2022 - Insurtech Market Impact Difference in US and Europe

Insurtech, changing the landscape

During the past years, the business world has faced several changes, from the change of workforce to high volatility and austerity in the capital markets. These challenges forced organizations to adapt on this new context changing the structure of costs, prioritizing traction instead of growth. The predicted hawkish monetary policy around the world gives signals of coming recession that still on divide opinions in the market, but surely increased the risks associated to either European or American Insurtech markets.

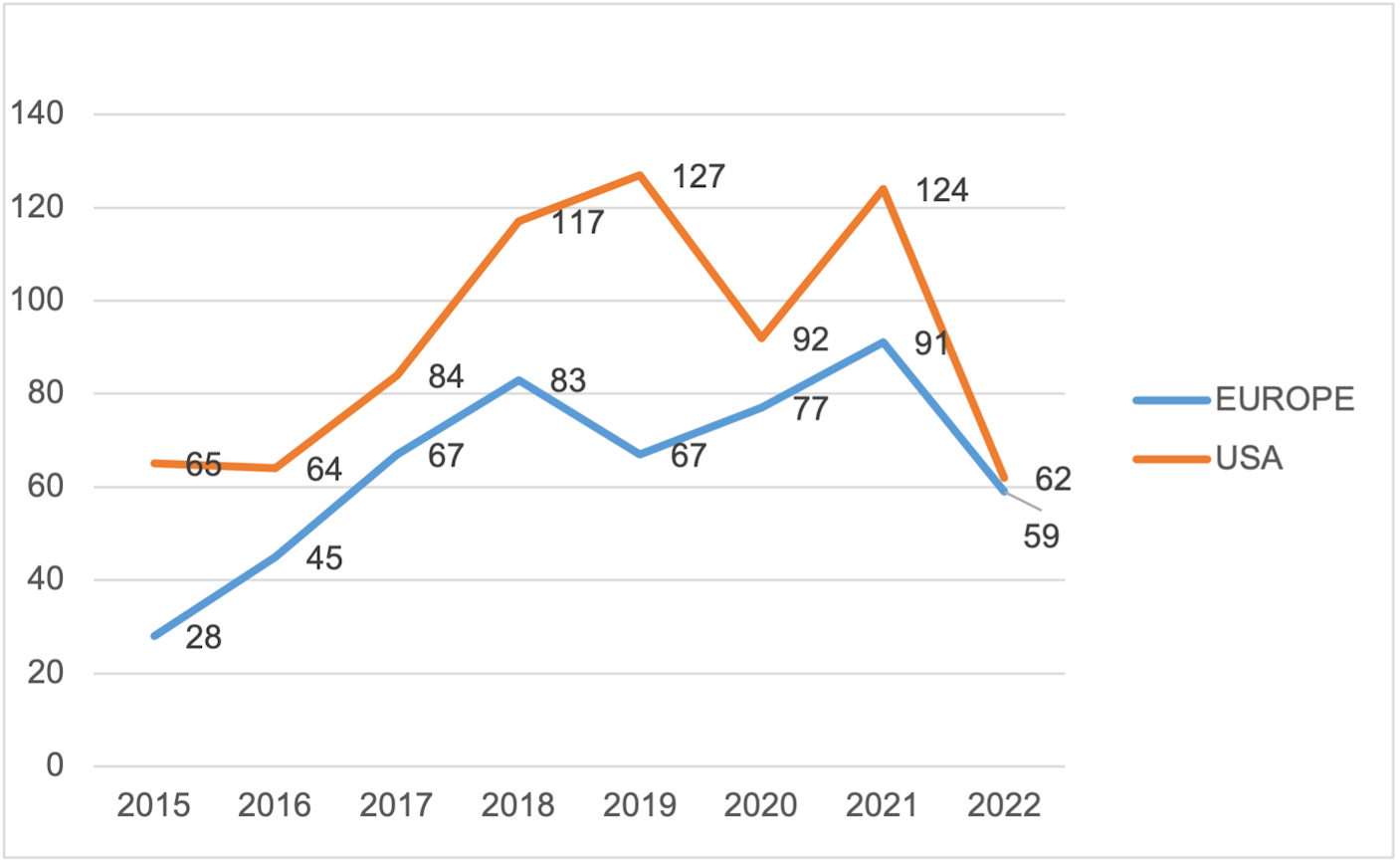

Ideally, the difference perceived in the Insurtech industry would be reflected in terms of investments in the USA and Europe, in which the latter on average gives more preference to traction and profits would be least affected than leveraged markets such as USA. In this brief study, Europe and USA will be used to analyze the impact of the new world context in the main Insutech markets in 2022.

