AI & Risk Management: Tackling Climate Risks, Boosting P&C Profits

We discussed previously how parametric insurance is bridging the protection gap exacerbated by climate change, taking Insurtech Raincoat as an example (Why Parametric Insurance for Climate Change (nttdata.com)). By setting objective and measurable triggers for payouts, this approach aims to tackle one of the industry's most pressing pain points: response time. While promising, its scalability and impact have faced challenges. By 2050, the World Economic Forum forecasts [1]

that the global cost of climate change damage will be between $1.7 trillion and $3.1 trillion per year. Meanwhile, some insurance carriers are withdrawing from admitted markets, leaving many households unprotected.

External factors like inflation and increased climate volatility contribute to these issues. However, another critical consideration is the mismatch between the payout triggered by predetermined external parameters (such as wind speed, earthquake magnitude, or rainfall levels) and the actual losses incurred. This means that minimizing this discrepancy and achieving higher precision might be the game changer. As a result, regulators, insurers, tech giants, and Insurtechs are exploring alternative risk management solutions. The integration of AI is at the forefront of these efforts.

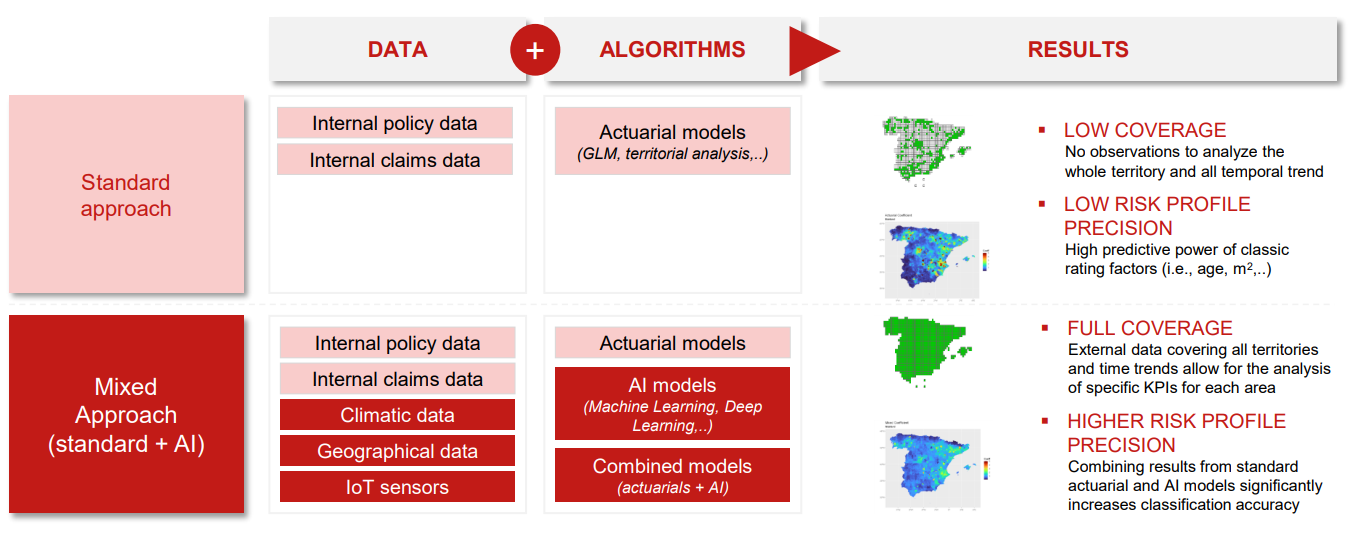

Research [2] found that Artificial Intelligence can significantly improve the fairness of natural catastrophe models, with external data leading to more accurate identification of risk profiles and fairer pricing. Compared to the standard approach, the mixed approach combining standard approaches with AI algorithms demonstrates higher technical accuracy and robustness in the risk modeling of natural catastrophes. On one hand, adding more granular external data, such as climatic data, geographical data, and data collected from IoT sensors, allows for the analysis of whole territory and all temporal trends as well as specific KPIs for each area. On the other hand, combining results from standard actuarial and AI models also significantly increases risk profile classification accuracy.

