The Lemonade Case

The 2015 Insurtechs represented by once scary names in the industry such as Oscar Health, Hippo, Next Insurance, Metromile and Lemonade have come to a new beginning to prove these models on the public markets. It is no secret that the performance of these stocks has been weak following the harsh reality of the insurance landscape to turn all investors’ expectations into profits.

However, the legacy of these companies is already in place leaving behind parts of technology, business or products adopted by other players in the industry. If they did not change the game, then for sure they speed it up. Personalization, digitalization, pay-per-use and other trends became a commodity in the insurance game, making younger Insurtechs go one step further.

Some of the 2022 highlighted Insurtechs can illustrate this effort. If the loss ratio was a struggle, then Alan's model aims for a 100% loss ratio and sells a subscription for its platform. If the Direct-to-Customer channels were a struggle, Wefox empowers agents to sell insurance efficiently. If losses from natural disasters destroyed a year of financial performance, Descartes's underwriting tries to cover climate risks. We could go on, but it is clear that this second wave looks different attracting Billions of investments.

LMND facts

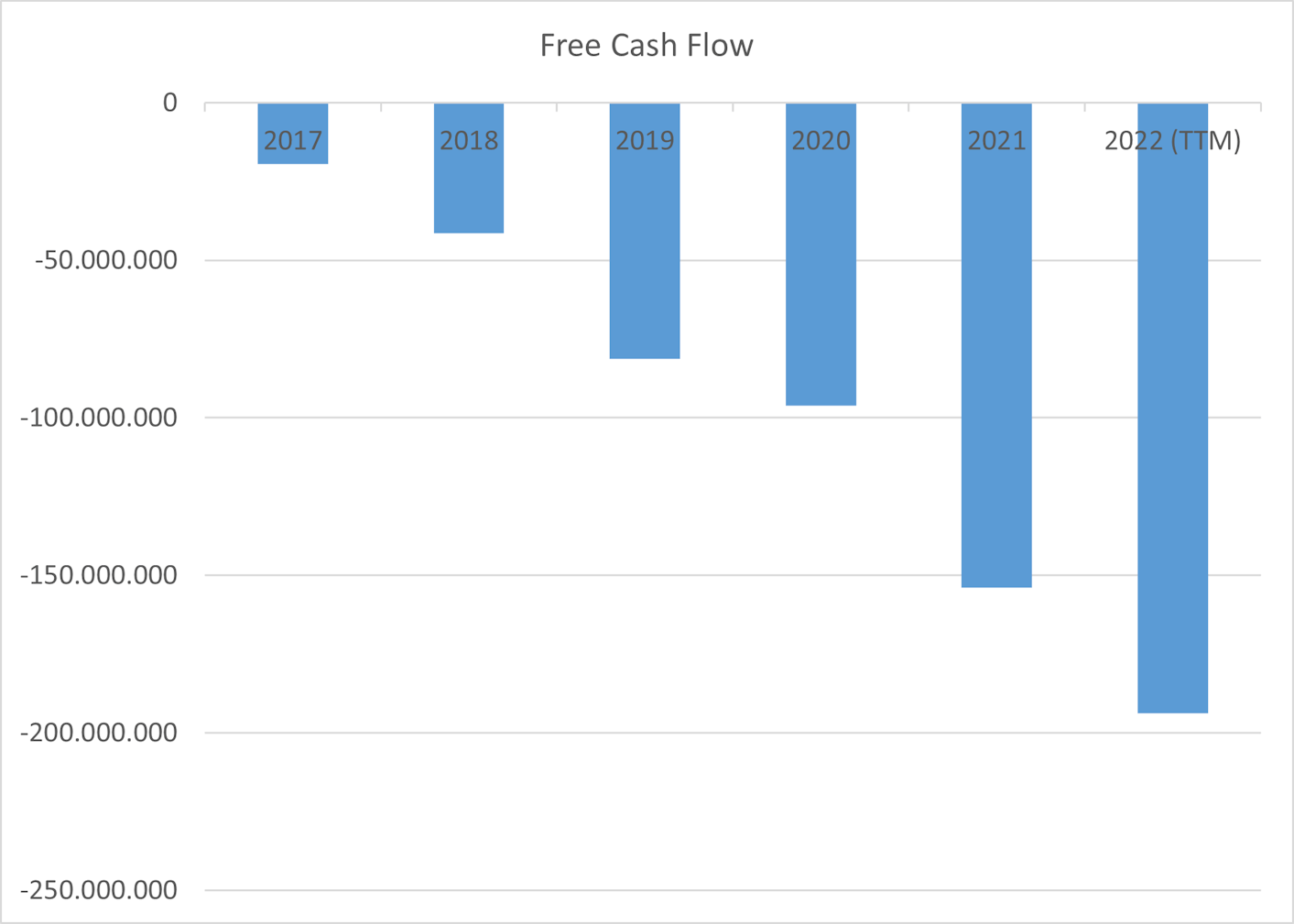

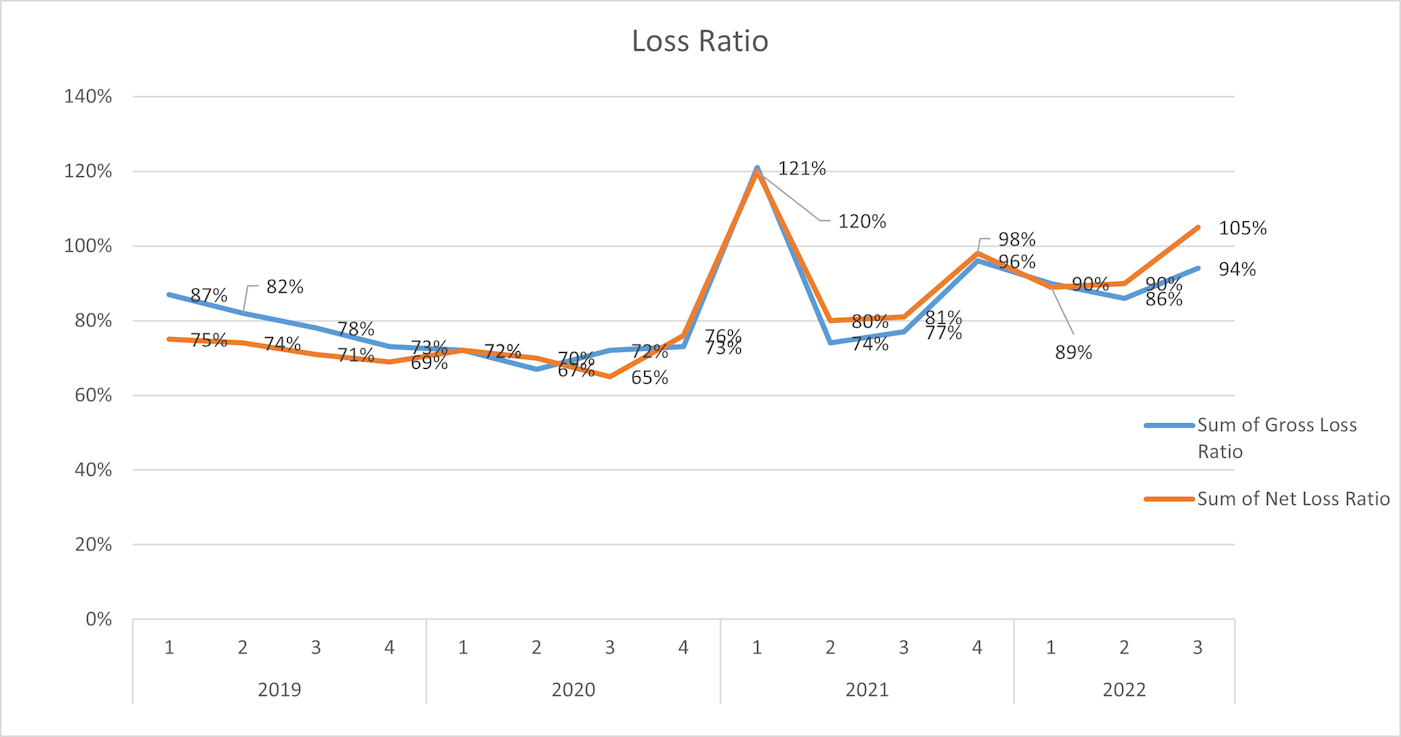

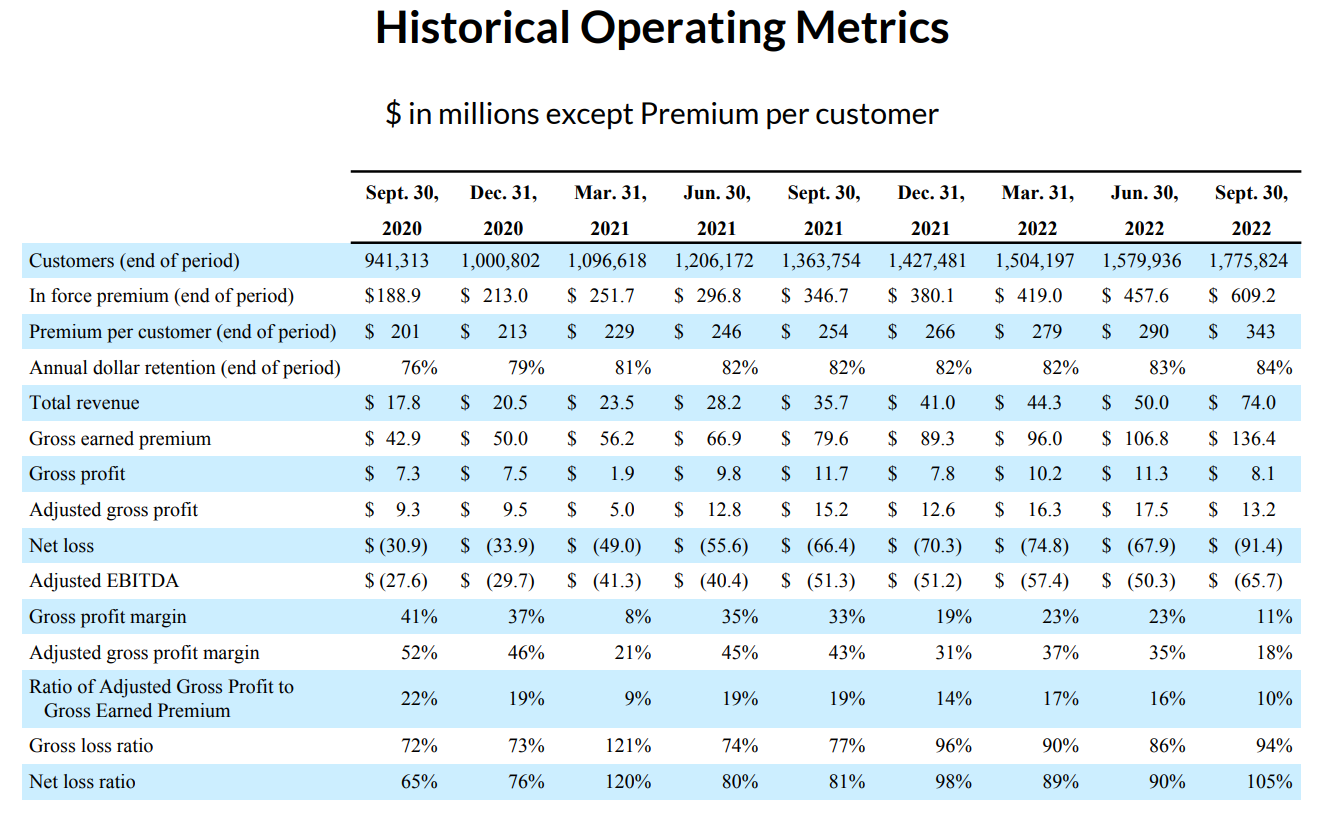

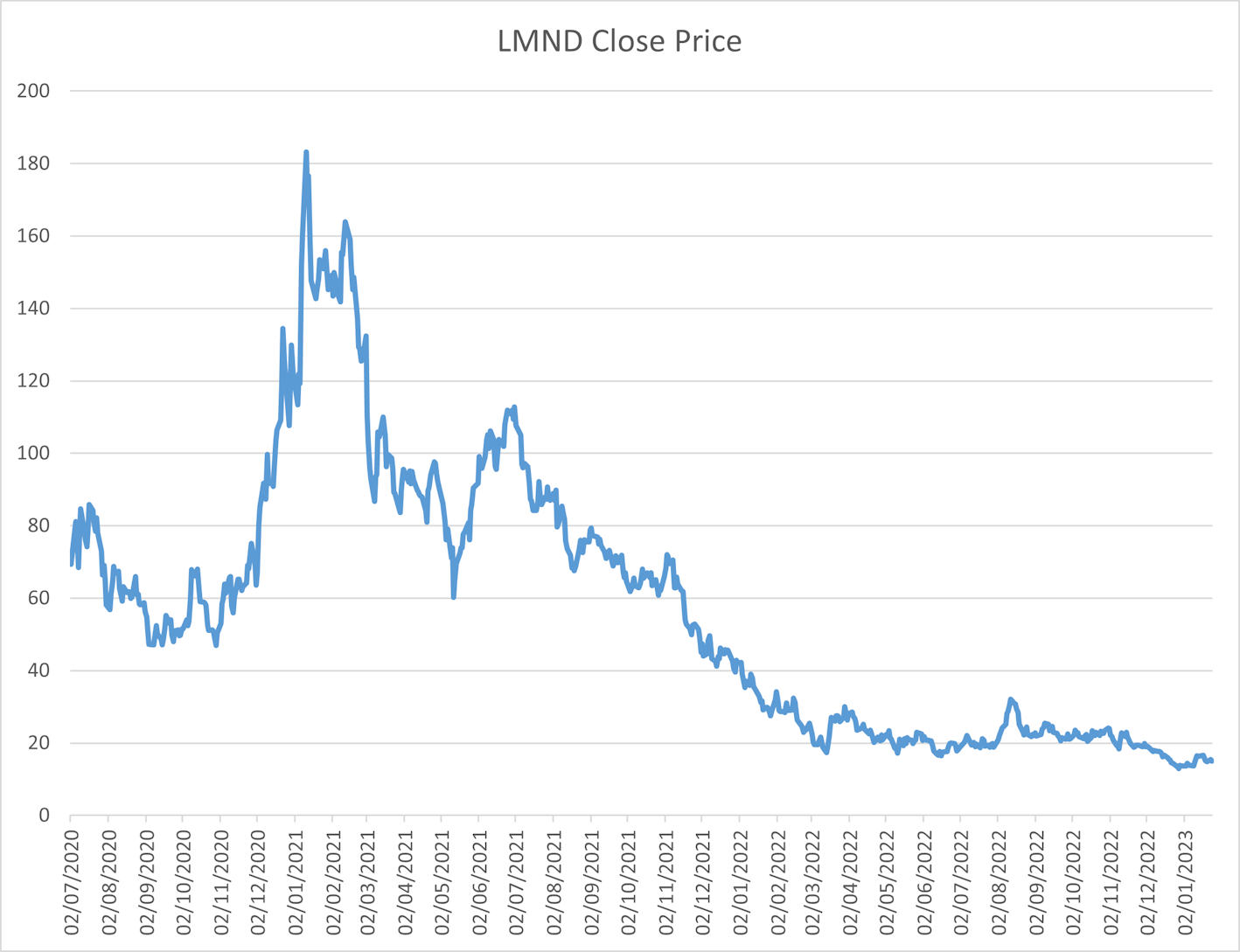

It seems, though, that is too early to discard older Insurtechs, especially Lemonade. This company represents everything the insurance industry ever wanted, but at the same time, its market cap has been consistently decreasing. The company went from almost 7 B USD in 2020 to 1 B USD at the end of 2022, following a Cash Flow of -194 M USD (in the past 12 months), a Gross loss ratio of 94% and a Net loss Ratio of 105% (in 2022 Q3).

Indeed, these are not exciting numbers and have an impact on the company's cost of capital that probably will affect all future projects such as expansion and growth. The fast adjustment of LMND value in capital markets could be aggressive and extreme, but it will put the Lemonade model to a test in a low capital abundance environment. Hence, the success of this Insurtech will be interesting to watch, given that there are ambiguous facts about the company and it can represent a real disruption for B2C insurance models.

