What is Pricing Tech in Insurance?

It Is Not About the Right Price

The concept of the “right price” can be misleading in the context of pricing technology. Prices in insurance are inherently dynamic, varying across time, business strategies, and distribution channels. This variability arises from a combination of external and internal variables that influence pricing decisions.

From an insurer’s perspective, the “right price” should theoretically minimize customer surplus, the difference between what a customer is willing to pay and the actual price. If the price exceeds what the customer is willing to pay, no deal occurs. On the other hand, if the price falls below what the customer is willing to pay, the insurer forfeits potential revenue. While this is an oversimplified perspective, it serves as a foundation for understanding the complexities of pricing.

Adding more variables highlights how intricate pricing can become. Pricing often goes beyond achieving zero customer surplus. For instance, what if an insurance product operates in a commodity-like environment under perfect competition? Pricing might then serve as an entry point for simpler products that pave the way for upselling later. Additionally, insurers may aim to maximize the likelihood of purchase, where the optimal price is not necessarily the lowest. These considerations underscore that the “right price” is a relative concept, shaped by product type, customer segment, and other variables.

It Is About the Right Model

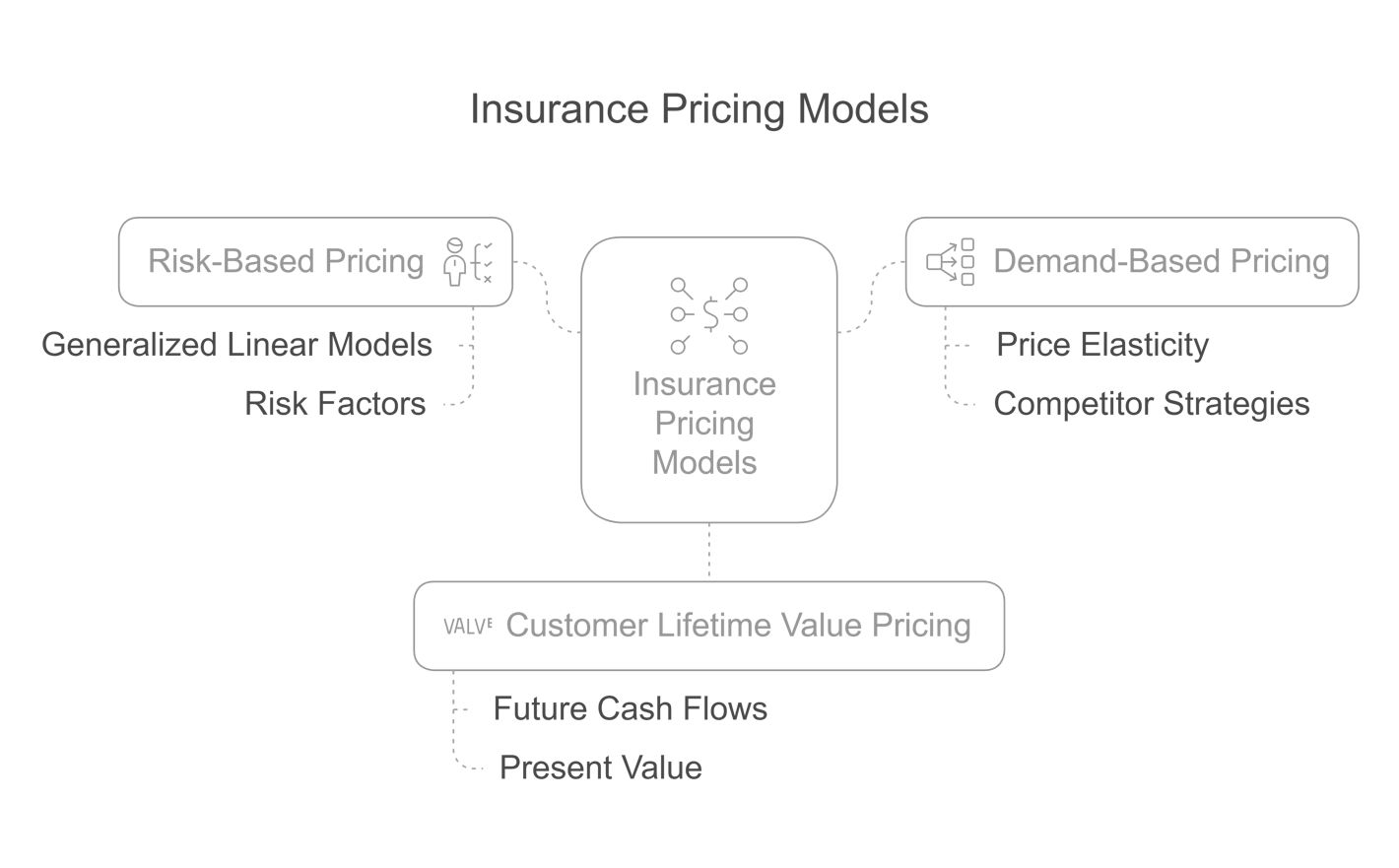

Given the nuanced nature of pricing, focusing on the “right model” is a more practical and effective approach. Insurance pricing models vary depending on a company’s strategic priorities. Broadly, these models fall into three main categories:

1. Risk-Based Pricing: This traditional approach uses models like Generalized Linear Models (GLMs) or similar techniques to assess individual risk factors, such as claims history, age, or gender. The fundamental principle is that higher risk correlates with higher premiums.

2. Demand-Based Pricing: This model centers on understanding demand behavior, with a particular focus on price elasticity and competitors’ pricing strategies. The goal is to explore how price changes influence demand and conversion likelihood, enabling insurers to optimize their pricing strategies.

3. Customer Lifetime Value (CLTV) Pricing: This approach involves pricing customers or businesses based on their overall present and future value. Similar to financial asset valuation, this model evaluates all potential future cash flows from a customer, discounted to their present value, while accounting for associated costs.

The effectiveness of these models is often constrained by external factors such as regulatory requirements, competition, and data availability, as well as internal company strategies. These constraints are particularly pronounced in the insurance sector, where flexibility in pricing models is more restricted than in other industries like retail.

What Is Pricing Tech?

