Insurance and the Gen AI Hype

When we look at the current landscape, it's clear that generative AI (Gen AI) is sparking a wave of optimism and excitement across various industries. From the astronomical valuation of OpenAI to NVIDIA's astounding climb towards becoming a $3 trillion company, AI stocks are on the rise, fueling enthusiasm for this groundbreaking technology. Insurance is no exception. Industry experts frequently refer to the Gartner Hype Cycle to describe this optimistic phase, where Gen AI is at its peak of inflated expectations but has a long journey ahead to prove its transformative potential beyond internal productivity tools.

At the ITC Amsterdam conference, I had the opportunity to witness the Gen AI hype in full swing. The atmosphere was buzzing with discussions about the latest advancements and applications of Gen AI in insurance. There were, however, ambiguous signals about its real-world impact.

On one side, there are multiple applied cases showcasing Gen AI's utility. For instance, many companies are leveraging AI to enhance documentation processing efficiency, handling policies faster and more accurately. Conversational AI agents, like those developed by Lula Insurtech, are being used to improve customer interactions and streamline service delivery. These real-world examples are essentially what we might envision ChatGPT doing within an insurance company—automating routine tasks, improving efficiency, and enhancing customer experiences.

However, it's not all rosy. Several challenges could slow down the adoption and impact of Gen AI in the insurance industry. As Selim Cavanagh, the Director of Insurance at Mind Foundry, pointed out, about 50% of the workforce in AI is focused on governance. This includes ensuring compliance, managing ethical considerations, and mitigating risks associated with AI deployment. The governance aspect is crucial because AI systems can potentially make biased decisions or misuse data if not properly managed. This necessitates a significant investment in monitoring and regulating AI activities to ensure they align with legal standards and ethical guidelines.

Moreover, the challenge of data privacy cannot be overlooked. As AI systems rely heavily on vast amounts of data to function effectively, ensuring this data is handled responsibly is paramount. The risk of data breaches or misuse of sensitive information is a serious concern that requires robust security measures and transparent data handling practices.

Craig Beattie, an analyst from Celent, drew parallels between the current enthusiasm for Gen AI and the over-optimism surrounding blockchain in insurance a few years ago. Blockchain was heralded as a technology that would revolutionize the industry by providing unparalleled transparency and security. However, the actual adoption and impact of blockchain have been slower and less transformative than initially anticipated. This serves as a cautionary tale for Gen AI, reminding us that while the technology holds significant promise, its journey to widespread, impactful implementation may not be straightforward.

The excitement around Gen AI isn't confined to the insurance industry. Globally, it's being hailed as the next significant leap in productivity, with predictions suggesting it could add a staggering $7 trillion to the global economy. This widespread optimism, however, should be tempered with a dose of skepticism.

In the short term, Gen AI is unlikely to solve deep-rooted challenges within the insurance industry. These include addressing the protection gap in climate change impacts, improving insurance penetration and attractiveness in underserved regions, and coping with the rising cost of living. These are complex, multifaceted issues that require more than just technological innovation to resolve.

Even in the best-case scenario, where Gen AI revolutionizes the insurance industry, it will take many more years than we are currently anticipating. The journey from inflated expectations to actual, impactful implementation is a long one, fraught with hurdles that go beyond technological capabilities. Regulatory compliance, ethical considerations, and the need for robust governance frameworks will play significant roles in determining the pace and extent of Gen AI adoption.

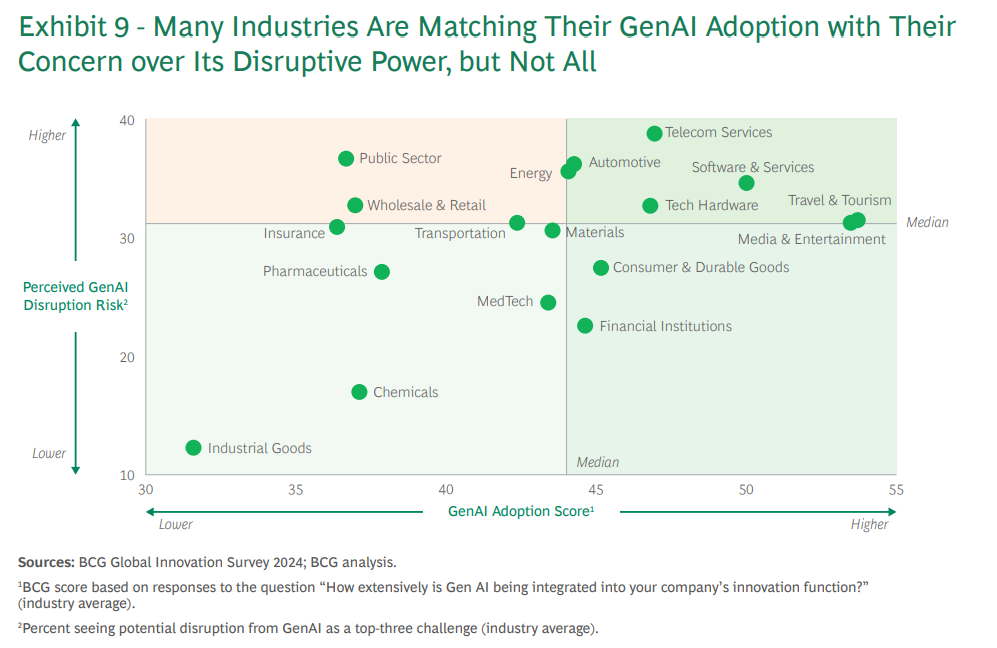

To illustrate the current state of Gen AI adoption across various industries, consider the following chart from the BCG Global Innovation Survey 2024. It highlights how different sectors are matching their Gen AI adoption with their concerns over its disruptive power. Notably, the insurance industry is positioned in a low adoption score, reflecting low adoption and moderate perceived disruption risk.