The Lemonade model

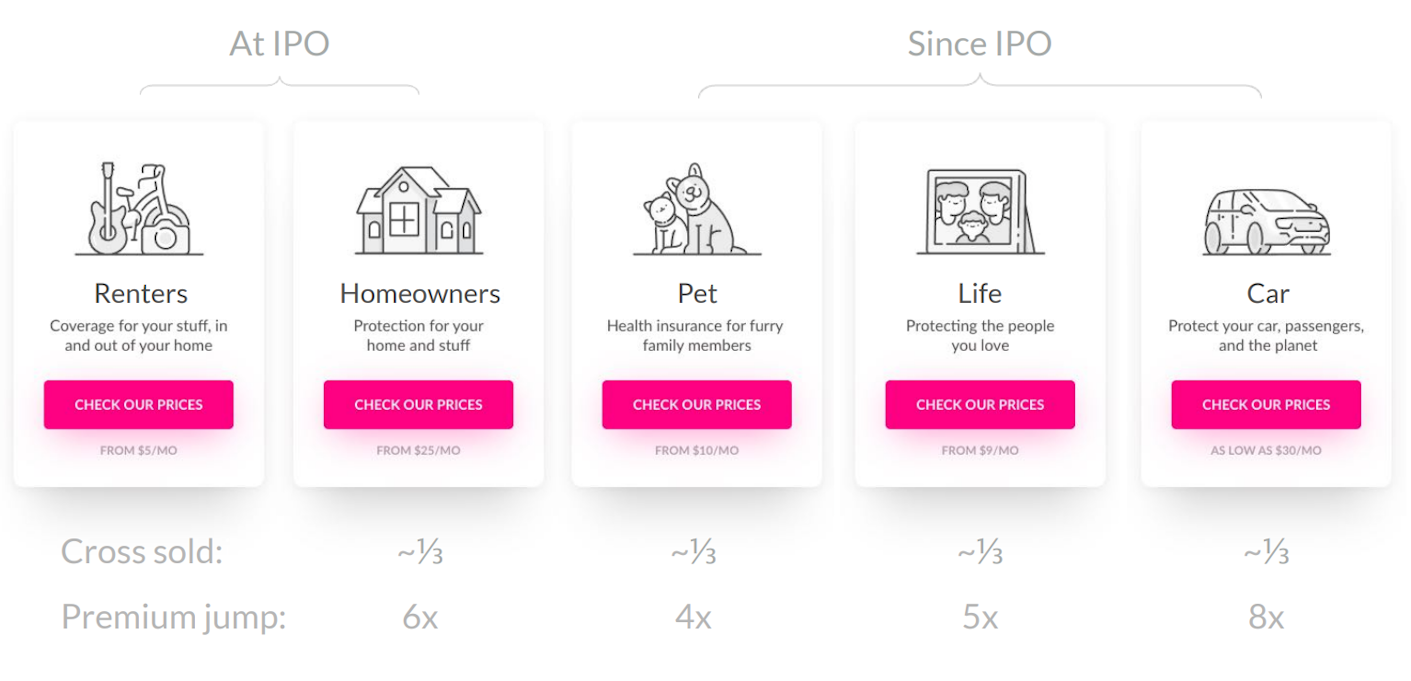

Lemonade was founded in 2015 and attracted large investments in the early days collecting around 170 M USD two years later from relevant investors such as SoftBank (that is still the largest LMND stockholder until this day), Allianz and GV. The company portfolio at that time only embraced homeowners and renters, but the bet on Lemonade was about the D2C distribution, the AI-centric technology and the simple, personalized and digital insurance product for young customers. Soon the company incorporated Pet, Life and car insurance into its portfolio creating an insurance ecosystem that we see today and intends to follow customers’ different life demands for insurance.

Artificial Intelligence is the core of the company that operates and enhances several parts of its business from internal process automation to customer experience. The proprietary technology can improve the Lemonade LTV model, pricing customers precisely and improving the model itself with more customers and their data sets.

Besides the AI-centric model, Lemonade has other technologies in place that would make the perfect insurer on paper, like prevention for natural disasters, Telematics, Computer vision and NPL, enhanced fraud detection, claims automation and predictive models using machine learning that identifies (KYC) and pricing customer by customer.

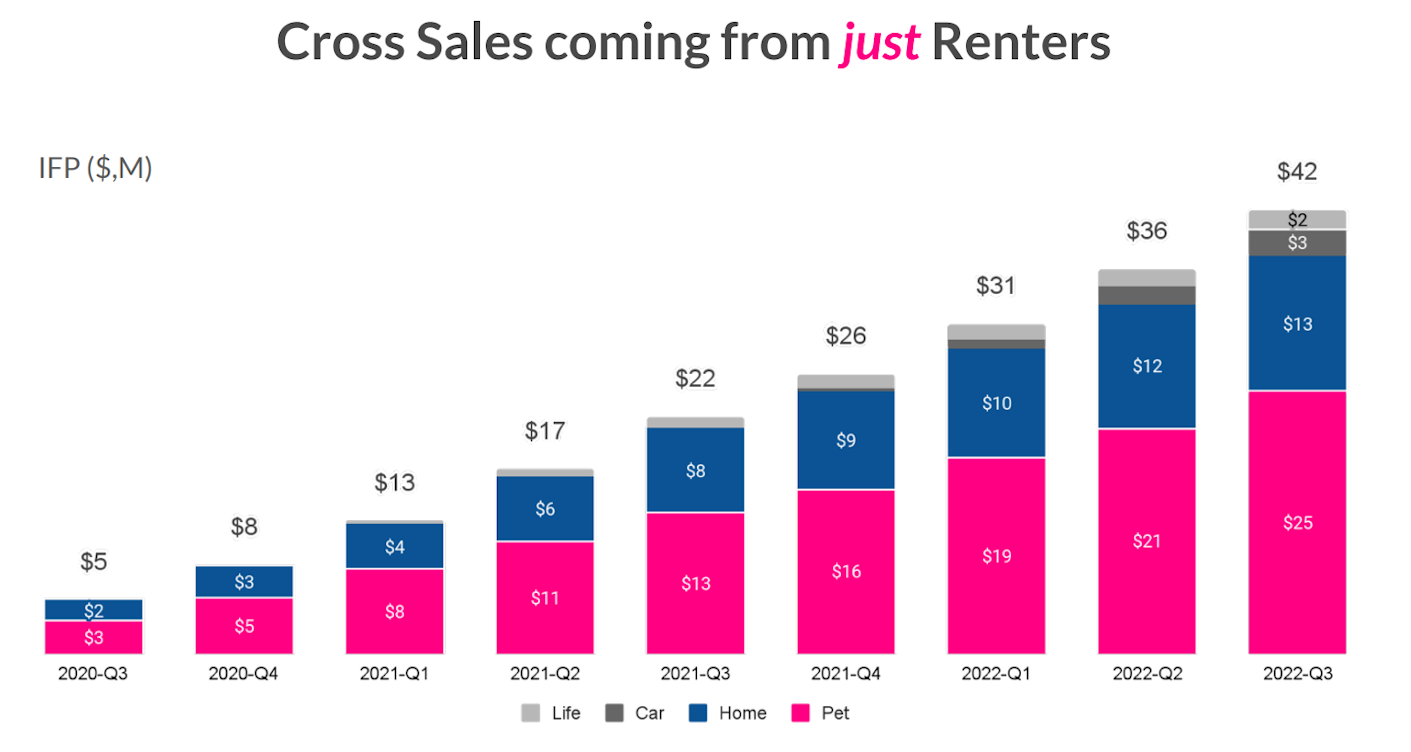

On the business side, one can have the same perspective on its potential; Lemonade creates an insurance ecosystem that empowers cross-selling activities, and attracts young customers with simple and digital insurance with a high NPS score and a customer experience parallel to tech companies.

