Insurtech Redundancy: Food for Thought

The Importance of Behavioral Change in Utilizing New Data Sets in Insurance

In Life and Health insurance, for example, industry leaders were excited about the opportunities presented by genetics and biometrics. In Property & Casualty (P&C), smart homes and pay-as-you-drive models experienced their own waves of hype.

Today, we see more of the same. The growth of external data via APIs is flooding the insurance industry with fast, reliable data. However, one fundamental statistical concept keeps coming to mind: you cannot model price with quantity, as they are dependent (endogenous) variables, this led me to think: What if all this new data is simply trying to explain the same risks that insurers have understood for centuries? What if adding complexity is not useful unless it leads to behavioral changes among customers or clients?

My hypothesis is that both high-scale and low-scale information lead to the same results. For instance, genetic information without behavioral change is no more valuable than traditional data points like smoking status. Similarly, tracking how hard someone brakes may not be significantly better than using age and gender to assess driving risk. In general, increasing granularity to a microscopic level may be counterproductive in an industry where risk aggregation is key.

Therefore, in my opinion, insurtechs that promise to enhance pricing, risk assessment, underwriting, or claims evaluation through new data alone are not sufficient. I do believe in the value of biometrics for fraud prevention and frictionless customer experiences, but I reject the idea that knowing someone’s biological age will improve insurance metrics without also encouraging healthier behavior. Similarly, I appreciate telematics because it drives behavioral changes in drivers, but I am skeptical that acceleration patterns alone provide better risk insights than traditional variables like age.

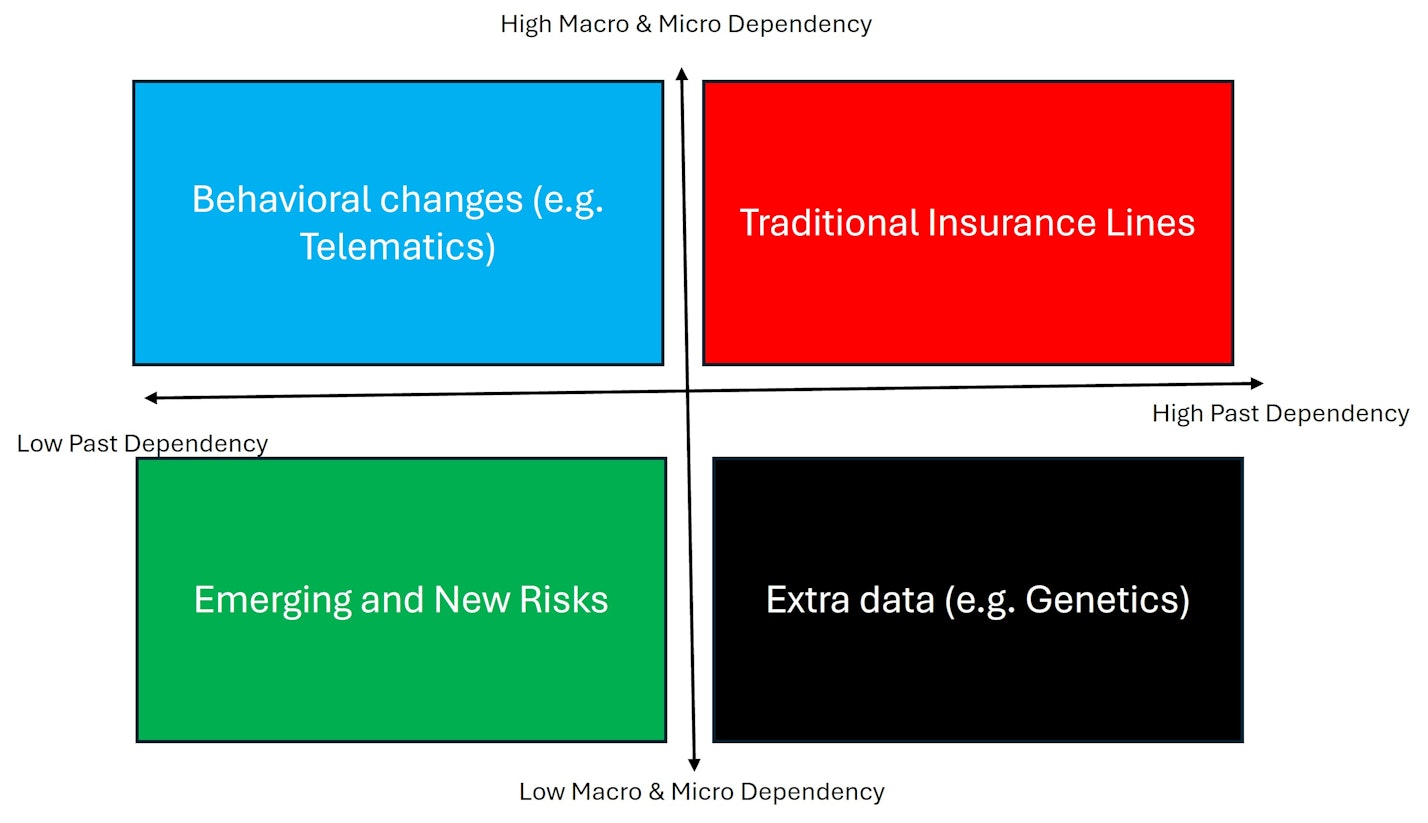

This skepticism led me to create a framework for evaluating the likelihood of success for new insurance players. This framework considers only insurtechs that introduce new insurance models or enhance existing ones by adding complexity. To understand this framework, we must first grasp the concept of lumpability.

Lumpability is the property of a system that allows it to be accurately modeled or analyzed at a broader scale without losing essential predictive power. In other words, it enables us to group (or "lump") micro-level states into macro-level categories that are easier to work with.

For example, if age alone can explain driving risk as effectively as telematics data, then telematics data offers little added value. However, if telematics can actively change driver behavior, it can break the dependency. Therefore, past dependency must also be considered in the framework—how well past data predicts the future and how much data influences future outcomes.

Here’s how this framework categorizes different types of insurance innovations:

Blue Box – Telematics like models:

Highly dependent on existing data but capable of driving behavioral change. Success in this category requires relentless efforts to modify customer behavior.

Red Box – Traditional insurance lines of business:

These rely on past predictive models that work well. New entrants in this space would struggle to compete with established incumbents.

Green Box – Emerging risks (e.g., cyber and climate insurance):

New players can compete by developing better models from scratch using original data sets. Micro and macro dependency are low, and past data explains little about the future.

Black Box – Genetics like models:

Genetics can predict the future, much like behavioral habits. However, without actionable insights that drive behavior change, this type of data is not highly valuable.

The insurtech industry often focuses on technological advancements without questioning whether they meaningfully improve core insurance functions. Simply having more data does not necessarily lead to better underwriting, pricing, or risk assessment, unless it changes how people behave. The future of insurance innovation will not be defined by how much data we collect but by how effectively we use it to influence actions, mitigate risk, and improve outcomes for both insurers and policyholders.

Header photo by National Cancer Institute on Unsplash

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email