The Future of Insurance: Embracing Hyperpersonalization

Welcome to the world of hyperpersonalization, where Insurance is no longer a one-size-fits-all deal but a tailored experience designed just for you! Imagine your Insurance provider knows you so well, it feels like they’re reading your mind—or at least your data! With hyperpersonalization, insurers are using advanced technology to create highly customized products, services, and experiences that cater to your unique needs and lifestyle.

The global Hyper Personalization market was valued at USD 18.9 billion in 2023 and growing at a CAGR of 14.75% from 2024 to 2033. The market is expected to reach USD 74.82 billion by 2033.

What is personalization in Insurance, and what does it mean for policyholders and companies?

The personalization trend in Insurance involves tailoring policies and premiums to individual customers based on their unique behaviours, preferences, and risk profiles. Examples of personalization include usage-based motor Insurance, where premiums are adjusted based on driving habits, and health Insurance that offers discounts for maintaining a healthy lifestyle.

Data from various sources, such as telematics devices, wearable fitness trackers, and social media activity, is used to create these personalized policies. For policyholders, this means more relevant and potentially cost-effective coverage, while insurers can improve customer satisfaction and retention through targeted offerings.

Why Should You Care About Hyperpersonalization?

1. A Customer Experience That Wows: Ever dream of an Insurance policy that feels like it was made just for you? With hyperpersonalization, that’s exactly what you get. For example, imagine a Life Insurance company that tracks your fitness data from your smartwatch and rewards you for staying active with lower premiums or fun perks like free gym memberships. It’s like having a personal cheerleader rooting for your health!

2. Spot-On Risk Assessment: No more generic risk categories! Hyperpersonalization means your Insurance rates reflect your actual behavior. If you’re a safe driver who avoids speeding and harsh braking, your auto insurer can track this via telematics and reward you with lower rates. It’s like being paid to be good!

3. Streamlined, Super-Efficient Service: Say goodbye to long waits and hello to instant support. With AI-driven personalization, routine inquiries are handled in a flash, freeing up human agents to tackle the trickier stuff. Picture this: you have a question about filing a claim, and instead of navigating a phone maze, an AI chatbot provides instant, accurate assistance. Easy peasy!

4. Stand Out From the Crowd: In the competitive world of Insurance, standing out is key. Hyperpersonalization gives insurers an edge by offering unique, tailored experiences that keep customers coming back for more. Think about a health insurer that not only covers your medical bills but also creates a personalized wellness program based on your health data and goals. Now that’s a provider who gets you!

Challenges in Hyperpersonalization in Insurance-

Technological Transformation: The Insurance industry often lags behind other sectors in implementing technological transformation, with projects taking longer to deliver digital solutions effectively.

Data Privacy, Security, and Quality: Collecting and analyzing extensive customer data raises concerns about privacy, security, and compliance with regulations like GDPR and CCPA. Additionally, ensuring data accuracy and reliability is crucial, as poor data quality can lead to incorrect insights and negatively impact customer experiences.

Data Disparity and Integration: Hyper-personalization requires aggregating and integrating data from various sources, including historical data, IoT devices, and third-party insights. Data disparity, lack of aggregation, and the presence of data silos complicate this process, leading to time-consuming analytics and low-quality insights.

Technology Costs: Implementing advanced technologies like AI and machine learning for personalization is often expensive, posing challenges for smaller insurers who may struggle with the required financial investment.

Customer Trust and Expectations: Personalization efforts must balance innovation with respect for privacy to avoid discomfort and mistrust among customers. As personalization becomes more prevalent, customer expectations rise, making it harder for insurers to meet these demands.

Regulatory Compliance and Change Management: Adhering to evolving regulatory requirements related to data usage and personalization is challenging. Additionally, transitioning to a hyper-personalized model often requires significant changes in organizational processes, employee training, and technology infrastructure.

Algorithm Bias: The use of AI and machine learning in personalization can introduce bias, leading to unfair or discriminatory practices that must be carefully managed.

Companies helping achieve Hyper-personalization -

AXA leverages AI algorithms to analyze customer data and deliver personalized policy recommendations. Examining individual preferences, behaviors, and risk profiles, AXA's AI system tailors Insurance solutions to meet the unique needs of each customer. This approach not only enhances the relevance of the coverage provided but also improves customer satisfaction by offering policies that are specifically designed for their individual circumstances. Personalized Insurance products are more likely to meet customers’ specific needs, reducing the likelihood of policy cancellations and increasing retention rates.