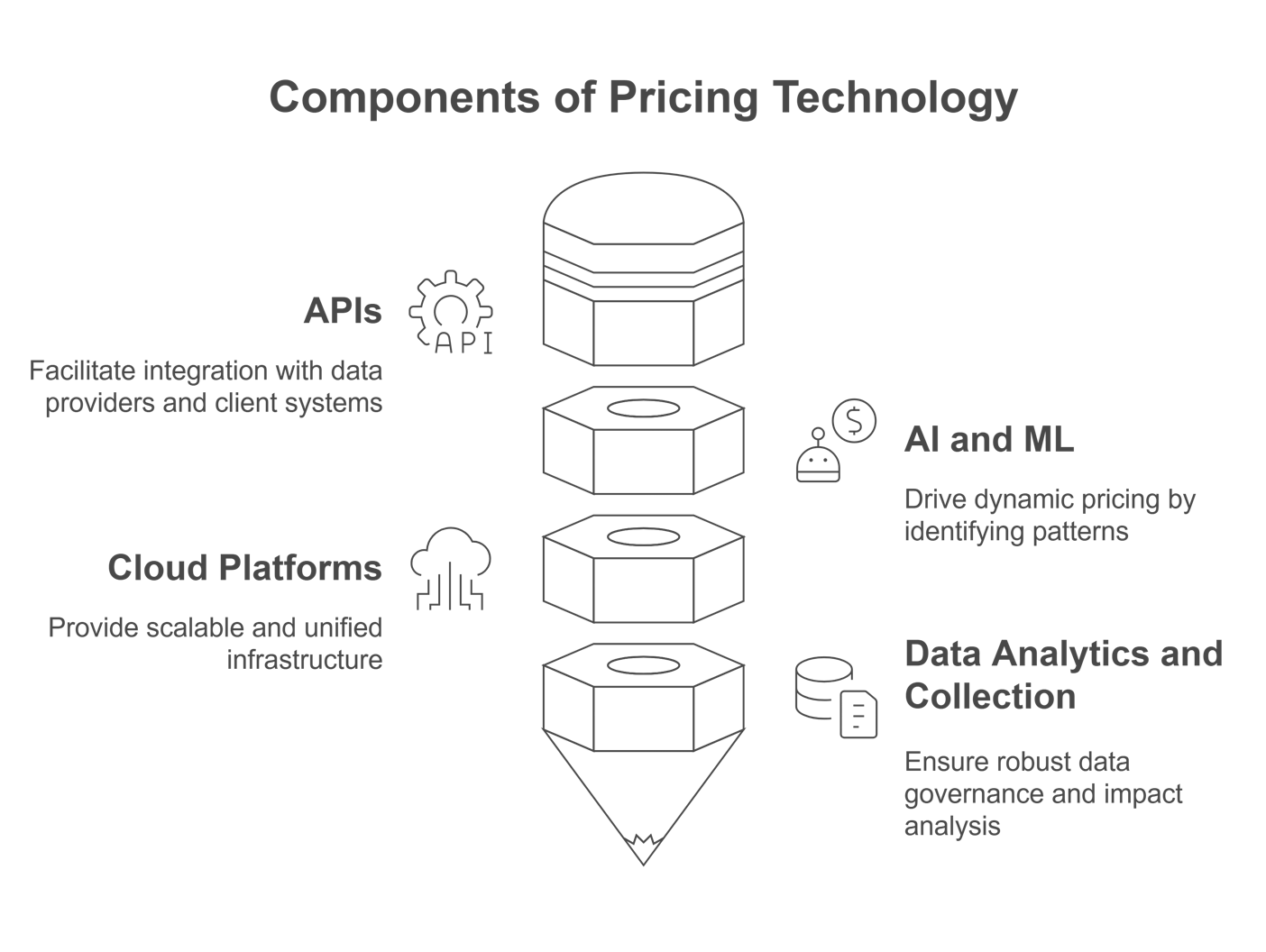

Analyzing frontier pricing models from Successful Insurtech in this area, I am inclined to believe that pricing tech on its core refers mainly to APIs, AI and ML, Cloud, Data analytics and Collection. With the goal to adjust prices according to clients demand curve and risk. Pricing technology integrates existing technologies to enhance pricing models in insurance.

· APIs: APIs facilitate seamless integration with external data providers and client systems, allowing insurers to incorporate new variables and experiment with pricing models.

· AI and ML: Artificial intelligence and machine learning drive dynamic pricing by identifying patterns, creating granular models, and enabling rapid adjustments to parameters.

· Cloud Platforms: Cloud-based solutions connect datasets and modules, forming a scalable and unified infrastructure for pricing innovation.

· Data Analytics and Collection: Key features include pulling data from external sources, analyzing model impacts through dashboards, and ensuring robust data governance.

So, what value Pricing Insurtechs create for Large insurers with robust pricing models and heavy external and internal limitations? It is hard to believe that an Insurtech has more robust pricing models than an Insurers, at the end of the day a good pricing model is the foundation for an insurance business. However, clearly there are gains to partner with these new players specially to explore the following features:

· Agility and Microservices: Insurtechs deliver modular, fast-paced solutions that enhance existing models through simulation, testing, and rapid deployment.

· Innovative Business Models: Collaboration with insurtechs opens opportunities to design new pricing models tailored to emerging business needs.

· Emerging Risks: When historical data becomes irrelevant—such as in the face of new risks—insurtechs offer adaptable platforms and processes to fill critical gaps.

