Insurtech Post Hippo-LMND-Root

Introduction

The perception of insurtechs oscillates between admiration and criticism, subject to the perspective of the beholder. Recently, a noticeable uptick in the stock prices of Lemonade, Root, and Hippo has occurred following the global implementation of stringent economic policies due to COVID-19, alongside rising interest rates and a liquidity crunch for startups. These conditions have compelled publicly traded insurtech companies to present robust financial outcomes.

In this scenario, these young companies pivoted their hypergrowth model to a profitability-focused model, showing promising improvements in important metrics such as their loss ratio and profits. Moreover, the switch on external variables tested companies built for the long term, in which critical customer numbers, economies of scale, and M&A synergies were essential to achieve profitability, in the short term. Subjectively speaking, it appears there's a window to glimpse the future through these companies as they recalibrate their operations in an environment where growth increasingly demands higher costs.

It's pertinent to underscore the core hypothesis that underwent scrutiny during the three years of insurtech downturn. Additionally, the recent uptick in stock prices could be interpreted as a positive market response, indicating that there's now empirical support to either validate or refute certain hypotheses. The primary hypothesis, and the focus of this discourse, posits that the entities comprising what is termed as the first wave of insurtech are indeed profitable.

Navigating Challenges: A Testament to Resilience

The path of innovation is fraught with challenges. These companies have navigated skepticism from traditionalists, regulatory hurdles, and the intrinsic risks of disrupting well-entrenched markets. However, their resilience is evident in their ability to adapt quickly to changing market dynamics, refine their business models in response to feedback, and leverage failures as steppingstones. In the next section, we will analyze some of the achievements from the different strategies applied by Lemonade, Hippo and Root.