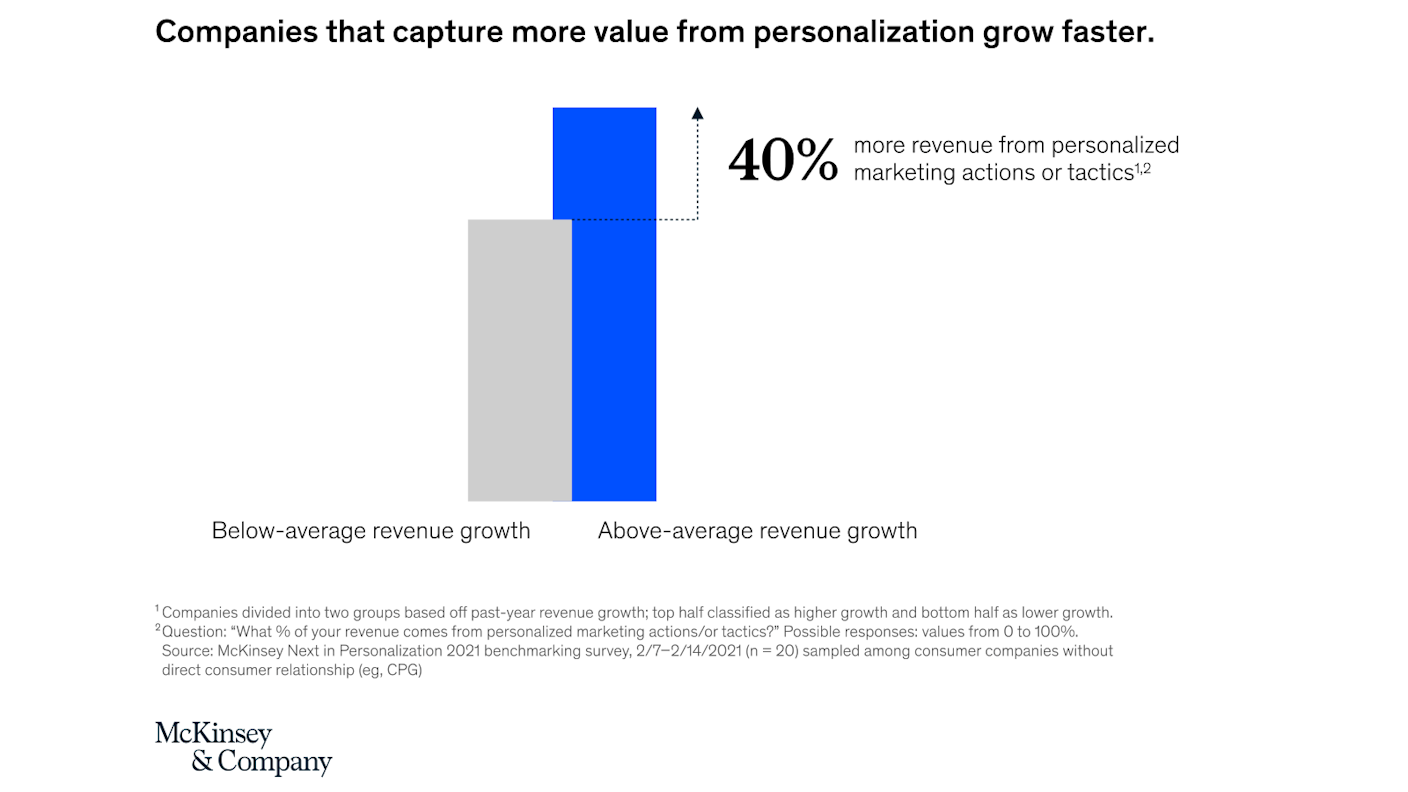

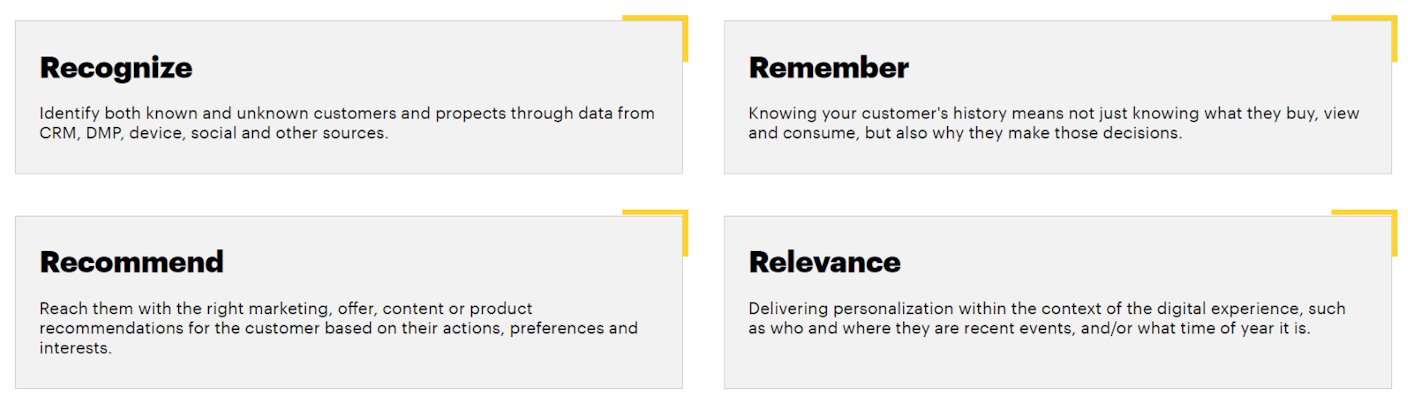

According to a report by Accenture, insurers that implement hyper-personalization strategies can achieve a 15% increase in customer retention and a 10% increase in premium growth. To help tackle this broad and critical topic, Accenture developed the 4R Personalization Framework. Similar to the way customers expect to be treated by their favorite offline business, online customers expect to be recognized by name when they arrive, and have their preferences remembered without having to be reminded. Customers expect the business to know them better than they know themselves by paying close attention to their unique preferences and making recommendations that are relevant within the context of the situation.

Aviva's Digital Transformation with MyAviva and Zowie

Aviva focused on building MyAviva, a digital self-service platform, to enhance customer engagement. As part of their digital transformation, they recognized the importance of balancing automation with human interaction. To manage increasing customer inquiries without overwhelming their service team, Aviva implemented Zowie, an AI chatbot. This solution now handles 90% of inquiries, allowing human agents to concentrate on more complex issues and improving overall service efficiency and customer satisfaction.

INSTANDA offers a platform that enables insurers to design and deliver highly personalized Insurance products quickly and efficiently. Their technology allows for dynamic policy creation and management, catering to individual customer needs and preferences.

Cognizant leverages its extensive experience in digital transformation and AI to help insurers implement hyper-personalization strategies. Their solutions focus on harnessing data analytics and AI to enhance customer experiences, improve risk management, and drive business growth through tailored Insurance offerings.