Early Stages

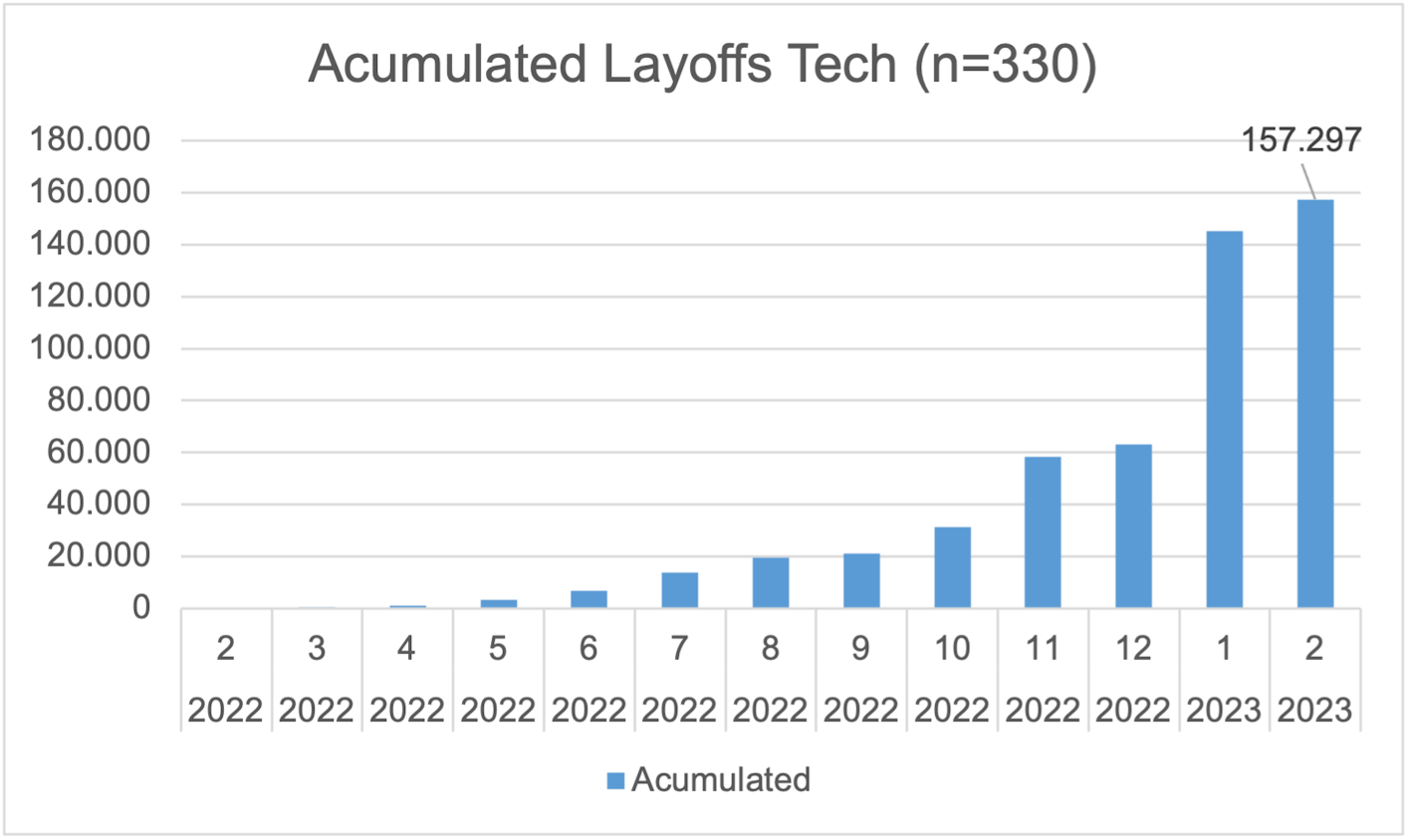

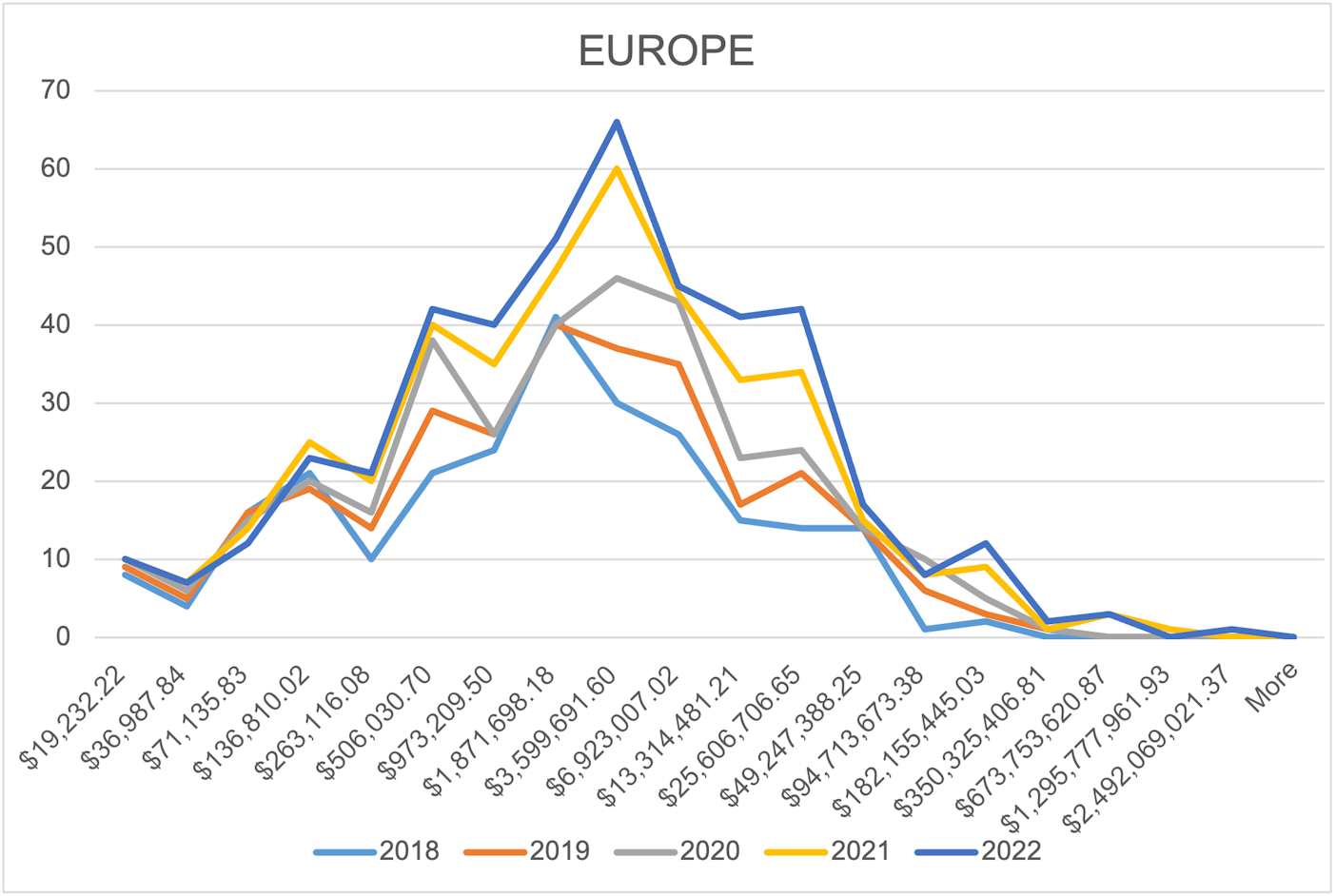

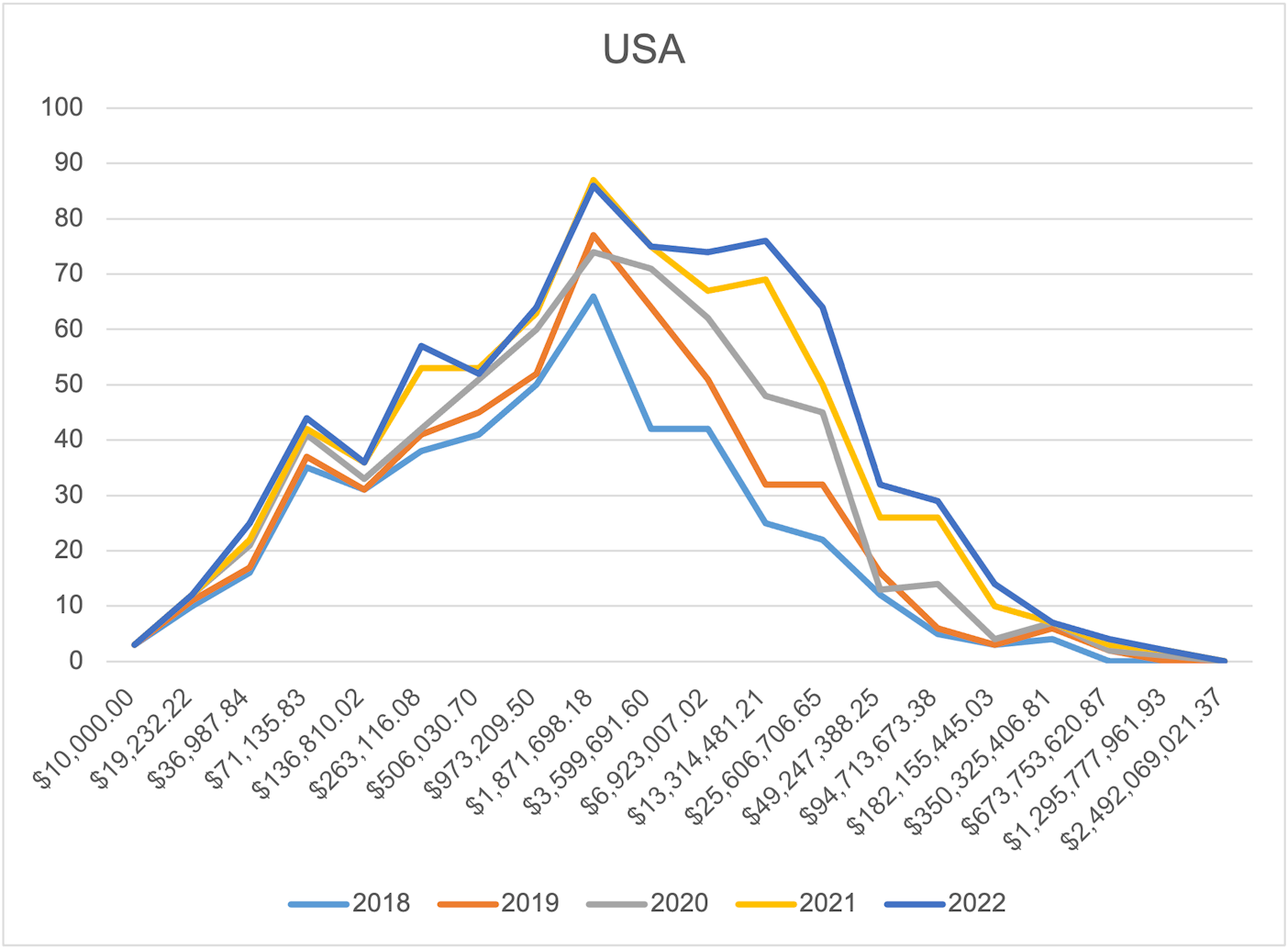

In 2019, USA dominated the Seed and Pre seed number of deals with the gap from Europe widening year by year. However, in 2022 the two regions had the smallest difference mirroring the behavior that looked lagged by one year. For instance, the first large decrease in these early stage rounds for Europe happens in 2018 to 2019 while in USA in 2019 to 2020. The next period of a large decrease happens for both regions in 2021 due to the mentioned world framework.

