Modernizing Legacy Systems in Insurance

A Competitive Necessity

Insurance companies are facing a crucial moment where their legacy systems have become more of a hindrance than a cost-saving measure. As global IT spending in Insurance reached around $210 billion in 2023 and is projected to grow by 9% annually until 2027, the shift toward digital transformation has become inevitable. With an increasing share of investment going into modernization, companies must move beyond their outdated infrastructures, or risk falling behind in an industry where customer expectations are evolving rapidly.

Why Modernization is Critical

For years, Insurance companies relied on outdated, rigid systems that required significant effort to maintain. These legacy systems were originally developed to support specific Insurance functions, but over time, their lack of integration and flexibility became glaring weaknesses. These systems now inhibit data sharing and process automation, making it difficult for insurers to offer efficient, customer-friendly services.

Moreover, the costs of maintaining these outdated platforms continue to rise. Modern core systems, which enable faster and more accurate decision-making through automation and real-time data sharing, offer a compelling alternative. They can boost revenue by as much as 25%, reduce operational costs, and cut the time to bring new products to market by a factor of three to four.

Key Benefits of Core Modernization

The transition to modern core systems brings numerous advantages, transforming not only internal operations but also the customer experience. Here are some key benefits:

Cost Efficiency: Automated processes reduce administrative overhead, lower labor costs, and streamline workflows, which directly improves an insurer’s bottom line.

Increased Automation: By integrating digital capabilities like automated underwriting and claims processing, insurers can reduce errors, accelerate response times, and optimize back-office functions.

Improved Customer Experience: With upgraded systems, insurers can provide digital self-service tools and real-time claim status updates, offering a seamless, user-friendly experience that meets modern customer expectations.

Faster Time-to-Market: Agile and modular core systems allow insurers to quickly develop and launch new products, from personalized policies to usage-based Insurance. This agility positions companies to better respond to changing customer needs and emerging market trends.

Approaches to Modernization

There is no one-size-fits-all approach to modernizing core systems. Insurance companies can choose from three main strategies based on their goals and existing infrastructure:

Modernizing the Legacy Platform: This involves upgrading specific components of the existing system without completely overhauling it. It is a lower-risk option that allows insurers to adopt new technologies gradually.

Building a Proprietary Platform: For insurers that need more control over their operations, building a custom platform offers flexibility but can be more expensive and time-consuming.

Buying a Standard Software Package: Many insurers opt for off-the-shelf solutions, which provide immediate access to modern capabilities like cloud computing, data analytics, and automation.

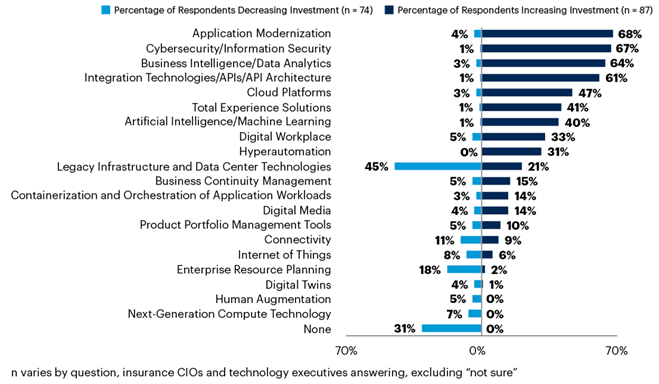

The Shifting Investment Landscape

In a recent Gartner survey, 68% of insurers reported plans to increase investment in application modernization, reflecting a broader shift in the industry. As consumer expectations evolve toward more personalized and digital-first services, insurers are reallocating budgets away from maintaining outdated legacy systems. They are focusing instead on adopting advanced technologies like cloud computing, artificial intelligence, and machine learning.

These technology investments are essential for improving operational efficiency and meeting the demands of digital-savvy customers. By modernizing core systems, insurers can streamline operations, reduce costs, and create a more agile infrastructure capable of supporting future innovations.

