Insurance Product Development: From Fragmentation to Agentic Growth

The insurance industry is at a turning point. Risks are multiplying, regulations are tightening, and customer expectations are evolving faster than ever. For carriers, the challenge is no longer just about keeping pace—it’s about rethinking how products are designed, built, and delivered in a world defined by speed and complexity.

Insurance product development is no longer about incremental tweaks. From unified data to agentic workplaces and real-time insights, the future lies in creating faster, smarter, and more customer-centric solutions across global markets. Those who embrace this shift will not only accelerate growth but also redefine their role in a rapidly changing industry.

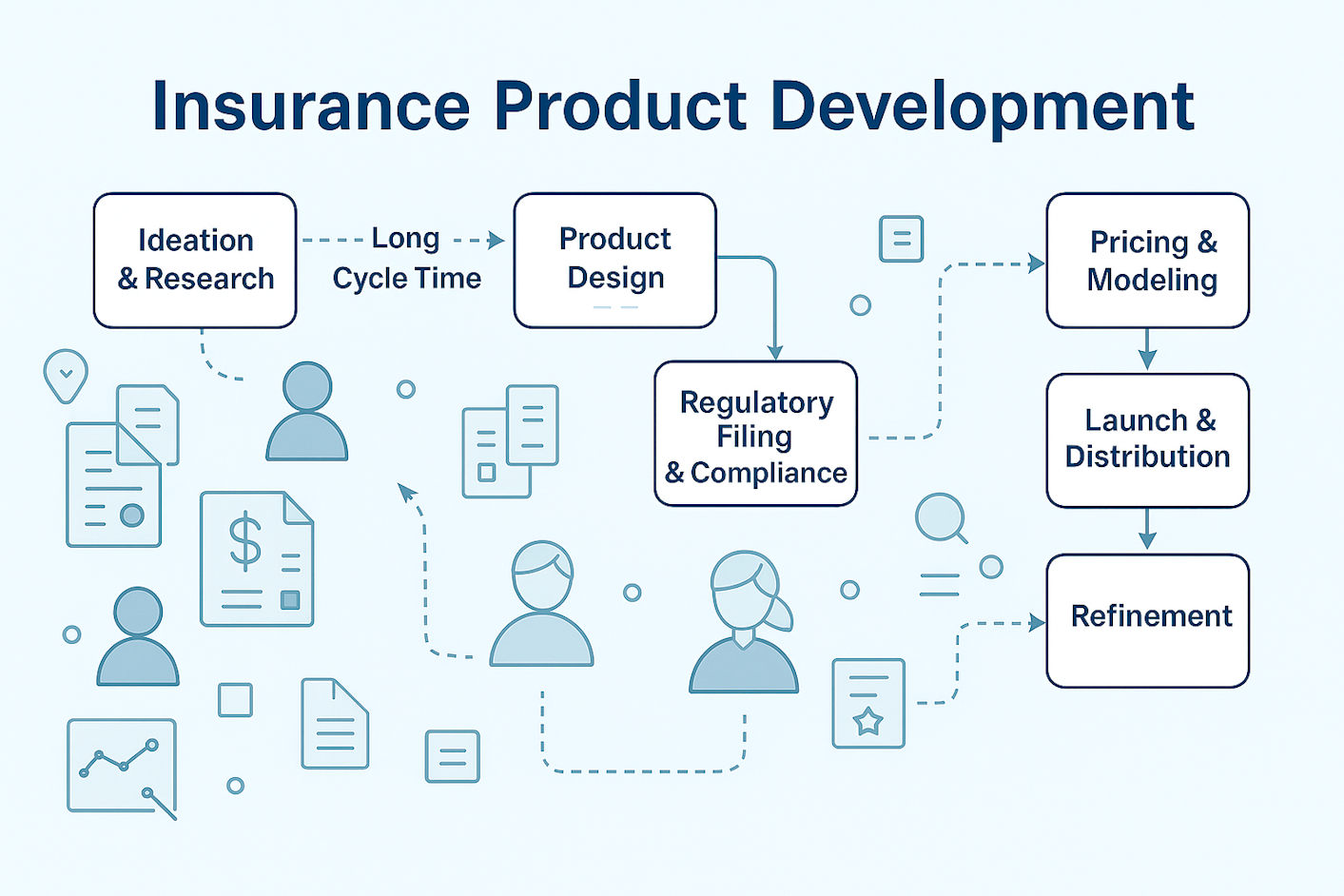

Fragmentation and Friction

The ambition is clear, but execution remains a struggle. Many insurers are still operating with fragmented workflows, siloed teams, and manual processes that stretch product development cycles into months—or even years.