Distribution Curves

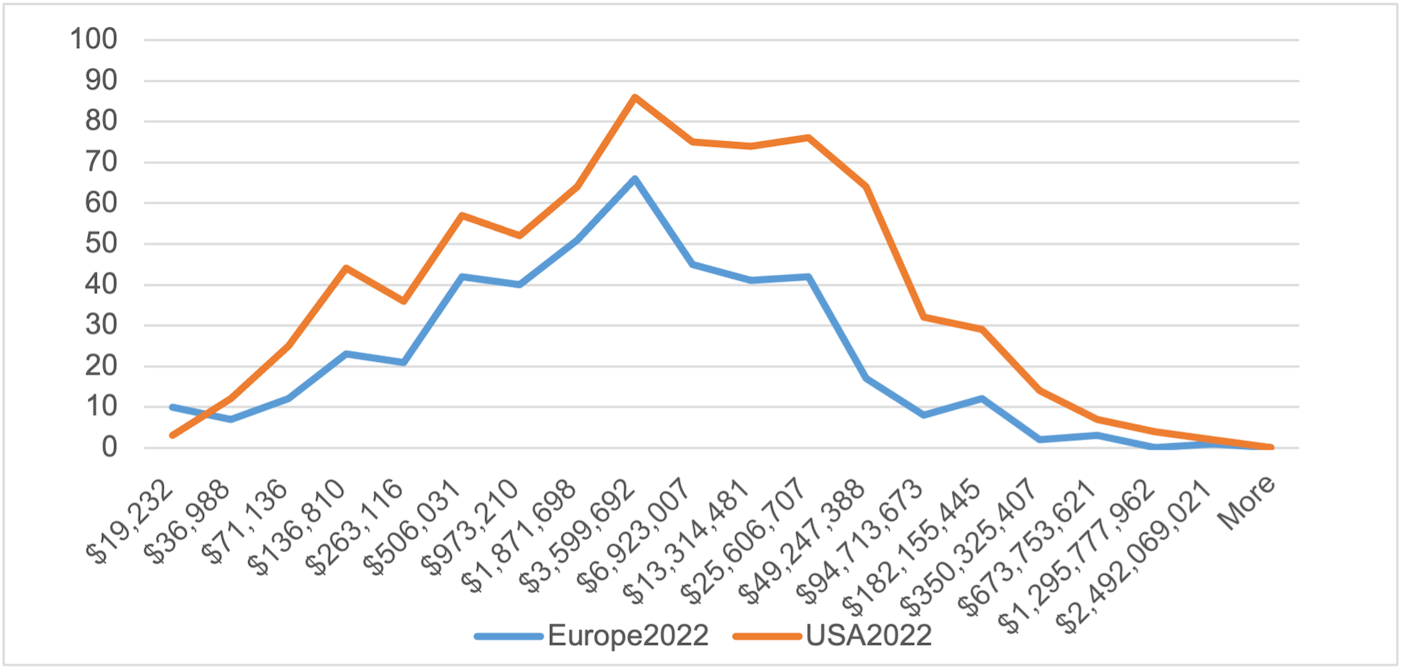

The Insurtech Investments in USA has been greater than Europe for a long time. Further, the average funding amount (excluding funding lower than 19k) in the country reached in 2021 43M USD compared to 21M USD in Europe, the largest gap in the last 5 years. In terms, of growth of this average 2022 was not favorable to USA making just 8% increase, that might be the reflection of the maturity of its market and the impact of macroeconomics variables.

Moreover, there is a similarity on the distribution of funding behavior. In order to understand the creation of a new cluster of startups in the USA and the consolidation of Europe towards the average, the Insurtechs included in these investments’ levels should be further explored. The following graphs is a comparison of YoY accumulated money raised by region until a specific year:

In 2022, the 25 M USD funding Insurtechs pushed both USA and Europe Curves. The intensity that this happened in the American market almost created a new mode that would replace 3.5M USD Insurtechs. On the other hand, European earlier stages are still considerable high with fewer changes when compared to 2021, gathering more companies in the same level of funding.

The 2022 world framework impact these regions differently, the USA market increased larger bets forming a new cluster with companies working in relatively new business Lines. For instance, Seel is a post sales ecommerce guarantees that enhance inverse logistics for its clients and T care assists caregivers to prevent work burnouts and insurance coverages. These types of companies were the ones pushing USA insurtech funding.

On opposite side, Europe has not found winners or has not intended to find them in several line of business like in US, which pushed known business models once again. The Flitter model says it all "With Flitter Kilometer Car Insurance, the less you drive, the less you pay". or Feather that looks like a renewed Ottonova. It is important to mention that this is just an illustration of different philosophies of investment that react to the market differently, but unlikely dictates success.