Here let’s explore two examples of Insurtechs leveraging AI technologies to enhance various aspects of risk assessment, mitigation, and overall management.

Case of Kettle: next-level parametric insurance

Kettle [3] is an Insurtech that offers commercial parametric wildfire products. Founded in 2019, the latest notable updates about the company were the partnership with Reask [4] in 2023 and a $25-million Series A financing round in 2021. This case provides valuable insights into how Insurtechs can integrate AI into parametric insurance and the precision they can achieve.

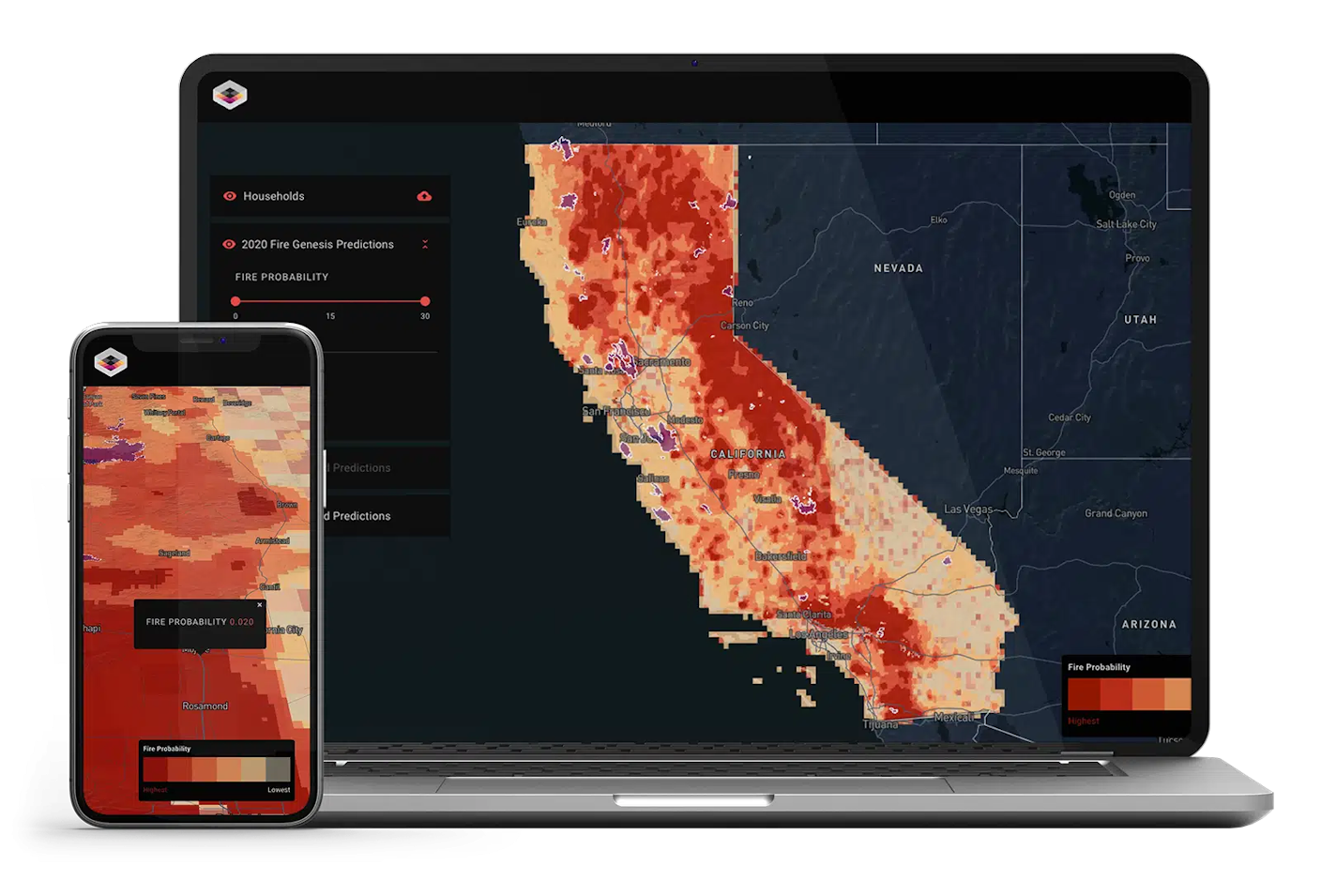

Kettle uses sophisticated machine learning models that analyze billions of lines of weather, fuel, satellite, anthropogenic, and ground truth data to predict wildfire likelihood in any given square mile. Nathaniel Manning, Co-Founder and COO (Chief Operating Officer) of Kettle highlights the predictive power of AI in enabling better pricing and lowering basis risk: “In Kettle’s case, AI allows for creating synthetic wind speeds based on real data points, which allows for triggers without needing expensive hardware sensors on every building”. [5]

Kettle has developed a robust risk management solution encompassing both assessment and mitigation strategies. By integrating data from NASA, NOAA, and the European Space Agency through an extract, transform, and load (ETL) pipeline, Kettle builds a deep neural network model that generates over 2 million wildfire footprints at a 100-meter resolution. The accuracy score of Kettle’s Genesis Model reaches 89% by dividing California into 419,000 microgrids, each half a square mile in size [6]. It then uses these millions of grid-level, high resolution simulations to generate wildfire ignition and spreading patterns, accurately capturing the distribution of wildfire risk and property damage. Finally, the model informs mitigation strategies that could potentially lower insurance premiums for property owners.

Flash forward to 2024, and AI technology has advanced significantly. The level of precision Kettle achieved even four years ago sets a high benchmark. Given these advancements, customers now have higher expectations. Kettle’s approach provides a reference point for the precision that companies using AI in parametric insurance should strive to reach.