Regulatory filings require multiple iterations, slowing launches and draining resources. Pricing models are often disconnected from real-world performance, leaving carriers unable to react quickly to shifts in risk or customer behavior. The result is an environment where opportunity exists, but friction repeatedly gets in the way of value creation.

Global and Local Imperatives

These challenges are not confined to any single geography. Carriers across North America, Europe, and emerging markets face the same core dilemma: how to balance speed with compliance, innovation with operational reality, and global best practices with local market nuances.

Increasingly, the ability to harmonize these competing imperatives is becoming a key strategic differentiator. Those who can bridge global expertise with local execution will be the ones to thrive in this next chapter of insurance.

Learning from Leaders

Encouragingly, some organizations are already showing what’s possible. By combining consulting expertise, advanced analytics, and proven technology platforms, they are reimagining the product development lifecycle from end to end. In North America and Europe, for example, carriers are integrating modern pricing engines with configuration expertise to accelerate launches while ensuring compliance.

In parallel, advanced modeling and scenario analysis are enabling teams to benchmark rates, anticipate regulatory feedback, and make smarter decisions faster. These examples highlight a broader truth: transformation is not about replacing everything at once, but about intelligently combining capabilities to deliver tangible impact.

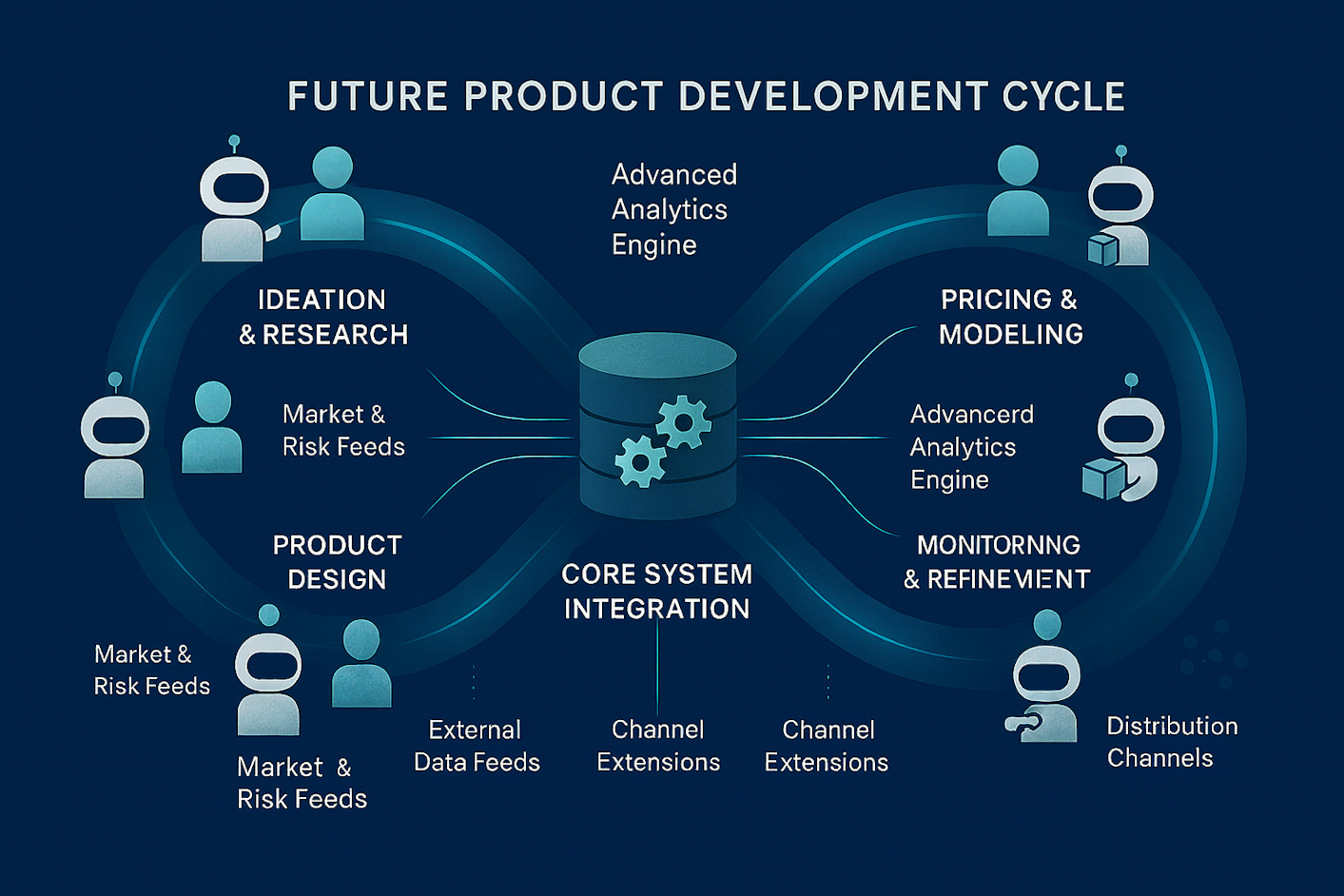

The Rise of Agentic, Composable Workplaces

At the heart of this transformation lies a powerful shift: the emergence of the agentic, composable workplace. Intelligent agents and modular architectures are no longer abstract concepts—they are becoming practical tools for insurers to reduce complexity and unlock agility.

Imagine replacing weeks of manual data reconciliation with automated insights that flag anomalies in real time, or empowering teams to simulate pricing strategies in hours rather than months. This evolution is not only about technology; it is about freeing people to focus on strategy, creativity, and customer innovation.

When routine tasks are automated and insights surface seamlessly, teams can channel their energy toward creating real differentiation in the market.

