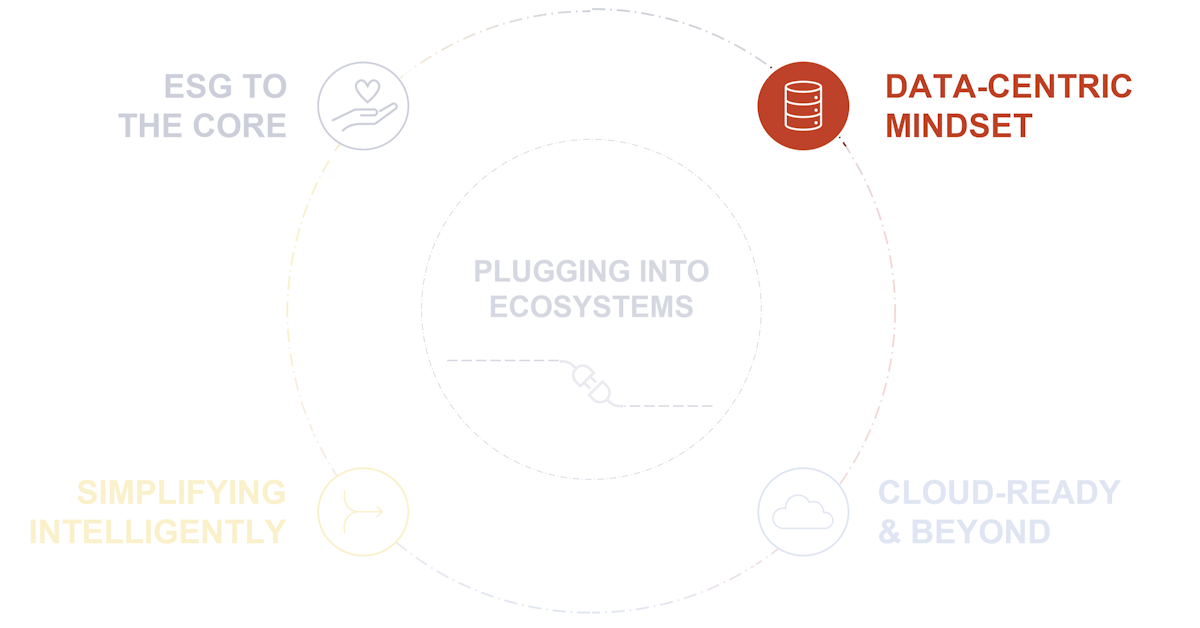

Data-Centric Mindset

Data as the Fuel of All Insurers' Operations

Data Across the Insurance Value Chain

Use real-time, actionable data to know better our customer.

The insurance industry is no exception to the actionable and real-time data trend. The incorporation of data into all areas of an insurance company has become not only essential but mandatory. Data-driven decision-making is a must and companies that do not embrace this cultural transformation risk being left behind by their competitors.

Insurers must go beyond just implementing data analysis tools. Instead, data must be integrated throughout the whole value chain, into all processes, and across all departments within the organization. By doing so, insurers can gain insights that allow them to make more informed decisions, develop more accurate risk models, and provide better customer experiences.

Three Ideas to Take Away

DATA IN THE INSURER'S DNA

Data must reach the entire structure of an insurer. Not just the customer's risk profile data, but everything that has to do with the customer's day-to-day life. Insurers must incorporate it into all their processes so that customers perceive that they are receiving value on an ongoing basis.

REAL TIME ACTIONABLE DATA

All data captured by the insurer should be easily actionable. The company must make the entire data lifecycle agile, and frictionless, to ensure quick responses to what customers need at the exact moment they need it. From new product development to claims management.

BOOSTING INNOVATION THROUGH DATA

Innovation has a fundamental ally in data. Everything the insurance company can learn from the data it has from different sources (its own and third parties) will be the basis for the creation of new products, services and disruptive business models.