The Path to Sustainability: European Legislation & Reporting Standards

The Insurance industry is undergoing a transformative journey towards sustainability, driven by evolving regulatory landscapes, heightened stakeholder expectations, and growing awareness of environmental and social risks.

In Europe, recent legislative developments, coupled with the adoption of new reporting standards, are reshaping the way insurers approach sustainability, requiring them to adopt new expertise and solutions to effectively navigate this changing landscape.

Understanding Insurers' Carbon Emissions:

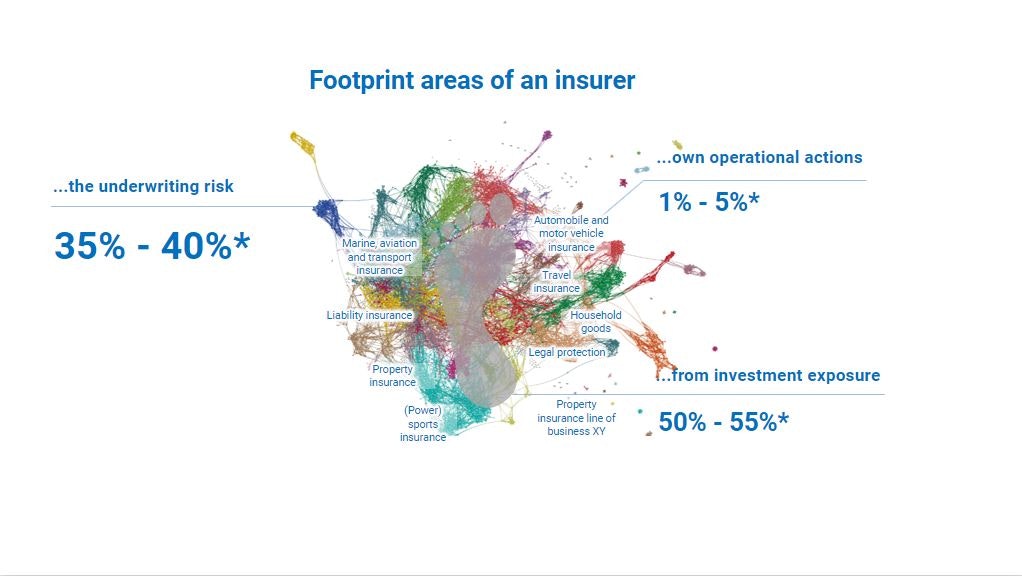

Insurers' carbon emissions emanate from various operational areas:

- Underwriting Risk: Contributes 35% to 40% of insurers' carbon footprint, encompassing emissions from insurance underwriting processes and claims management.

- Own Operational Actions: Account for 1% to 5% of emissions, covering internal activities such as office operations and business travel.

- Investment Exposure: Represents the largest portion, contributing 50% to 55% of insurers' carbon footprint, arising from investment portfolios including holdings in carbon-intensive industries and assets.

European Legislation: A Catalyst for Change

In recent years, European legislation has emerged as a key driver of sustainability initiatives within the Insurance industry. The Corporate Sustainability Reporting Directive (CSRD), introduced to replace the Non-Financial Reporting Directive (NFRD), has set stringent requirements for companies, including insurers, to enhance transparency and accountability on environmental, social, and governance (ESG) issues. Under the CSRD, insurers are mandated to report on a wide range of sustainability factors, including climate change mitigation efforts, adaptation strategies, and investment exposures.

New Reporting Standards: ESRS E1 and Beyond

At the heart of CSRD implementation lie the European Sustainability Reporting Standards (ESRS), furnishing a comprehensive framework for sustainability reporting. ESRS E1, specifically focusing on climate change-related information, delineates meticulous requirements for insurers to divulge their greenhouse gas (GHG) emissions, underwriting risks, own operational actions, and investment exposures. Insurers are now tasked with navigating the intricacies of these reporting standards, ensuring compliance and precision in their disclosures.

Timeline for Reporting:

- Fiscal 2024, first sustainability statement in 2025: Companies previously subject to the NFRD, including large listed insurance firms, large banks, and large non-EU companies with over 500 employees.

- Fiscal 2025, first sustainability statement in 2026: Other large companies, including additional large non-EU entities.

- Fiscal 2026, first sustainability statement in 2027: Listed SMEs, including non-EU SMEs.

- Fiscal 2028, first sustainability statement in 2029: Final possible date for listed SMEs to commence reporting.

Challenges and Opportunities:

The transition to sustainability poses both challenges and opportunities for insurers. While the adoption of CSRD and ESRS introduces compliance burdens and reporting complexities, it also presents a unique opportunity for insurers to demonstrate leadership in ESG integration and climate risk management. Insurers are encouraged to leverage innovative solutions and expertise to enhance their sustainability performance, capitalize on emerging opportunities, and navigate the evolving regulatory landscape.

The Need for New Expertise and Solutions

As insurers adapt to the evolving regulatory landscape and reporting standards, there is a growing demand for new expertise and solutions in sustainability management. Insurers are increasingly seeking professionals with specialized knowledge in ESG factors, climate risk assessment, and sustainable finance to drive their sustainability agendas forward. Additionally, there exists a pressing need for innovative technologies and data analytics tools to facilitate seamless data collection, analysis, and reporting, enabling insurers to effectively monitor and manage their sustainability performance. However, a significant challenge persists as evidenced by the fact that 49% of insurer CEOs acknowledge their company's inability to measure emissions accurately today. This underscores the urgency for investment in robust measurement methodologies and emission tracking systems to address this gap and ensure comprehensive sustainability reporting in the future.

The Insurance industry stands at a critical juncture in its sustainability journey, propelled by new European legislation, reporting standards, and mounting pressure to address climate change. As insurers adapt to these changes, there is a clear imperative to embrace new expertise, innovative solutions, and robust reporting practices to navigate the complexities of sustainability management effectively. By seizing this opportunity and embracing sustainability as a core business principle, insurers can drive positive environmental and social impacts while securing their long-term competitiveness in a rapidly changing world.

Sources:

EU Commission (2023)

ESMA (2023)

ESG, A growing sense of urgency – PWC Analysis (2022)

The Net-Zero Insurer, BCG (2022)

Header photo by Scott Graham on Unsplash

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email