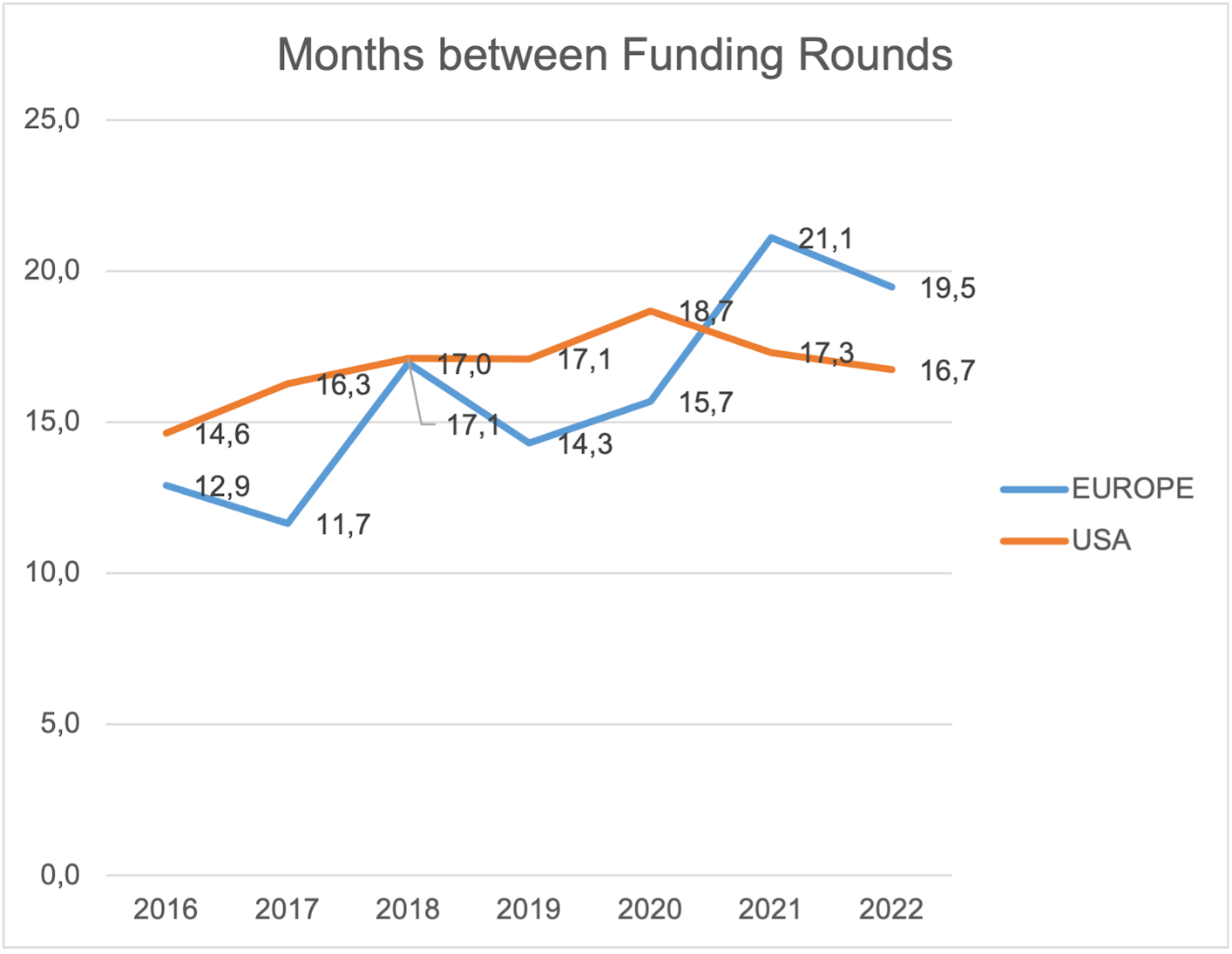

Moreover, the speed to a new funding round can illustrate the level of leverage on capital that these regions naturally may have. In a high-risk scenario, European Insutechs will probably have less necessity to raise capital when compared to American companies, making them more solid to face adversity and more prone to selective money on the investors’ side.

