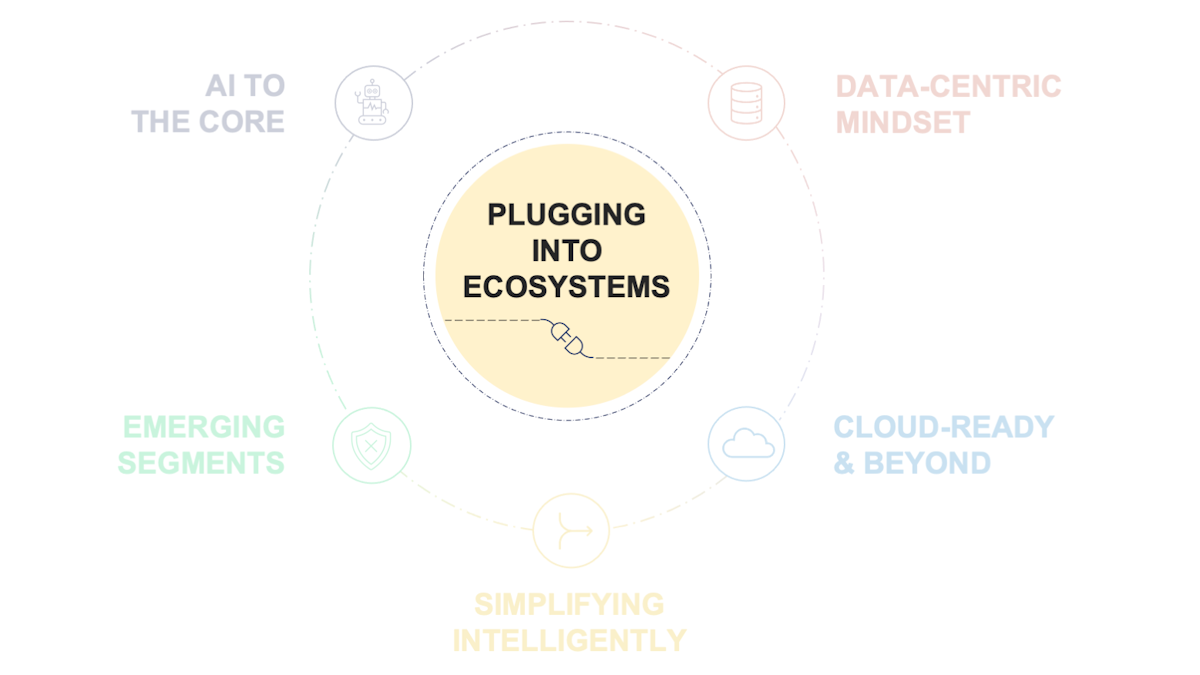

Plugging into Ecosystems

Omnichannel Experiences to Be Where and When the Customer Needs It

Plugging into Ecosystems: Reinventing Distribution for the Digital Era

Embed insurance into platforms and moments to boost relevance, reach, and real-time engagement.

In today’s competitive landscape, digital transformation and modernizing distribution channels are top priorities. Insurers must move from selling products to insuring moments—embedding their services within commerce, travel, and finance ecosystems.

DTC (Direct-to-Consumer) channels with AI-personalized offers, digital rewards, and real-time engagement will be essential. Intermediaries should be augmented with intelligent guidance tools and scenario-based quoting.

Three Ideas to Take Away

ACCELERATING ECOSYSTEM INTEGRATION WITH AI

Insurance companies need to accelerate ecosystem integration by leveraging AI technologies to enhance every step of the customer journey. Creating value in real time through personalization and context-based interactions will become a fundamental competitive advantage.

EMBEDDING INSURANCE INTO LIFESTYLE PLATFORMS

Rather than just offering traditional insurance policies, insurers must embed their services into lifestyle moments and key platforms, making insurance an invisible yet crucial part of everyday decisions in mobility, commerce, travel, and beyond.

AUGMENTING INTERMEDIARIES WITH DIGITAL TOOLS

Distributors and intermediaries must evolve. Intelligent digital tools, including guided selling and personalized quoting based on real-world scenarios, are essential to bridge the gap between insurers and increasingly digital-savvy customers.

Know more about

Plugging into Ecosystems

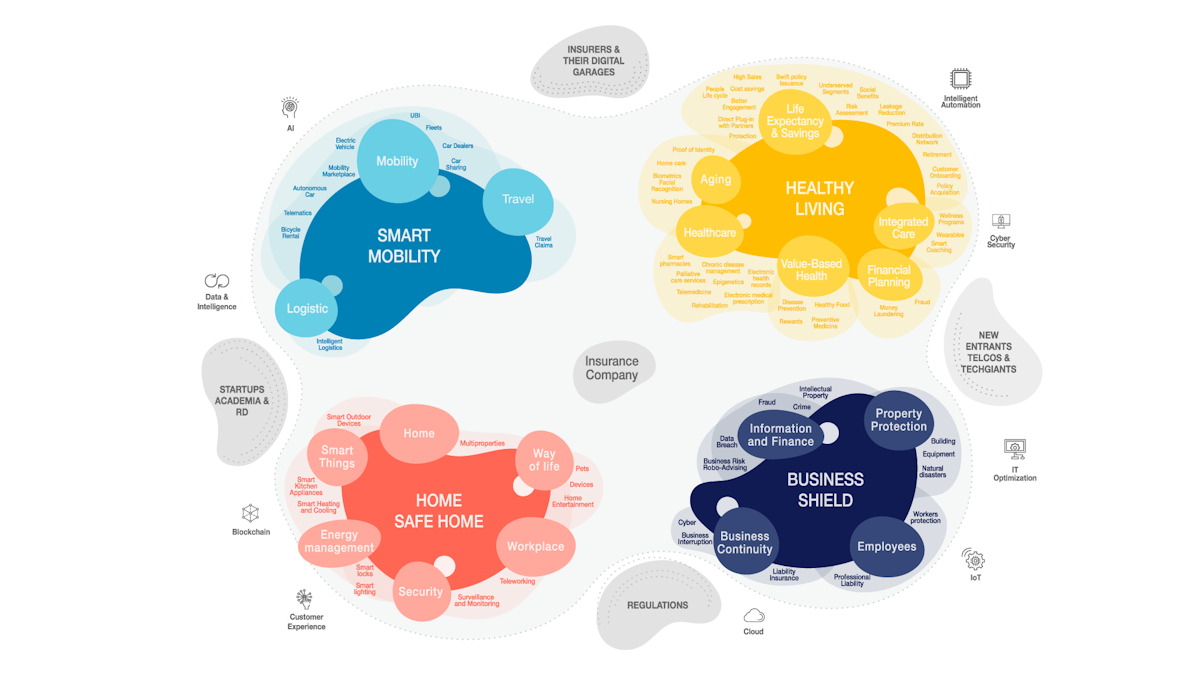

Insurance Liquid Ecosystems

In this new scenario, insurers must be at the center and take advantage of the elements surrounding them.

Companies are transforming the way they interact with their customers. Now relationships occur both ways (companies-clients), where a network of empowered personas, tech-savvy companies and different players work together to deliver seamless, end-to-end and fluid experiences in the Insurance Liquid Ecosystem.

At the center of these ecosystems are insurers. The center is also the space in which the new digital and connected distribution takes place. On the outside are the emerging and cutting-edge technologies and the four acceleration forces: digital insurance garages or innovation labs; new entrants from other industries & TechGiants; insurance and technology regulations; and startups and insurtechs.