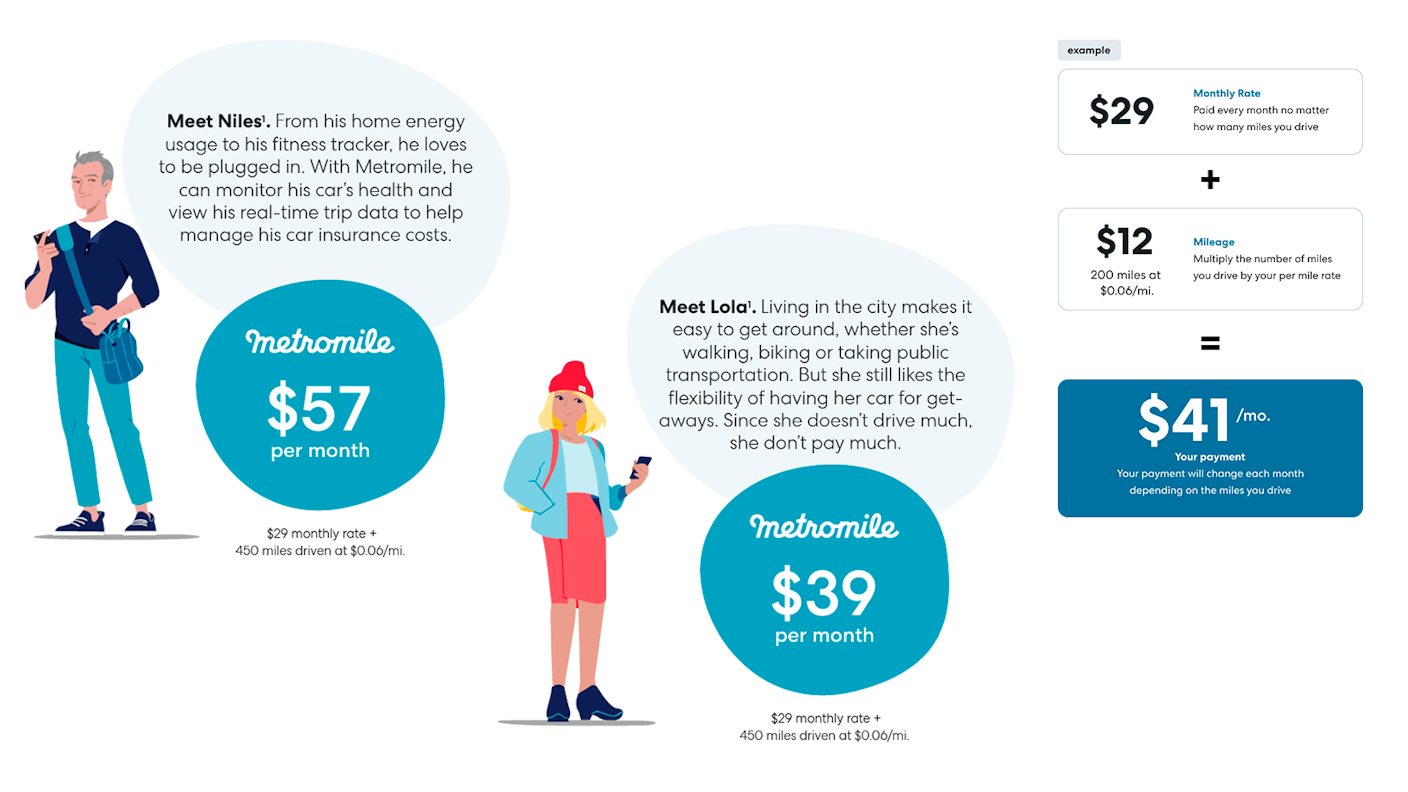

Metromile offers a distinctive pay-per-mile auto Insurance model that tailors rates based on actual driving habits. Through using a device called the Pulse, which tracks mileage and driving behavior, Metromile charges customers based on the number of miles they drive rather than a flat annual rate. This approach allows low-mileage drivers to save significantly—an average of 47% compared to their previous Insurance premiums by paying only for the miles they actually drive.

In addition to mileage-based pricing, Metromile provides customizable coverage options and an intuitive app that offers real-time access to policy details, claims filing, and driving insights. This personalization ensures that customers receive coverage that fits their unique driving patterns and needs. For infrequent drivers or those who use their vehicles mainly for short trips, this model aligns Insurance costs more closely with usage, making it a cost-effective solution for managing auto Insurance.

Oscar Health providing Health Insurance with Personalized AI Solutions

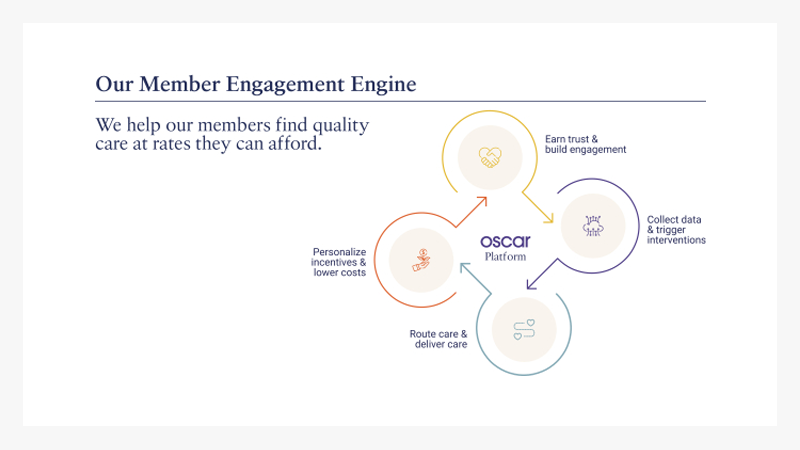

Oscar Health has emerged as a trailblazer in the health Insurance industry by harnessing the power of artificial intelligence (AI) to offer highly personalized health Insurance plans. Through analyzing individual health data, medical history, lifestyle, and preferences, Oscar Health’s AI-driven system provides tailored plan recommendations that include specific medical services, medications, and wellness programs suited to each policyholder’s needs. This innovative approach enhances customer satisfaction by delivering a more customized and relevant healthcare experience.

