Muffintech and the Rise of Generative AI in Insurtech

GenAI is booming and is making business processes easier. However, these tools can be generic and are still limited in industry language and knowledge. Unlike generic tools like ChatGPT, Muffintech employs a team of industry experts who designed its conversational AI AION specifically for the insurance industry. AION has been trained in over 30,000 insurance-related conversations and has successfully passed the certification of an insurance salesperson in Germany.

With continuous real-world training and a unique insurance core that includes specific knowledge of the German insurance market and custom input from clients, its GenAI doesn’t just give generic responses based on keywords, like Google, for example, would do. Instead, it provides detailed, context-aware answers that offer users valuable support. Muffintech already has several clients ranging from brokerage pools like PMA to brokers and insurers in Germany. They also have a handful of PoCs with Top20 insurance companies in DACH and first engagements in Poland and Western Europe.

Why do we need Muffintech AI tool, is this required?

While many insurance companies already use AI chatbots, Muffintech’s AI tool provides a much more advanced solution specifically designed for the complexities of the insurance industry. Standard chatbots typically handle basic customer queries, but Muffintech's AI uses a specialized Large Language Model (LLM) to address industry-specific tasks such as underwriting, fraud detection, and claims processing. This tool not only improves accuracy and compliance but also enhances operational efficiency and customer service. By offering personalized and predictive insights, Muffintech optimizes back-office operations and reduces human error, making it essential for insurers looking to modernize and scale their operations.

Muffintech’s AI solutions align perfectly with the insurance sector’s need for transformation, helping insurers deliver more tailored, efficient, and scalable services.

Efficiency and Innovation at the highest level

Their AI was developed by industry experts with deep insurance industry knowledge. Its goal is to provide the market with a tool that truly meets its needs.

This tool that incorporates industry-specific expertise is much more than just a chatbot. Our AI is a pre-trained assistant designed for speed and efficiency. From knowledge management to customer service, Aion quickly solves common problems, allowing you to reduce your team's workload, boost customer satisfaction and improve conversion rates.

Key Features:

Industry-Specific LLM: Muffintech's Large Language Model is specially trained for insurance, equipped with deep, sector-specific knowledge.

GDPR Compliance: Adheres to stringent data protection regulations to ensure the handling of sensitive information is secure.

Branded Interface: Offers customizable interfaces that integrate seamlessly with existing digital platforms, preserving brand consistency.

Failsafe Mechanisms: Includes protocols to transition tasks smoothly to human operators if the AI encounters limitations, ensuring reliability.

Embedded Knowledge Bases: Interacts directly with embedded databases for faster, more efficient customer responses, bypassing traditional document navigation.

Who is Using Muffintech?

Insurance Companies: Enhancing customer service and internal operations.

Healthcare Providers: Managing patient data and insurance claims more efficiently.

Financial Institutions: Integrating insurance services within broader financial platforms.

Customer Support Centers: Utilizing AI for routine inquiries and claims processing.

Uncommon Use Cases: Employed by academic researchers for studying AI applications in finance and by tech startups developing insurance-related applications.

How is muffintech different from ChatGPT?

Allora is a specialized tool crafted expressly for the insurance industry. Unlike generic platforms like ChatGPT that rely on a single large language model (LLM), Allora features a custom modular architecture that utilizes the most suitable LLM for each specific task, ensuring optimal performance tailored to customer needs. Additionally, while tools like ChatGPT are prone to hallucinations and often provide unpredictable responses, Allora is designed to eliminate such issues. Developed by industry experts, its architecture and features are meticulously designed to meet the unique demands of the insurance sector, enabling us to deliver highly personalized services and tailored support for our clients.

This is how it works

For each use case start with the base and then expand it with modules.