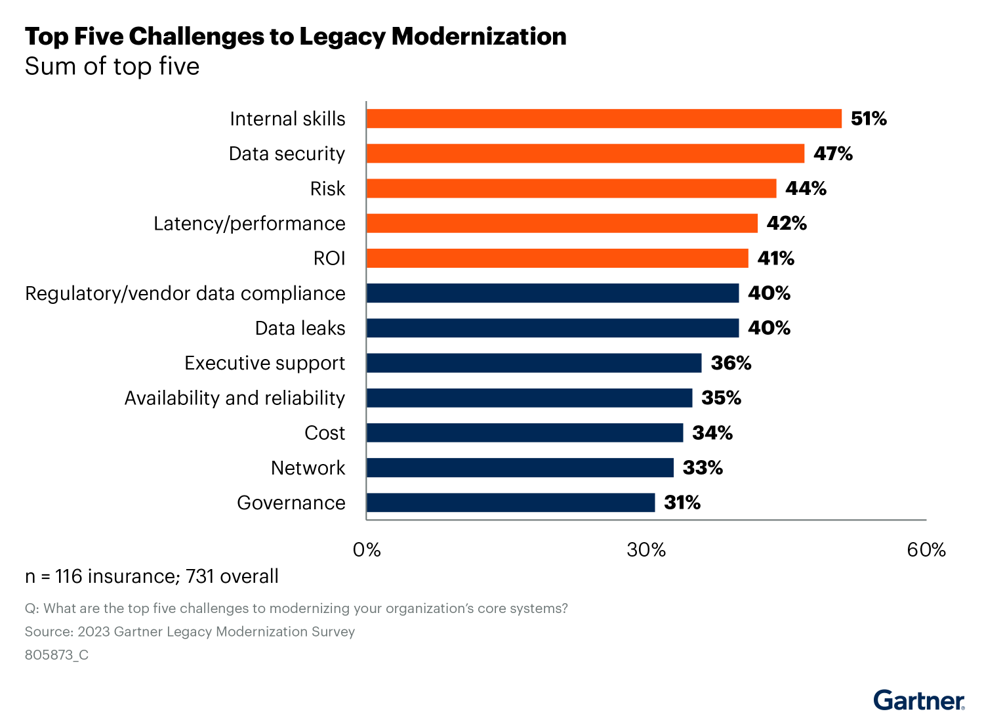

Challenges on the Road to Modernization

Despite the clear advantages of core modernization, the process comes with challenges. Replacing or upgrading legacy systems requires significant financial investment, often exceeding $5 million for large insurers. The transformation timeline can stretch from 12 to 18 months, making it a high-stakes, resource-intensive undertaking. Given the risks and complexities, many insurance CIOs view modernization as a pivotal, once-in-a-lifetime project.

Moreover, external factors such as economic instability and geopolitical risks can complicate the transition. Swiss Re’s Sigma 06/2023 report highlights how ongoing market volatility and inflation are increasing claims costs, making it even more essential for insurers to focus on cost-efficiency and agility.

Opportunities Amid the Challenges

While the road to modernization is challenging, the long-term benefits make it an essential investment. By adopting cloud technology and automating core processes, insurers can unlock new revenue opportunities, innovate faster, and improve operational efficiency. As cloud platforms enable insurers to scale services quickly, they provide a crucial competitive edge in an industry where customer expectations are constantly evolving.

Emerging trends like artificial intelligence (AI) and machine learning (ML) are further shaping the future of insurance. AI-driven solutions can help insurers better assess risk, detect fraud, and personalize policies for individual customers, making the industry more proactive and customer-centric. For example, automated claims assessment powered by AI enables faster settlements, enhancing customer satisfaction.

The Role of InsurTech in Modernization

One of the key drivers of modernization in the insurance industry is the rise of InsurTech solutions. By collaborating with InsurTech firms, insurers can gain access to cutting-edge technologies that streamline processes, reduce fraud, and enable more personalized offerings. From AI-driven risk assessments to automated claims processing, InsurTech provides insurers with the tools they need to stay competitive in a rapidly evolving market.

Investing in partnerships with InsurTech companies allows traditional insurers to remain nimble while benefiting from the innovation happening within the startup ecosystem. Insurers that embrace these technologies can reduce costs, improve efficiency, and create a better overall experience for their customers.

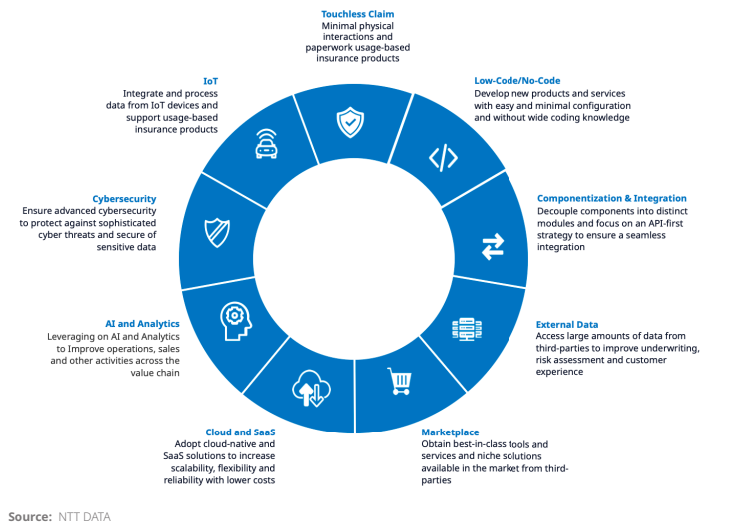

Emerging Trends in the Market

In the dynamic insurance industry, cutting-edge technologies are transforming traditional processes to boost efficiency and agility. Undertaking a legacy modernization initiative within an organization can lead to multiple projects. These projects may involve streamlining applications, modifying infrastructure (such as leveraging the cloud), implementing new data management approaches, transforming processes, restructuring teams, and addressing talent requirements. Below is a detailed exploration of the emerging trends resulting from these modernization efforts.

A Strategic Imperative for the Future

In conclusion, core modernization is no longer an optional upgrade for insurers; it is a strategic necessity. With the potential to boost revenue, reduce operational costs, and enhance the customer experience, modern core systems provide insurers with the tools they need to compete in the digital age. While the transition comes with risks and challenges, the long-term payoff is undeniable. Insurers that embrace modernization today will be better positioned to meet future challenges and seize new market opportunities. As the industry continues to evolve, those that fail to adapt risk being left behind.

Through a combination of careful planning, strategic investments, and partnerships with technology providers, insurers can modernize their core systems to drive growth, enhance efficiency, and deliver superior customer experiences. This transformation is not just about technology—it’s about rethinking the way insurance companies operate and serve their customers in a rapidly changing world.

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email