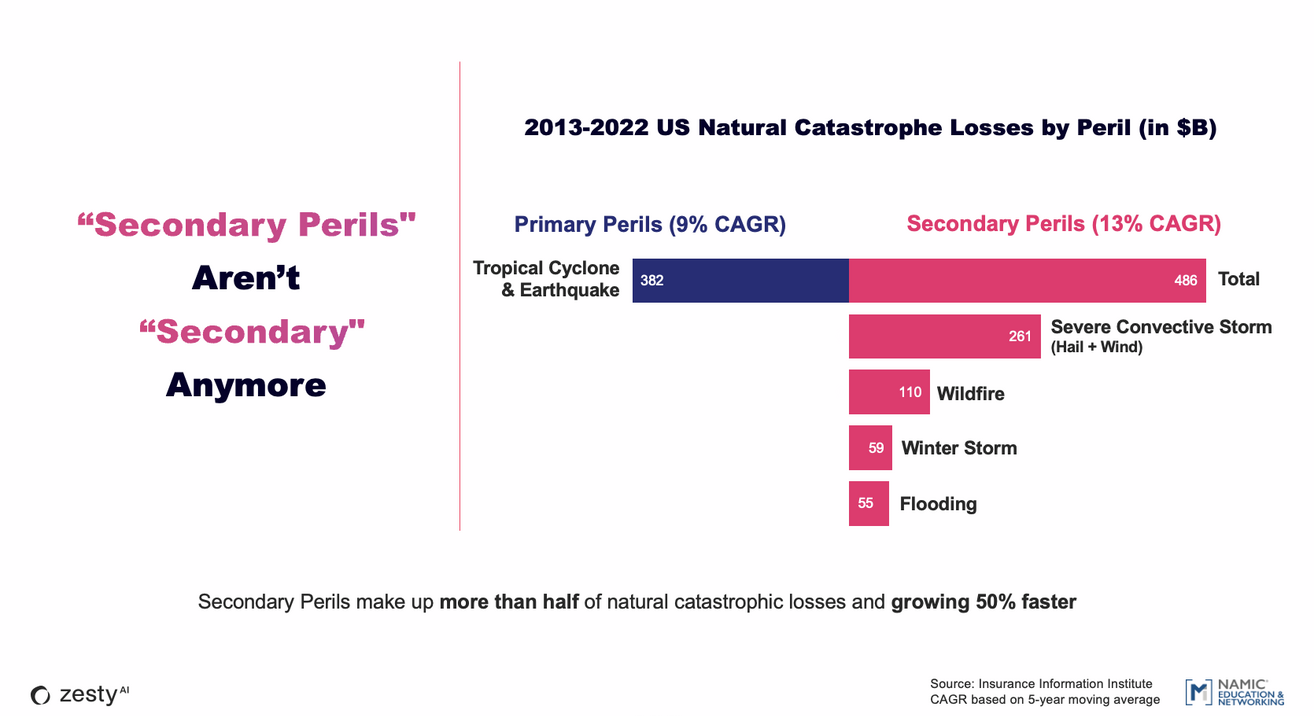

Case of ZestyAI: harnessing AI and data science to assess risk exposure at the property level