Use Cases

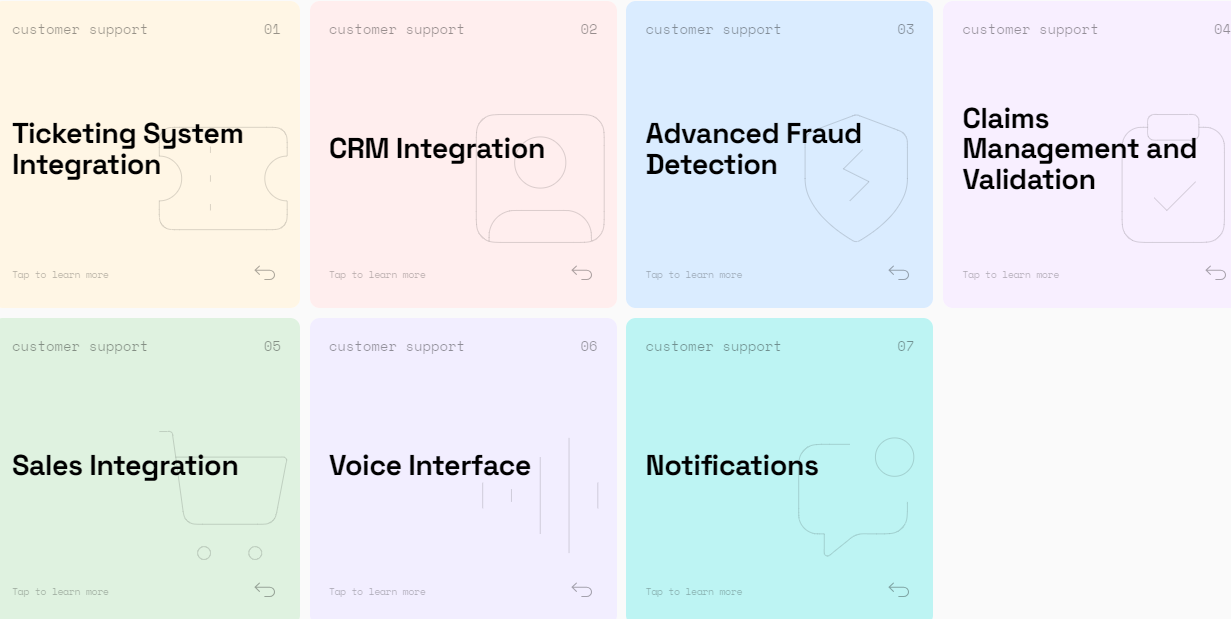

Customer Support

Increase customer satisfaction and lower the workload of your customer support team. A conversational Interface provides superior user experience and respond times over human support agents. Our conversational AI can fully take over first level customer support and solve all knowledge related issues. With our modules you can expand the AI's capabilities to connect to your CRM or ticketing system allowing to fully automate customer support.

Base

· First Level Customer Support - Accurately understand your customers’ needs to offer them the optimal products and experience. Increase overall customer satisfaction.

· Integrated Insurance Knowledge - Provide swift and helpful answers to your customers with a tailor-made LLM so that they can better navigate the world of insurances.

· Report Generation - For more complex cases our AI automatically generates a chat report describing the case to hand it over to the next level of customer support. Having a structured report helps creating tickets and saves your clients and your team time.