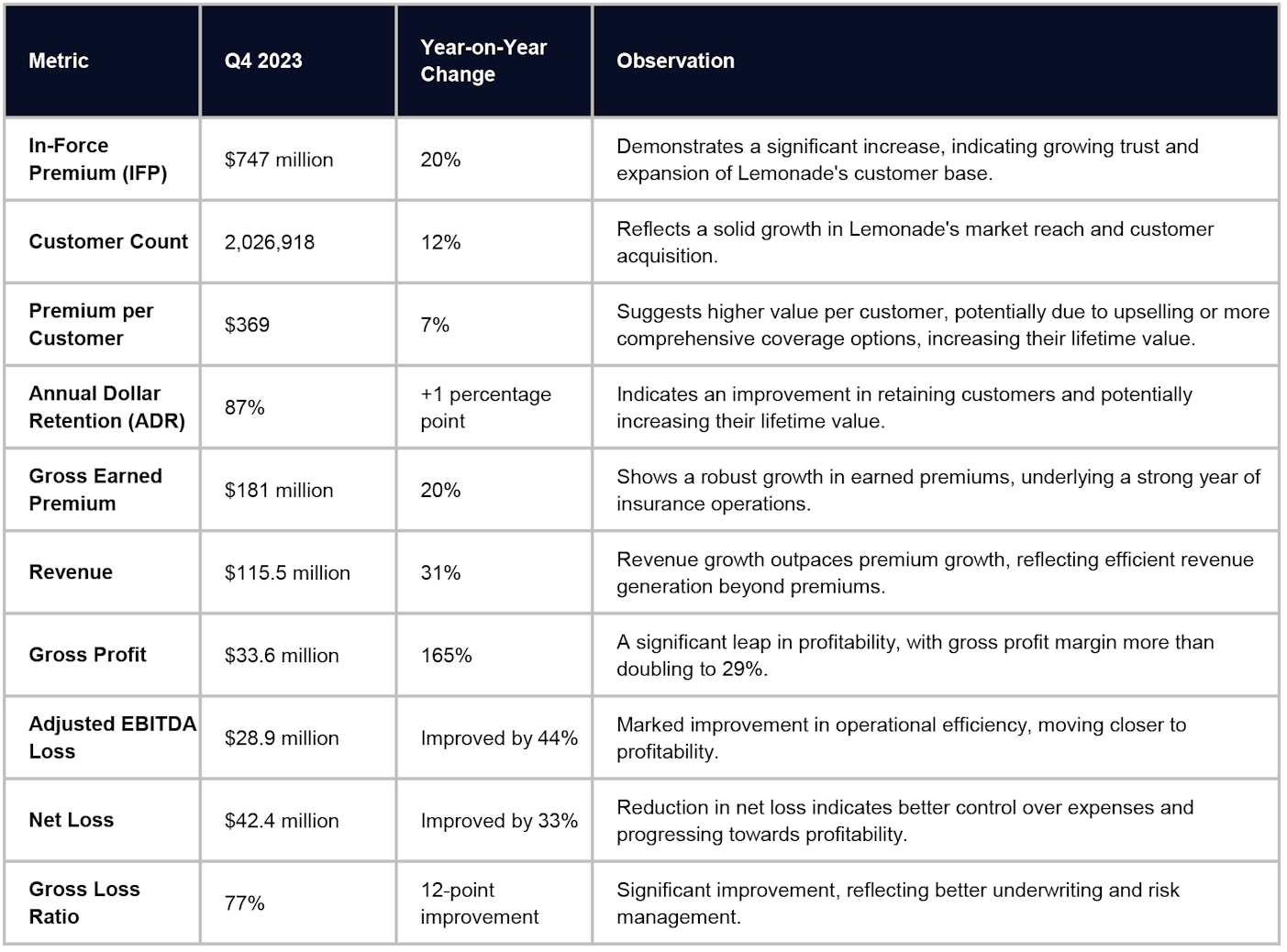

Lemonade – AI and the LTV Model

The data from Lemonade's Q4 2023 Shareholder Letter provides compelling evidence of its improvement and strategic positioning for long-term success. Through technological innovation, strategic market positioning, and operational efficiency, Lemonade is not just navigating the present but is also laying the groundwork for a future where it remains a relevant and influential player in the insurance industry.

Strategic Implications

These improvements across customer growth, in-force premium, and loss ratio are not mere numerical achievements. They reflect Lemonade's strategic foresight, technological leverage, and market adaptability. Here's how:

Technological Leverage: Leveraging AI and machine learning, Lemonade has optimized its risk assessment and claims processing, contributing to the improved loss ratio. The deployment of its 9th generation LTV AI model underscores the company's continuous innovation in technology to enhance profitability.

Market Adaptability: Lemonade's strategic adjustments, including product portfolio rebalancing and geographic diversification, have enabled it to navigate market challenges effectively. Its expansion into European markets, experiencing a 100% IFP growth in 2023, exemplifies Lemonade's successful adaptability and global growth ambitions.

Hippo – Scale Down and Cost Cutting

Hippo maintains a strategic emphasis on sustainability and growth to foster a lower loss ratio and exercise cost control. By prioritizing cost control and loss ratio improvement, Hippo achieves higher overall performance.