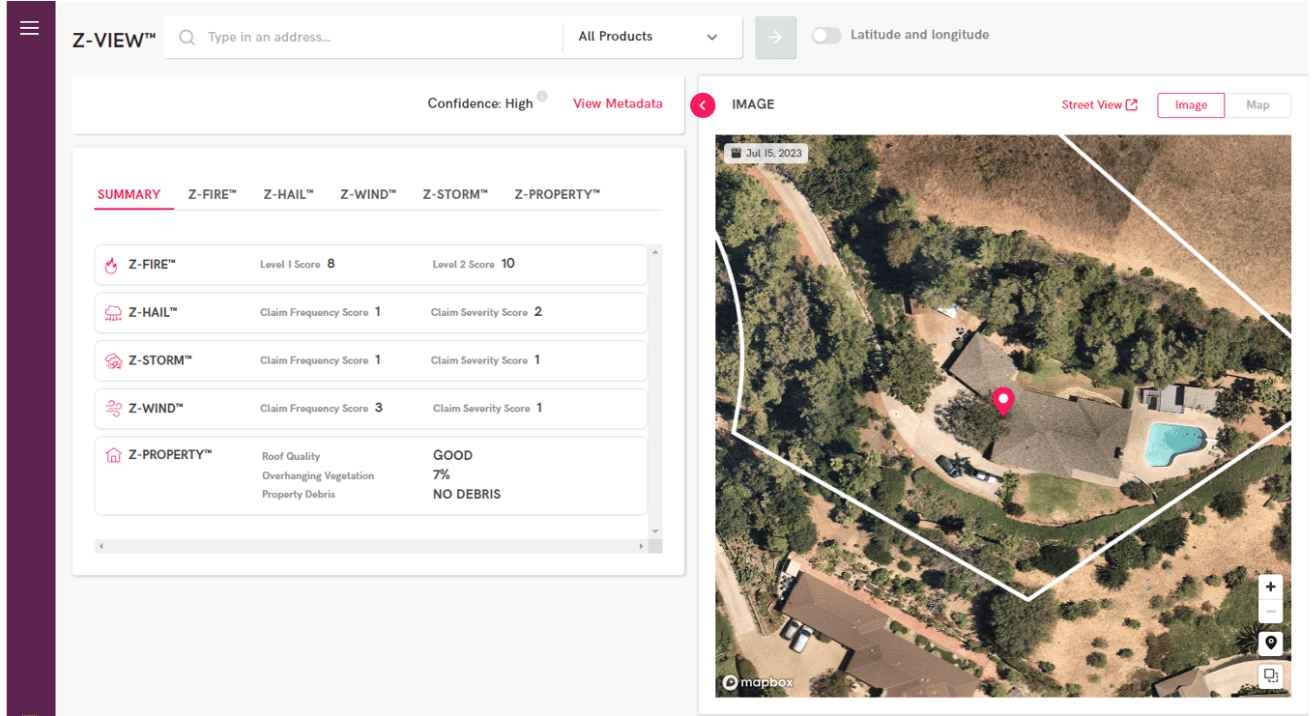

ZestyAI [7] is a leading provider of climate and property risk analytics solutions powered by AI. Compared to Kettle, which shares a similar mission, ZestyAI has been much more active in this field in recent years. The company closed a $33 million Series B funding round in July 2022. In the first half of 2024, ZestyAI announced several partnerships with insurers and tech providers, including Duck Creek Technologies [8], COUNTRY Financial [9], Avoca Risk Underwriting Solutions [10], and Florida Peninsula Insurance [11]. Previously, ZestyAI also partnered with Cytora and MetLife, along with many leading insurers. "ZestyAI's growth is fueled by being at the intersection of two current megatrends: AI and Climate," said Attila Toth, Founder and CEO of ZestyAI.