Reflecting on my observations, I wonder if I am being too critical or simply redefining the concept of hype technology. Either way, I hope to reinforce the point of overoptimism that is prevalent in the current discourse. The palpable excitement around Gen AI, while justified, needs to be balanced with a realistic understanding of the challenges and limitations ahead.

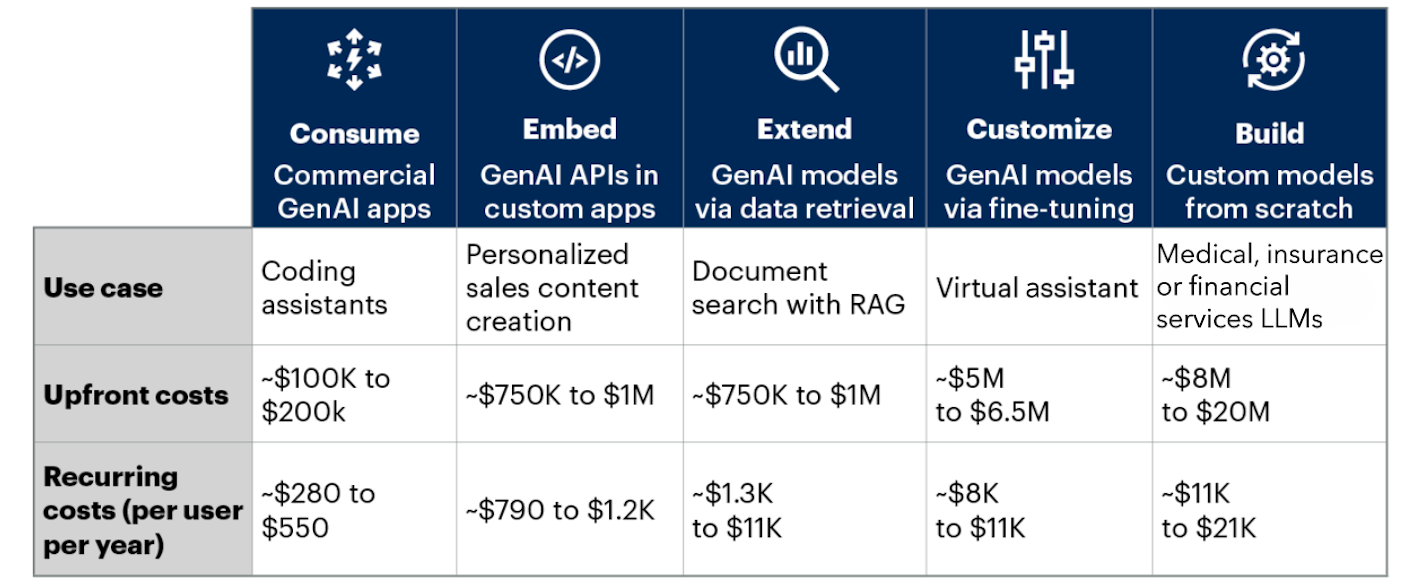

Moreover, according to recent report from Gartner it is suggested that around one-third of generative AI projects in enterprises will be abandoned by the end of 2025, primarily due to poor data quality, inadequate risk controls, and escalating infrastructure costs. This skepticism is further fueled by the high costs associated with AI adoption, which can range from millions for organization-wide implementation to substantial annual expenses for simpler tools. Moreover, a survey by Upwork indicates that AI might be adding to the workload rather than enhancing productivity, with many workers unsure how to achieve the expected gains. These challenges highlight the growing realization that while AI holds tremendous promise, realizing its full potential requires careful planning, realistic expectations, and ongoing investment in overcoming technical and operational barriers.

While the hype around Gen AI in insurance is palpable and the potential benefits are exciting, it's crucial to balance this enthusiasm with a realistic understanding of the challenges ahead. The technology holds promise for improving efficiency and enhancing customer experiences, but it is not a silver bullet for the industry's most pressing issues. As pointed out by Lori Beer, Global CIO at JPMorgan Chase, “You can’t really start talking about AI if you’re not in the cloud, if you’re not modernizing your data, if you’re not doing all the foundational stuff,”. As we continue to explore and implement Gen AI solutions, one question remains: Has the insurance industry done all the foundational work? My humble short answer is no.

Insurtech Global Outlook - NTT DATA

Header photo by BoliviaInteligente on Unsplash

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email