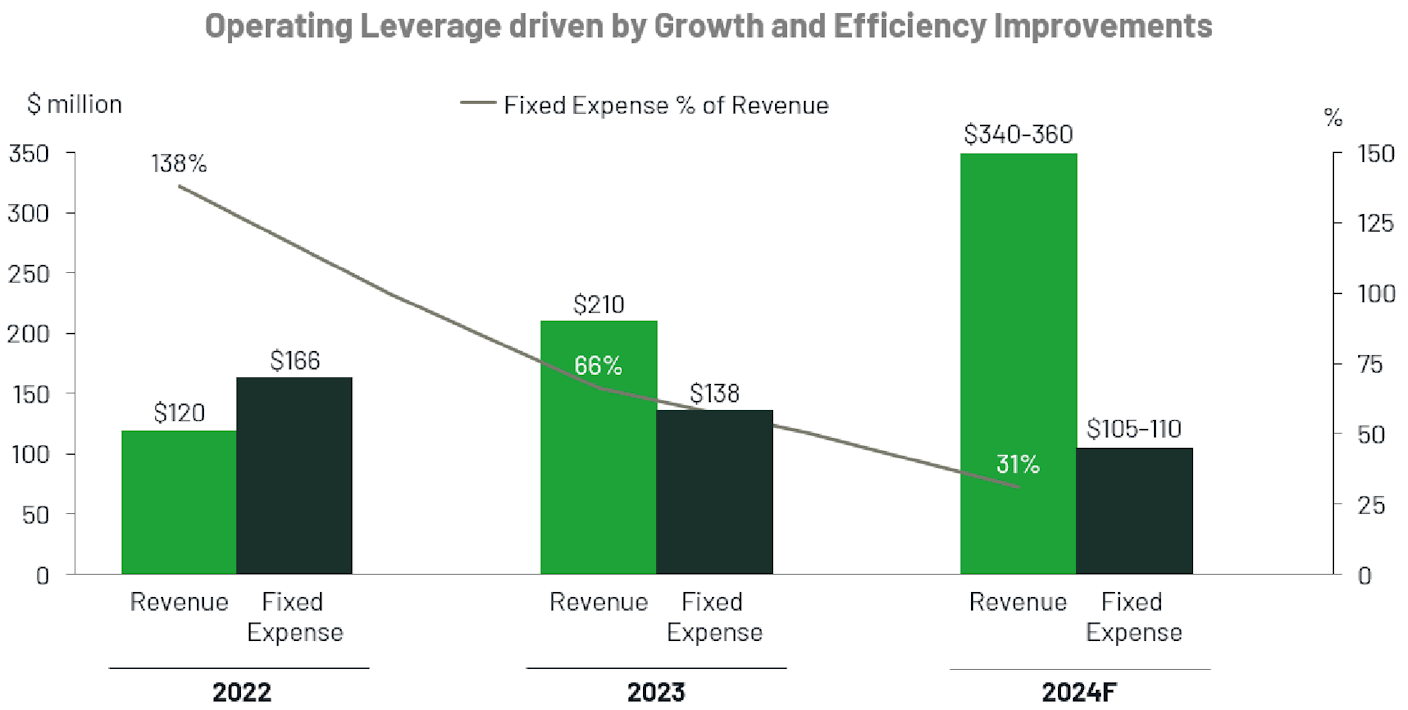

In two short years, Hippo nearly doubled the total generated premium from $606 million to $1.1 billion and more than doubled the revenue from $91 million to $210 million, all while lowering fixed expenses from $140 million to $138 million and improving the gross loss ratio on Hippo Home Insurance Program by approximately 40 percentage points.

The main business strategies are:

Focus on Cost Control: The improvements suggest that the company has implemented effective cost-cutting measures or operational optimizations, resulting in a more streamlined and cost-effective operation. This bodes well for the financial health and sustainability of the company, as it indicates better utilization of resources and improved profitability margins.

Loss Ratio Improvement: This improvement is attributed to enhancements in the gross loss ratio and more efficient utilization of reinsurance. Similar to the trend observed in 2023, the company anticipates a gradual improvement in the net loss ratio throughout the year, with the expected net loss ratio in Q4'24 projected to be below 75%. Further enhancements are anticipated in 2025, with the net loss ratio expected to be less than 75% for the entire year.

Root – Telematics and Product Innovation

The UBI business model is now widely understood by the public. The company has collected 20 billion miles of mobile telematics data to enhance and inform pricing models. With more than 12 million downloads, the modern app experience allows drivers to get their policy in less than 1 minute, manage their policy, and file a claim.