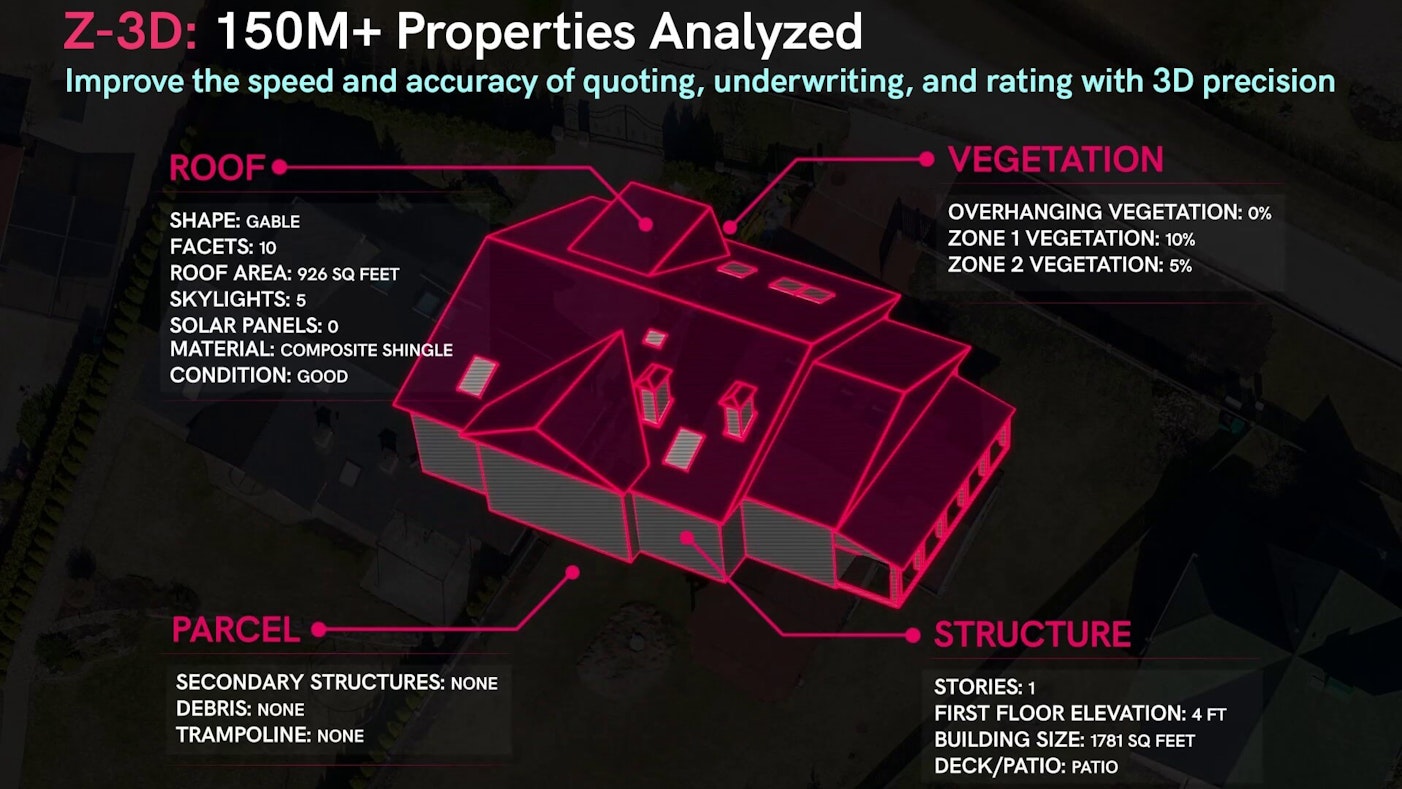

ZestyAI's selling point is its extensive reservoir of unique property insights. Originally a clean energy tech startup named PowerScout, the company developed remote-sensing AI models to accurately estimate solar panel installations and energy output for rooftops across the US. This involved mapping 120 million [12] rooftops with three-dimensional accuracy using high-resolution aerial and satellite imagery. The company gathered detailed data on roof size, material, vegetation density, and more for every property in the nation, initially for their digital clean energy marketplace and later to help P&C insurers make smarter risk decisions.

In addition to the above-mentioned data points of roof and location insights, by leveraging the power of AI and digital twins, ZestyAI also analyzes building permits, real estate transactions, climatology, historical loss data, and historical aerial imagery to produce even more accurate property insights. All the information is automatically incorporated into underwriting at the time of quote using ZestyAI’s API-based platform, which enables better underwriting, risk selection, and renewal decisions, lower loss ratio, and more proactive risk management solutions.

As these technologies continue to evolve, the insurance industry can expect to see more robust and proactive risk management solutions, ultimately bridging the protection gap exacerbated by climate change. For insurers, the benefits are clear: reduced time-consuming manual reviews and inspections, faster and more accurate quotes, and lower loss ratios through superior risk