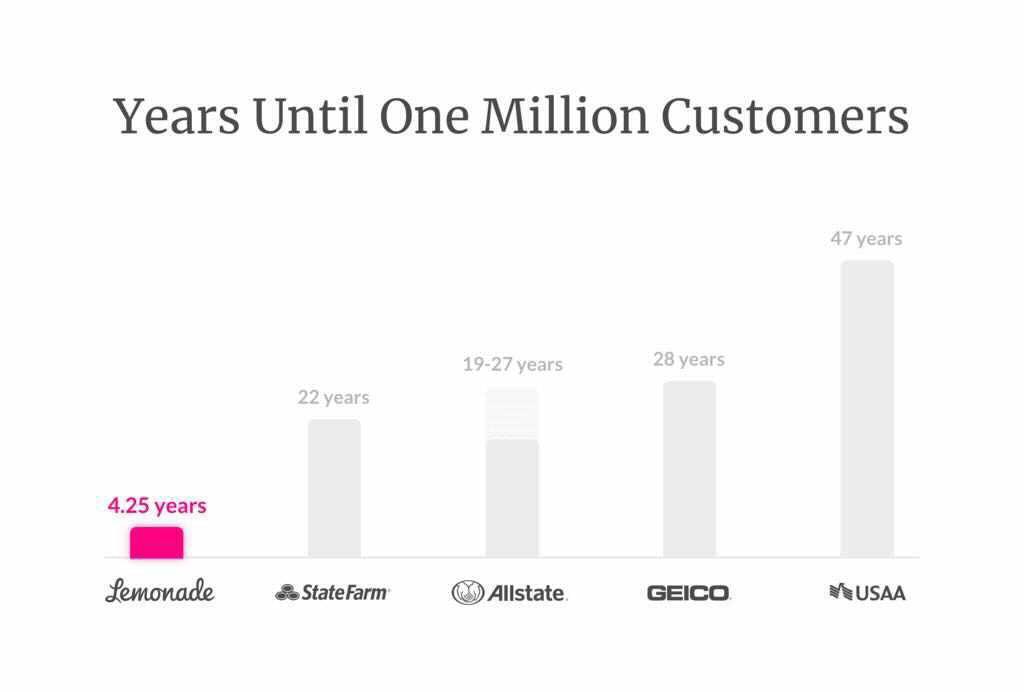

Related to this, Lemonade has managed in just 4 years to reach the figure of 1 million customers when other companies of the size of GEICO, Allstate or Statefarm needed more than 20 years.

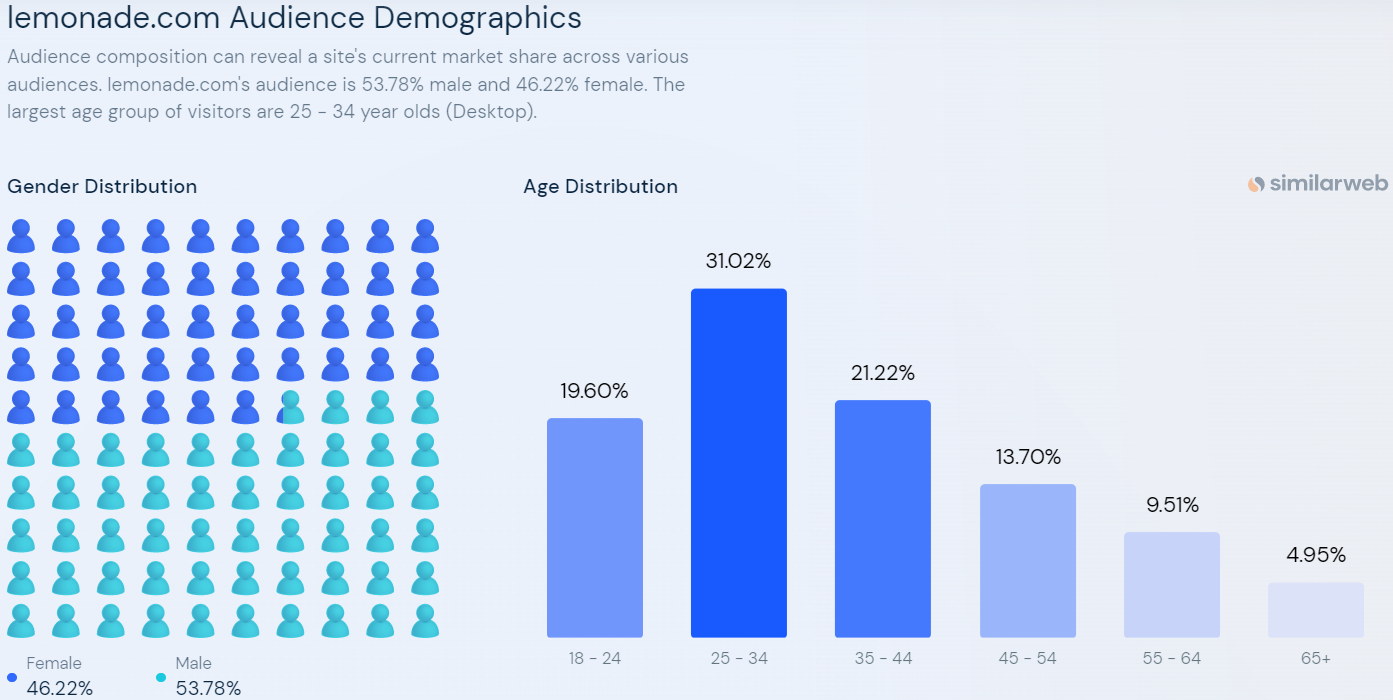

And in fact, Lemonade claims to be the first option for 1st-time buyers renters insurance and second for people under 35 years old. On a similar web, the audience demographics seem to support this claim with more than 50% of the company traffic coming from 18 to 34. This audience is at the centre of Lemonade’s strategy, focusing on young generations with short term convenient insurance products while establishing brand loyalty to get long term profits with their ecosystem strategy (first insurance for renters, then car insurance, and pet home and life insurance when this audience is getting older).