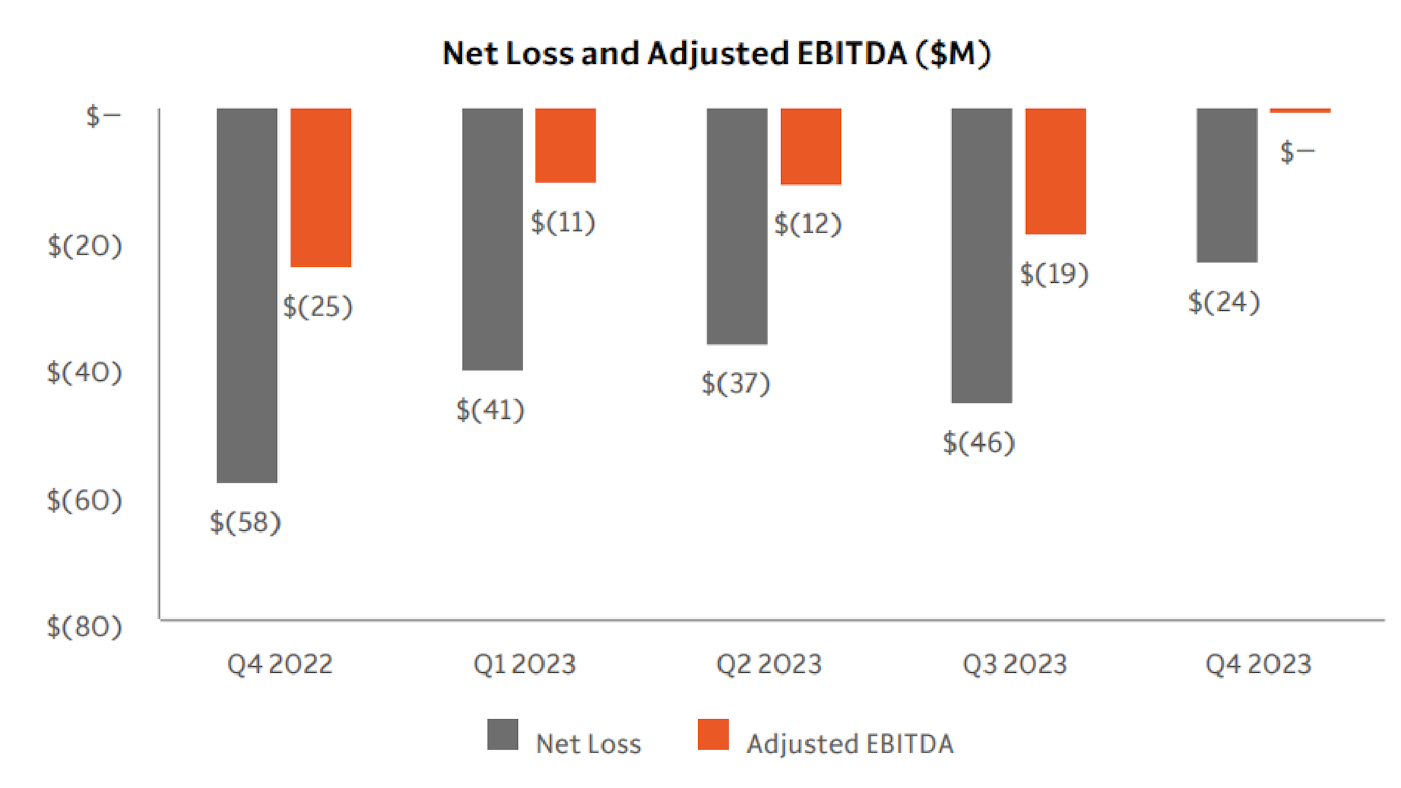

Through the enhancement of its data science platform, Root can effectively reach its target customers and offer them competitive policies, resulting in a significant increase in overall profitability. Root's Q4 2023 performance was marked by a 74% improvement in operating loss, which stood at $12 million compared to $48 million in Q4 2022. Adjusted EBITDA improved 99% over the prior year to a near breakeven loss of $300,000. The net combined ratio improved by 68 points to 112%, and the company grew total new writings almost five-fold.

Key Financial Tables

Root’s Q4 2023 results reflect a company that is leveraging its technological edge to improve its financial health and position itself for sustainable growth. The main business strategies are the following:

Automated data science platform: It leverages proprietary machine learning across all elements of the insurance value chain, including customer onboarding, underwriting, pricing, telematics, and claims.

Distribution strategy: Direct channel and partnership channel tend to be the key drivers of the growth. In 2023, the Direct channel emerged as the primary growth driver, propelled by performance marketing and organic traffic. Meanwhile, the Partnership with Verisk into existing platforms and minimizing barriers between insurance needs and policy purchase, featuring various integrations from marketing partnerships to fully embedded user experiences.