selection. For policyholders, the advantages are equally significant: improved product fit, rapid payout, and more fair and appropriate coverage based on individual property risk profiles. This new era of AI-enhanced risk management is poised to significantly mitigate the financial impacts of global challenges such as climate change while driving the industry towards greater innovation and sustainability.

Insurtech Global Outlook - NTT DATA

[1] Climate change is costing the world $16 million per hour: study. https://www.weforum.org/agenda/2023/10/climate-loss-and-damage-cost-16-million-per-hour/#:~:text=Follow-,The%20global%20cost%20of%20climate%20change%20damage%20is%20estimated%20to,%2C%20agriculture%2C%20and%20human%20health.

[2] AI Governance In Natural Catastrophes Risk Modelling, EIOPA Conference on AI Governance. https://www.eiopa.europa.eu/document/download/d8065ab1-5717-4ce4-b6e4-cf9379b7775a_en?filename=AI%20governance%20in%20NatCat%20-%20Generali%20Group.pdf

[4] https://www.artemis.bm/news/kettle-offers-parametric-hurricane-reinsurance-using-reask-model-data/

[5] https://www.forbes.com/sites/ruthfoxeblader/2024/02/15/ai-is-supercharging-parametric-insurance/

[6] https://www.insurancenews.com.au/insurtech/reinsurance-startup-kettle-uses-ai-to-price-wildfire-risk

[8] https://ffnews.com/newsarticle/fintech/zestyais-joins-duck-creeks-solution-partner-ecosystem/

[9] https://ffnews.com/newsarticle/insurtech/zestyai-welcomes-country-financial/

[12] https://zesty.ai/news/reinventing-risk-the-birth-of-zestyai

Header photo by Javier Balseiro on Unsplash

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email