The Market Need: Unified, Insight-Driven Product Development

The future of insurance product development lies in unified, insight-driven platforms. These platforms bring together disparate data sources, embed compliance into the workflow, and provide real-time feedback loops that inform decision-making. They allow carriers to manage the full product lifecycle—ideation, launch, and continuous refinement—while integrating seamlessly with core systems and distribution networks.

In a market defined by speed and volatility, the ability to monitor, benchmark, and adapt products dynamically is no longer optional; it is the foundation of competitive advantage.

Making It Practical: Overcoming Adoption Barriers

Of course, the path forward is not without obstacles. Legacy systems remain deeply entrenched, making integration complex. Regulatory landscapes grow more demanding, and talent shortages in analytics and compliance create additional bottlenecks.

Many teams are understandably cautious about adopting agentic or AI-driven approaches. The solution lies in pragmatism. Instead of attempting a sweeping overhaul, insurers can modernize incrementally—starting with a single workflow, a specific product line, or a targeted compliance process. Parallel investments in data strategy, cross-functional collaboration, and training will help build confidence and momentum.

Partnerships with proven technology providers and consulting experts can further reduce risk, accelerate adoption, and demonstrate value early in the journey.

Final Take

The transformation of insurance product development is no longer an abstract ambition—it is a business imperative. The winners will be those who break down silos, embrace agentic workplaces, and invest in unified platforms that turn complexity into clarity and friction into opportunity.

The journey has already begun, and the organizations that act decisively today will define the future of insurance tomorrow.

This perspective is informed by ongoing work across global and local teams, including collaborations with leading technology partners and consulting experts. The journey toward unified, insight-driven product development is underway—and the opportunity for innovation has never been greater

Header photo by Pawel Czerwinski on Unsplash

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email