A Technology-driven Product, at the Best Price, with Ease of Use

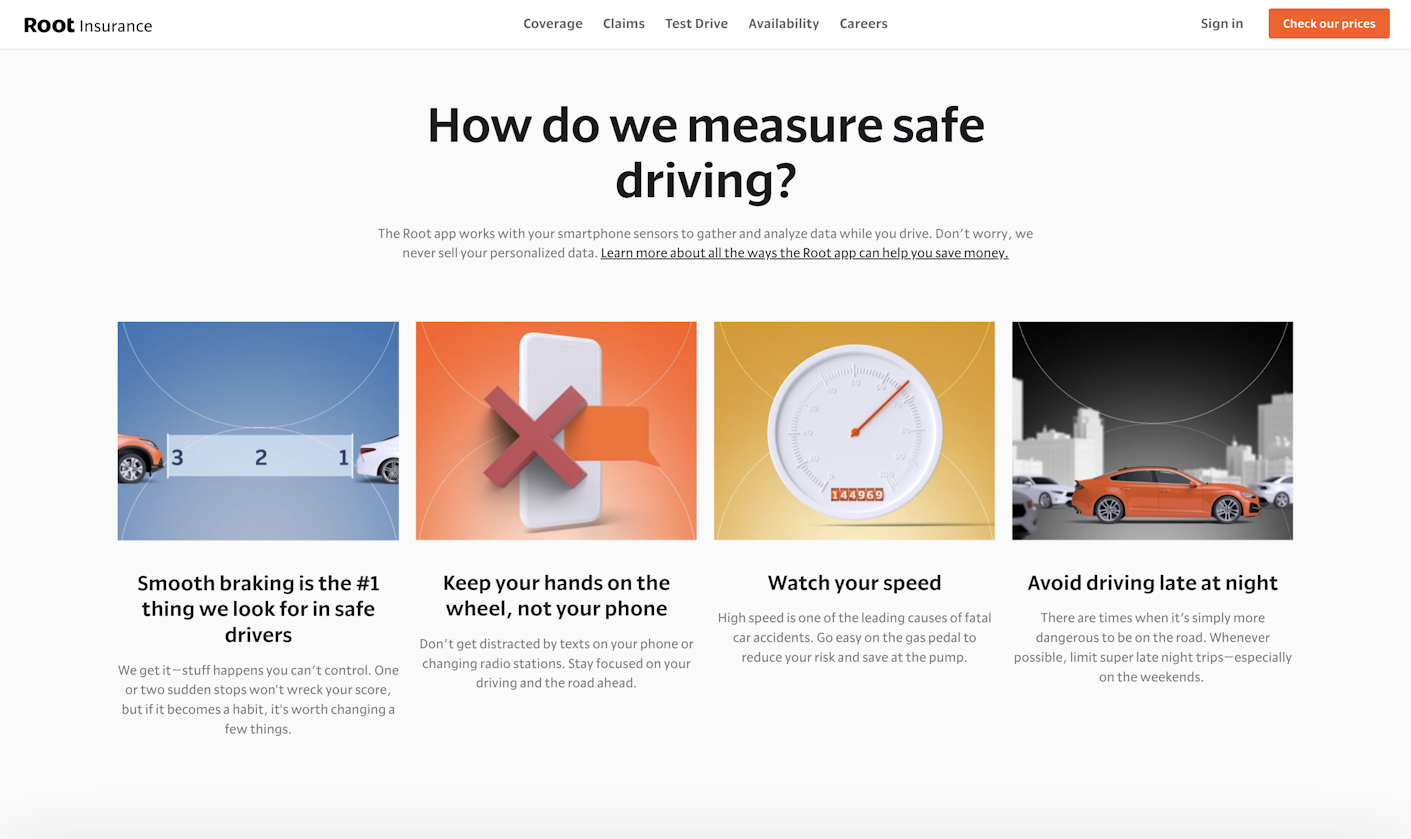

Products that customers know & love remain one of Root's competitive advantages. By leveraging modern technology, Root built a world-class mobile platform that creates delightful customer experiences. UBI-based Technology: From Car Sensors to Mobile Data.

While Root can offer many customers a quote using manufacturer data of some newer car models, the company can provide an even better quote through behavior measured through its app, as there are things that the car metrics don’t know because the driver is not interacting with the car, for instance, texting on the phone while driving. Root Insurance has perhaps the most accurate view of distracted driving in the market.

Fair Pricing Strategy by Dropping Credit Scores and Addressing Race and Equality

Root Insurance believes it’s more important to base premiums on a driver’s actual behavior rather than credit score which is one of the top ratings in anybody’s pricing in the insurance industry. One of its most notable initiatives is to completely eliminate credit scores from its pricing models by 2025.

Test Drive: A Tiny Push that Gets Good Drivers to Switch to Root

The company itself will be the first to tell you if you’re not a good fit as a Root customer, as it only accepts drivers it deems as good. Drivers take the test drive while keeping their current insurance. The company measures potential customers’ driving for two to four weeks, depending on how often they drive. For the good drivers who decide to switch to Root, the company helps make the change as easy as possible.