In addition to personalized plan recommendations, Oscar Health’s AI capabilities improve health outcomes and streamline processes. The AI system promotes preventive care by suggesting routine check-ups, vaccinations, and screenings based on individual health profiles, which helps in early detection of potential health issues and better management of chronic conditions. Moreover, AI optimizes claims processing, ensuring fast and accurate reimbursements, thereby reducing financial stress during health crises.M Focusing on individual needs and fostering a customer-centric approach, Oscar Health is setting a new standard in the health Insurance industry, making healthcare more proactive, efficient, and personalized.

Conclusion

Hyper-personalization has become necessary in the Insurance industry to meet customers’ evolving expectations. Harnessing the power of data, embracing AI and ML, implementing effective customer segmentation, optimising digital channels, and fostering proactive communication, insurers can create personalized experiences that resonate with their customers. In this age of customization, those who successfully achieve hyper-personalization will thrive in the competitive landscape and build long-lasting relationships with their customers. As we move forward, let us remember that the key to hyper-personalization lies in understanding and catering to the unique needs of every individual customer.

Hyperpersonalization isn’t just a buzzword—it’s the future of Insurance. Through understanding what you need before you even know you need it, insurers can offer a more personalized, efficient, and delightful experience. So get ready to enjoy a new era of Insurance that feels less like a transaction and more like a relationship. After all, why settle for ordinary when you can have extraordinary?

Insurtech Global Outlook - NTT DATA

Header photo by Luke Chesser on Unsplash

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email