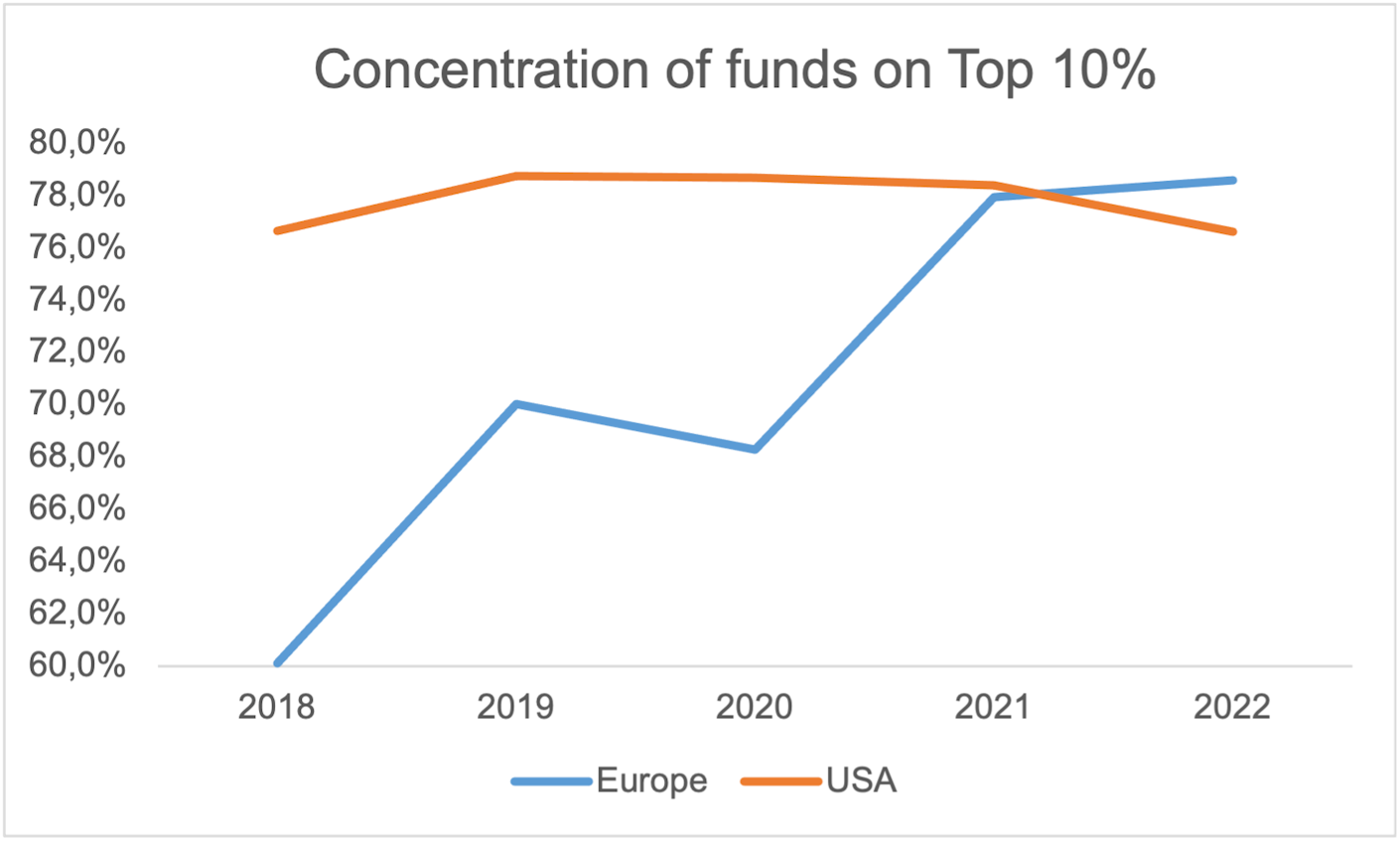

Assuming a more selective investment environment in Europe, the concentration on more consolidated and mature Insurtechs should rise in this Region. In fact, 2022 is the first time in the last 5 years that concentration is higher in Europe than USA, which can be related to the mentioned economics situation or other switches in specific risks such as a new innovation wave led again by USA.

It is true that the two regions appear to be responding differently to the same macroeconomic events. The USA has seen larger bets being placed on new, untested business models, while Europe has maintained its focus on more established companies. This could reflect a difference in risk tolerance or a more cautious approach to investment in Europe. In a high-risk scenario, European Insurtechs may be more solid and less likely to raise capital compared to American companies, due to their lower leverage on capital.

Therefore, regions behave differently subject to world macroeconomics events or due to their individual market characteristics. However, explain the changes is a mix between reasoning and speculation, in which there are surprising supporting metrics (considering the historical data). This alone cannot erase the hypothesis that the insurtech market is naturally in a new stage with several adjustments in its business models and applied technologies that ask for a distinct game.

If we had to draw a comparison to the stock market, then this divergence appears to have a similar pattern. European stocks on average are traded about 13 P/E and American 19 P/E. Also, the market prioritize low Price/Earnings in an economy recovery and Stable companies in a downturn. Surprisingly, even without clear consensus in the stock markets, the VC and Private equity space are already opened a discussion to restructure their investments patterns.

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email