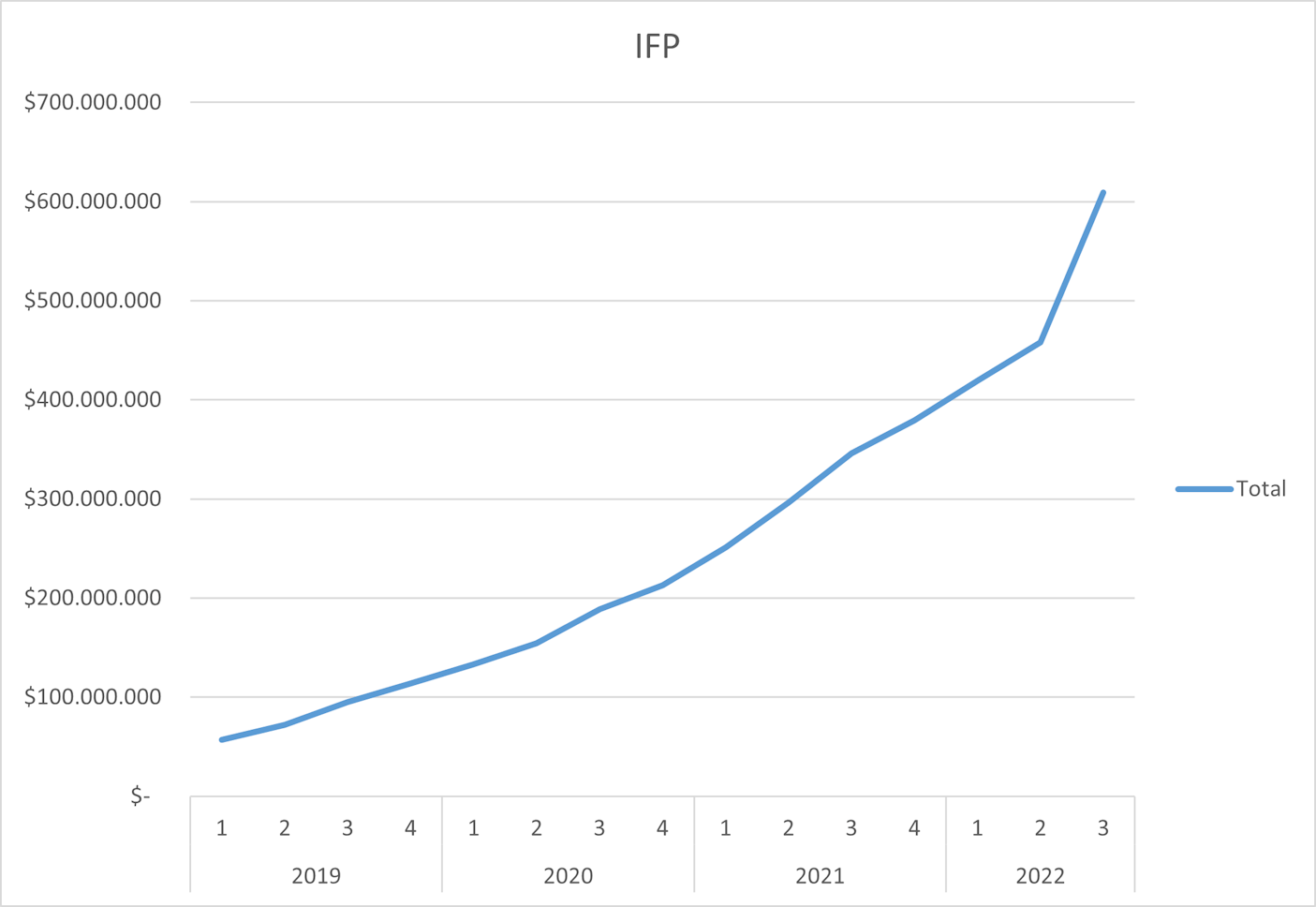

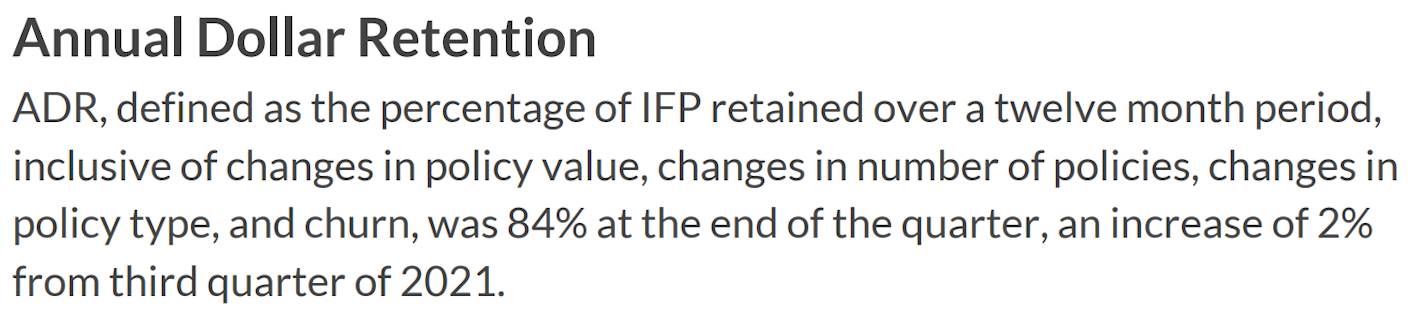

Consequently, Lemonade accumulates customers along the way and improves its In-force premium by leveraging cross-selling activities, also the increase of its customer base improves the predicted Annual dollar retention, acquiring along the way customers more aligned to its pricing-risk models. This indicator is a good retention indicator and aligned with the industry’s retention rate (84%).