Pricing, underwriting and risk assessment work together. They are intrinsically connected but by breaking down the concept of pricing we can see that pure pricing innovation will come mainly from two areas: Finding the best pricing model and helping to explore its biases and limitations. Insurtechs can not only help Insurers with the pricing models, but also in finding out the boundaries in which these models can play. By analyzing leading pricing insurtechs, we can identify commonalities on their focus to address regulatory and bias issues in insurance. From these observations, we can infer the value they add to their clients.

· Transparent AI: New pricing tech companies like Akur8 emphasize transparency in their AI. Akur8 ensures compliance and regulation by using transparent AI that allows insurers to audit, control, and explain their AI models, ensuring ethical and fair decision-making that meets regulatory standards.

· Governance: Teams with a strong presence of actuaries, who are experts in risk minimization and innovation, can bridge the gap between regulatory boundaries and innovative models. Hyperexponential exemplifies this approach.

· Co-creation in Controlled Environments: Model governance with self-host options, where clients can test new systems, is a common feature among emerging pricing insurtechs. Optalitix, for instance, provides a controlled environment for clients to manage and govern pricing data and models in the cloud.

Although pricing can also be impacted by innovations in underwriting and risk assessment with process automation, no code platform with flexibility of pricing rules, speed to underwrite and KYC, we solely focused on core pricing innovation in this article.

As the insurance industry evolves, the collaboration between traditional insurers and insurtechs offers immense potential. Insurtechs provide agility, scalability, and fresh perspectives, while insurers bring deep expertise and proven models. Together, they can redefine pricing innovation, crafting solutions that are not only technologically advanced but also tailored to diverse customer needs.

However, it is important to adjust expectations regarding what pricing technology can achieve. Each implementation should be analyzed on a case-by-case basis to determine where it can deliver the most significant value. Only through such thoughtful evaluation can insurers fully capitalize on the transformative potential of pricing technology.

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email