For people who need insurance right away, Root Insurance offers a base rate based on other more traditional factors such as driving history, and then there’s a provisionary period (depending on which state the driver lives in). The company measures data during that period and then comes back with a revised rate based on the actual driving behavior.

Positioning for the Future: A Long-term Game

“Amazon is genuinely customer-centric, genuinely long-term oriented, and they genuinely like to invent”.

The journey of insurtechs towards profitability through different strategies underscores the critical importance of a long-term business model over the allure of immediate results. This shift in paradigm—from a hypergrowth model to one centered on profitability—reveals a nuanced understanding of the insurtech sector's dynamics, where success is not merely about rapid market capture but building a resilient, scalable, and ultimately profitable enterprise.

The paths they chose—whether through enhancing operational efficiencies, pursuing strategic mergers and acquisitions for synergistic gains, or innovating in customer acquisition and retention—demonstrate a comprehensive approach to business that balances short-term pressures with long-term goals.

This strategic pivot closely reflects the journeys of giants like Tesla and Amazon. Despite initial doubts about their ability to turn a profit, they maintained a long-term perspective, investing heavily in innovation, infrastructure, and expanding their reach. They chose strategic growth over quick wins, focusing on building a solid foundation for the future. This approach has clearly paid off, proving that patience, thoughtful investment, and a consistent focus on long-term objectives can lead to dominant positions in their industries, even amidst short-term challenges.

The illustration above isn’t meant to draw a direct comparison between Tech Giants and Insurtechs, but looking ahead, Lemonade, Root, and Hippo are positioning themselves for long-term relevance and success. Their ongoing investments in technology and data science are not merely about automating processes but about gaining deeper insights into risk and customer behavior. This foresight will enable them to stay ahead of emerging trends and continuously refine their offerings.

The Insurtech New Heights – Food for Thought

“If all the parts of a ship are replaced, piece by piece, is it still the same ship?”.

The famous Ship of Theseus can open a discussion for insurtechs around the world and their role in the insurance industry as a whole. Take Lemonade, for example, the company is a full-stack carrier with new components throughout its whole business, leveraging emerging technologies and utilizing data like no other incumbent. The question that remains is, when we talk about Lemonade, are we still talking about an insurance company?

This question can extend further to question other innovative disruptors, but let's focus on the insurance sector. We have seen a hectic sentiment across the industry regarding the value of these young insurers, but I would argue that it is too soon to compare these companies with incumbents. While insurers are mammoths with billions in assets, public insurtechs are trying to pay their bills.

I am not saying they should not be analyzed by relevant metrics like loss ratio, EBITDA, or IFP, but it should not be the main argument why these companies are failing or succeeding. Instead, these companies should be compared with more suitable benchmarks such as growth and profitability potential. Hence, there is an inconsistency in the way the market judges these companies and how these companies judge themselves. I suspect that they do not see themselves as an insurance company.

In an ideal world, insurance protection should be available and affordable for the average Joe. I would say that is the vision that Lemonade bets on. A future where Lemonade becomes a major player is a future where insurance becomes widely available to a large audience. I believe that structural problems are way before the distribution problems. Discussions of the insurance world should be a little bit more focused on social and economic problems, instead of engagement and where to embed certain coverages. This is a big pie, but it is just a slice.

The gross or the main unlock opportunity for the insurance companies lies in the acceptance of the majority of people having no access to insurance products at all. Emerging countries like Brazil had a major introduction to banking since Nubank introduced banking and financial inclusion for dozens of millions of people. The power of technology and the mass adoption and education for insurance companies will likely come from insurtechs.

Concluding this exploration of insurtechs' transformative impact on the insurance sector, the journey of companies like Lemonade, Root, and Hippo embodies a larger, more profound narrative. It's not merely about the reconfiguration of a traditional industry through technology and innovation but about fundamentally rethinking what insurance can and should be. As we ponder the philosophical conundrum of the Ship of Theseus, it becomes evident that insurtechs, while replacing the 'parts' of the traditional insurance 'ship,' are indeed ushering in a new vessel entirely. This new ship sails towards a horizon where insurance is not just a transaction but a universally accessible tool for financial security and empowerment.

Header photo by Yorgos Ntrahas on Unsplash

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email