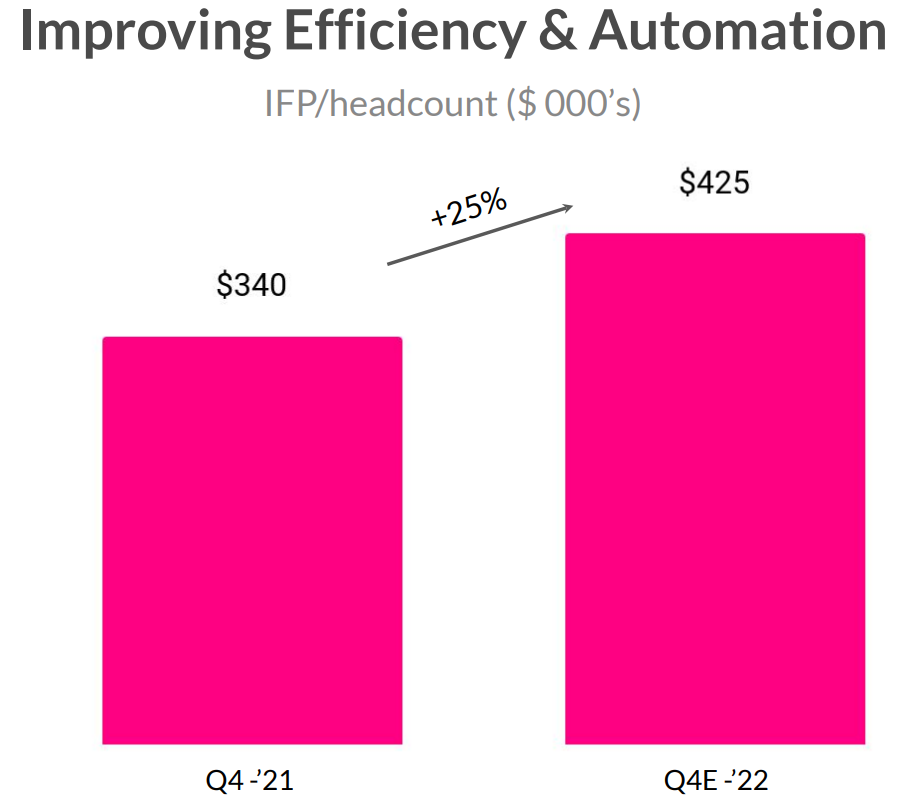

Efficiency measures by IFP per headcount also improved, showing that Lemonade has positive marginal revenue. This measure can be a sign of Metromile acquisition positive economies of scale and synergy within its business, partially justifying the layoff of 20% of acquired company employees.

On the other side, some ambiguous information may have been affecting the perception the market has of the company. As promising as Lemonade sound, the company will not work on a small scale, which means that it will take more time than expected to reach profitability. Likewise, other important metrics have a large gap when compared to incumbents:

56 pp to reach the benchmark in terms of Multiline customers

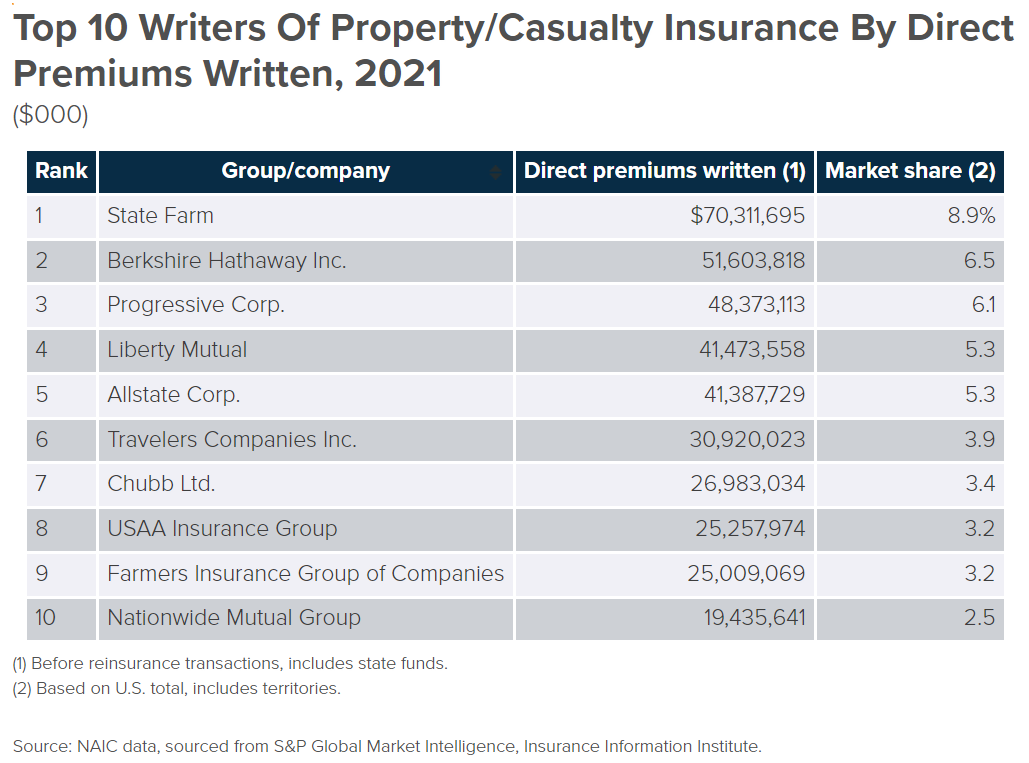

Need to increase the size by 50 to reach GEICO

Below average premium per customer

Lemonade was built to scale

This quote implies that Lemonade has negative marginal costs for every new customer and the level of process automatization, underwriting ability, Risk and pricing models will get better and better according to Lemonade's growth. At the centre of all this faith is the AI-centric model and proprietary technology built from scratch that holds a large part of Lemonade’s value.

