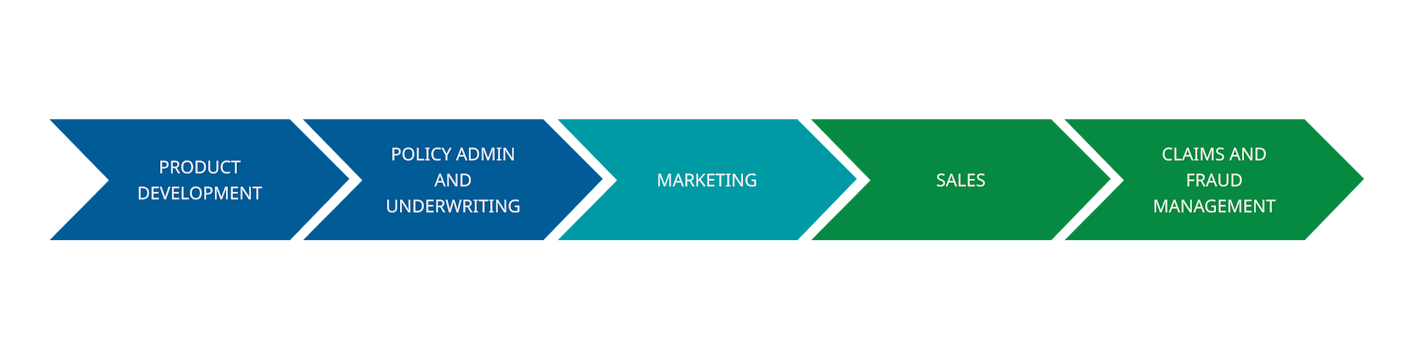

Wave One: Digital Insurance

PATH TO PROFITABILITY

Disruptors

Novel standards in customer experience, claims processing, and pricing strategies. Powered by digital platforms and AI technologies, it challenged traditional insurance models in terms of efficiency, accessibility, and customer centricity.