Modules

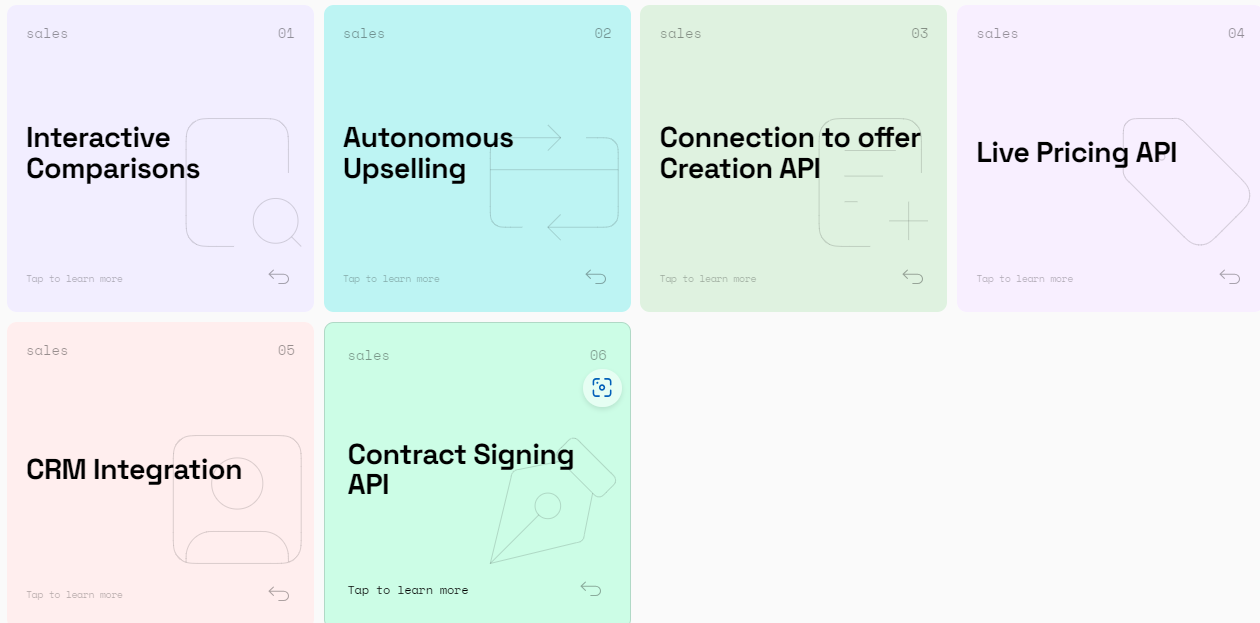

Sales

Our Conversational AI can not only help you make your sales process more efficient, but also boost conversion. The LLM advices customers around their insurance needs and different insurance products. It can also gather necessary data and use it, to create tailored offers and comparisons.

Sales Enablement

Their AI-powered solution enhances sales enablement for intermediaries and sales support by delivering quick access to critical information and turning it into actionable insights.

It helps internal sales support teams respond to inquiries faster by pre-drafting emails and providing accurate information. For brokers, agents, and intermediaries, the bot acts as a personal assistant, offering sales conversation tips, general insurance as well as product specific information, objection-handling strategies, and customized product recommendations. This ensures seamless, efficient support across all stages of the sales process. This seamless integration of support and sales boosts customer satisfaction while increasing overall profitability.

Direct sales

Their AI chatbot helps maximizing revenue from existing customers through cross-selling and upselling by identifying customer needs and offering personalized product recommendations.

This personalized interaction helps generate qualified leads, as the bot gathers customer information and schedules appointments with sales agents. The bot can even handle end-to-end sales, replacing traditional funnels with a conversational interface that feels like a human interaction.This seamless integration of support and sales boosts customer satisfaction while increasing overall profitability.

After Sales

Their AI chatbot helps maximizing revenue from existing customers through cross-selling and upselling by identifying customer needs and offering personalized product recommendations.

Additionally the bot automates first-level customer support, answering common product-related questions directly and reducing the need for support tickets. This allows your customer service team to focus on more complex issues. This seamless integration of support and sales boosts customer satisfaction while increasing overall profitability.

Base

· Autonomous Needs Assessment - Accurately understand your customers’ needs to offer them the optimal products and experience. Increase overall customer satisfaction.

· Integrated Insurance Knowledge - Provide swift and helpful answers to your customers with a tailor-made LLM so that they can better navigate the world of insurances.

· Automated Offer generation - Using advanced AI, generate tailored insurance offer proposals instantly to bring the best possible experience to your customers.

