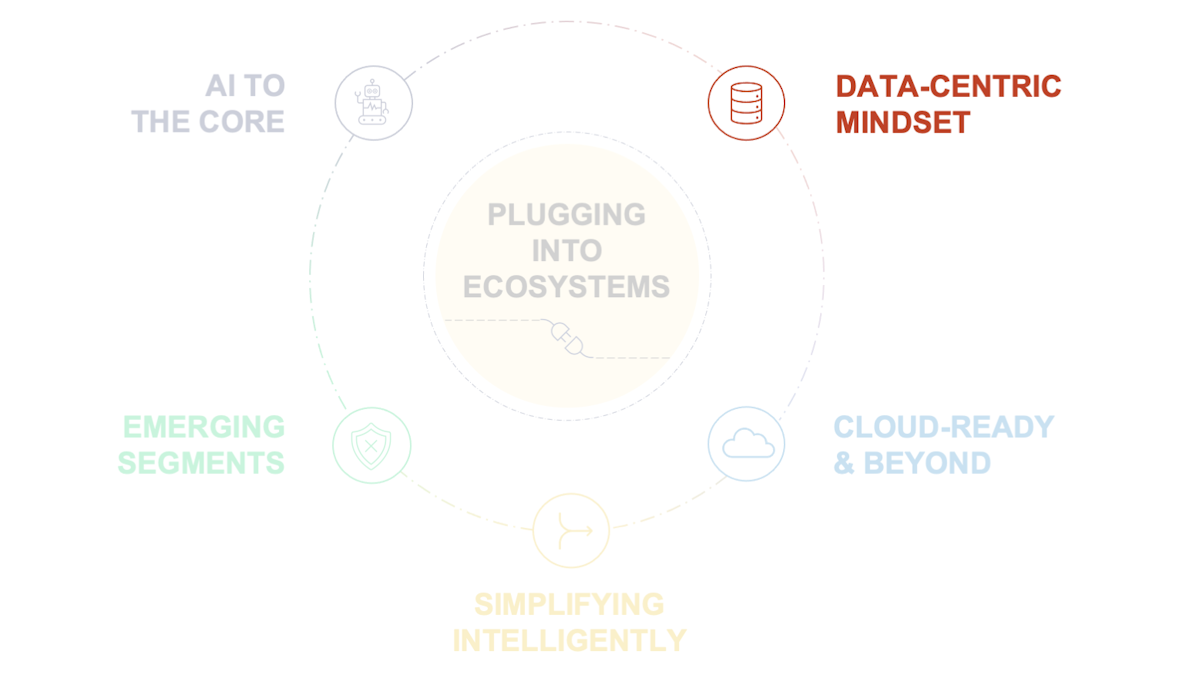

Data-Centric Mindset

Make data the engine of smarter decisions and continuous reinvention.

Data-Centric Mindset: Turning Insight into Innovation

Embed intelligent data into every decision to power real-time action and continuous transformation.

Data is at the heart of the insurance industry's transformation—powering everything from customer engagement to operational agility. To remain competitive, insurers must treat data not as a back-office function but as a strategic asset that informs every decision, process, and interaction. Real-time insights, predictive capabilities, and personalized experiences all depend on how well data is captured, connected, and activated.

Achieving this requires more than analytics tools. Insurers must embed data across the entire value chain—integrating it into underwriting, pricing, product design, claims, and service. This cultural and architectural shift enables faster responses to customer behavior, more accurate risk models, and the ability to continuously evolve with market dynamics. Data-driven insurers won't just move faster—they'll lead the future of the industry.

Three Ideas to Take Away

DATA IN THE INSURER'S DNA

Data must reach the entire structure of an insurer. Not just the customer's risk profile data, but everything that has to do with the customer's day-to-day life. Insurers must incorporate it into all their processes so that customers perceive that they are receiving value on an ongoing basis.

REAL TIME ACTIONABLE DATA

All data captured by the insurer should be easily actionable. The company must make the entire data lifecycle agile, and frictionless, to ensure quick responses to what customers need at the exact moment they need it. From new product development to claims management.

BOOSTING INNOVATION THROUGH DATA

Innovation has a fundamental ally in data. Everything the insurance company can learn from the data it has from different sources (its own and third parties) will be the basis for the creation of new products, services and disruptive business models.