The company foundation essentially means that either Lemonade grows to surpass the number of critical users or all this effort will be in vain, but this is the nature of radical and disruptive innovation. In the past years, the market has been punishing LMND expecting a better financial statement, opposing the essence of its business that puts profitability in the first place by carefully selecting where, when and how to expand.

Stock Price: $ 15 USD

Market Cap: $ 1.035 B

This is the Lemonade irony. It looks like they are not doing enough to reach profitability, but it is all they are doing. The big assumption here is that Lemonade models actually work better than incumbents in the long term, which will be tested in the upcoming years (next LMND results 22nd of February release of 2022Q4 results).

The pressure for results might speed the process to reach better results, but it is unlikely that it will speed the process of Lemonade adoption or healthy growth. The truth is Lemonade cannot compete with incumbents in the short term, making the only hope for the company to invest in the long term and make slight but consistent improvements to follow its value proposition.

Simple long-term game

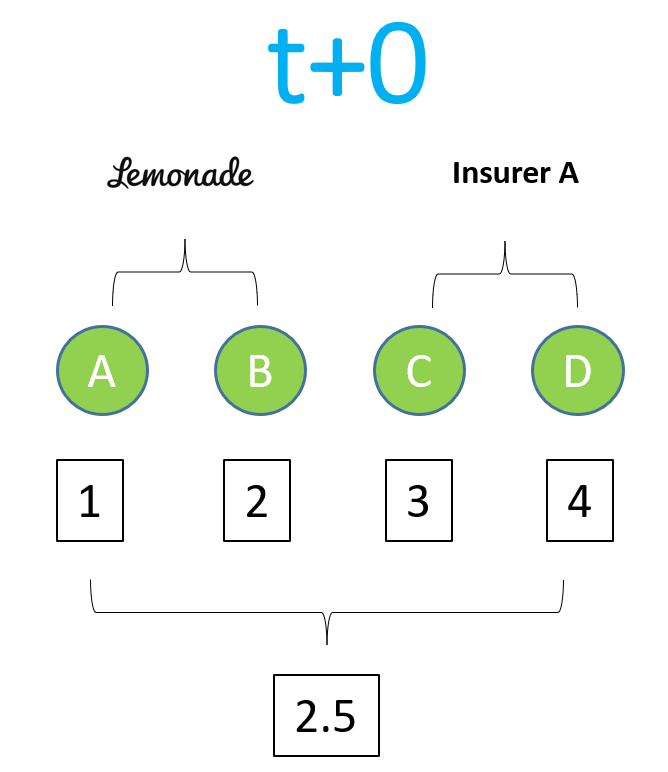

Considering that Lemonade has to bet on the long term a simple game was drawn below to illustrate what the innovation disruption might look like. Assuming that there is only two option for insurance, customers have to choose the right price/risk assessment or undervalued policies to maximize their satisfaction. In t+0, we would have the following:

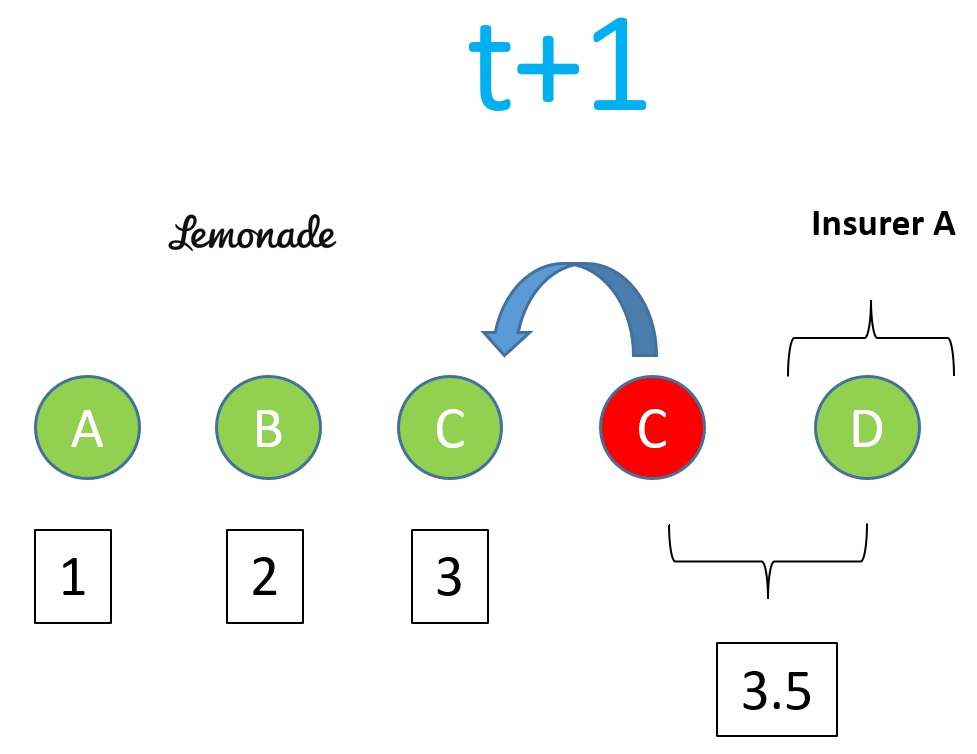

In this first scenario, Lemonade attracts lower premium/claims customers because of its perfect pricing, while Insurer A prices the pool by its aggregated average (2.5) and still beneficial for higher customers C and D. In the next scenario, t+1, the same game repeats:

In this case, customer C will perceive Lemonade as a more suitable Insurer and leave Insurer A. The result is that Insurer A always lag behind the pricing and sticks with lemons (asymmetric information) and Lemonade's upfront-enhanced pricing will always be ahead and increase slowly the PPC and customer base.

Therefore, Lemonade fails to deliver expected returns, but the market cannot discard it too soon. The ambitious bet on the long term is a high-risk and high-return game, since this Insurtech ambition is to disrupt the insurance landscape, changing its business heart and leveraging technologies that have become commodities in a unique way.

Header photo by Alicja Gancarz on Unsplash

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email