Modules

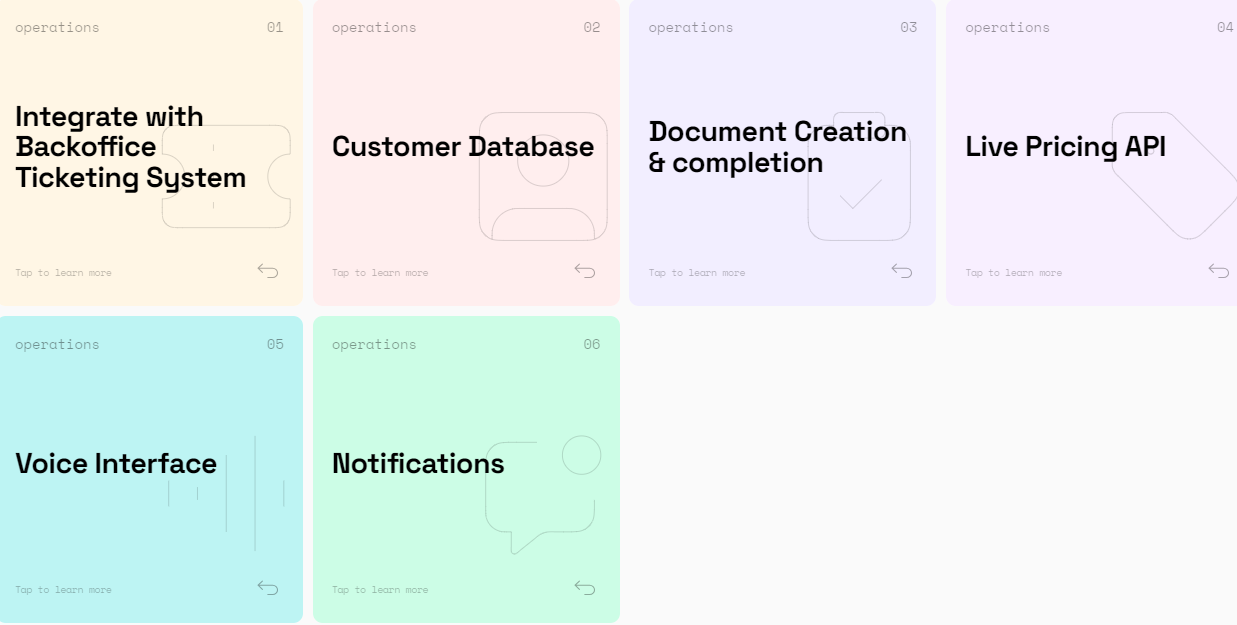

Operations

Imagine an employee who knows all your policies, processes and documents and can provide them 24/7 to her colleagues. That's our Conversational AI. Save your employees time and hassle and provide them with all the accurate information and documents they need in order to focus on other important aspects of their job.

Base

· Integrated Internal Knowledge - Our AI chat interface saves your employees time and peace of mind by answering any question and providing information regarding all your internal processes and products.

· Smart File Access - No more folder structures and filenames – our AI chat interface finds you everything you need based on its content and not just on its name or location.

Modules

Partners of Muffintech

Generative AI's Impact on Key Insurance Areas

Muffintech's generative AI platform offers multiple benefits for insurers, making it a valuable tool for companies that aim to stay ahead in a competitive market. Here are some key areas where the platform can make a significant difference:

Claims Processing: Automating claim assessments and fraud detection, the platform reduces human workload while enhancing accuracy and processing times.

Fraud Detection: With sophisticated algorithms, Muffintech proactively detects fraudulent claims, saving insurers from substantial losses.

Customer Experience: Through personalized recommendations and quick responses, Muffintech’s AI boosts customer satisfaction, improves retention, and enables tailored services that drive upselling opportunities.

Underwriting and Risk Assessment: Muffintech’s AI processes vast amounts of data, building predictive risk models that enhance accuracy and speed in underwriting, ensuring better pricing and risk management.

The Future of Insurance with Muffintech’s Generative AI

As insurance companies face growing challenges such as regulatory changes, customer expectations, and market competition, those that invest in AI will have a significant advantage. Muffintech is at the forefront of this AI revolution, offering insurers a future-proof platform that addresses these challenges head-on.

Generative AI, as implemented by Muffintech, represents the future of insurance in many ways:

- Efficiency and Cost Savings: Automation of tasks like underwriting, claims processing, and fraud detection significantly reduces operational costs.

- Scalability: Muffintech’s platform can grow with the company, ensuring long-term sustainability and adaptability to market changes.

- Innovation: The flexibility of the AI platform encourages innovation, allowing insurance companies to introduce new products, enter new markets, and better serve their customers.

Conclusion: Generative AI, Muffintech, and the Future of Insurance

Muffintech is more than just a tech provider; it is a key enabler of the AI-driven transformation in the insurance industry. By focusing on modularity, customization, and scalability, Muffintech is helping insurers optimize their processes, improve customer experience, and reduce costs.

As generative AI continues to evolve, the insurance industry will increasingly rely on companies like Muffintech to stay competitive, compliant, and customer focused. The future of insurtech is bright, and Muffintech is leading the way.

What Makes Muffintech Unique?

Muffintech is notable for its dedicated focus on the insurance industry, offering a specialized AI solution compared to more generalized models. Its deep integration with industry operations, emphasis on compliance, and robust security features make it a standout choice for insurance providers.

Header photo by Markus Spiske on Unsplash

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email