Advancing Sustainable Claims through Circular Economy Principles

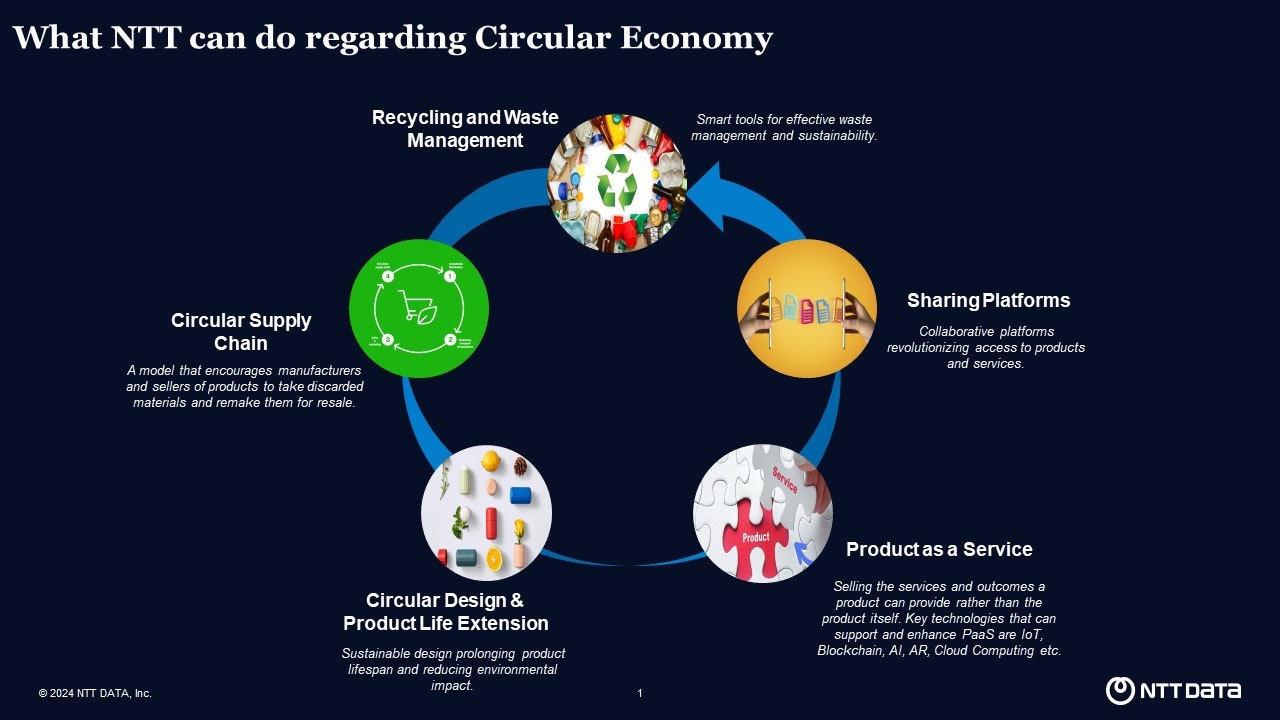

Circular economy principles can be applied to the insurance industry to make claims more sustainable, while reducing their average cost (increased in the past few years). The circular economy aims to minimize waste, promote the efficient use of resources, and encourage the reuse and recycling of materials. By 2026, circular supply chain practices will drive profit increases in 60% of global enterprises.

Here are some aspects of circular economy principles that can be incorporated into insurance claims processes:

•Repair and Restoration: Encourage and support repair and restoration instead of immediate replacement. Insurance companies can work with repair shops and professionals to assess damage and opt for repairs whenever feasible. This reduces the demand for new replacements, conserving resources and minimizing waste.

•Recycling and Reuse of Parts: Implement processes that facilitate the recycling and reuse of damaged or replaced parts. Salvageable components from vehicles involved in accidents can be properly recycled or refurbished for use in other vehicles. This reduces the need for manufacturing new parts and lowers the environmental impact.

•Extended Product Life: Support initiatives that aim to extend the life of insured products. This could involve promoting preventive maintenance, encouraging policyholders to adopt sustainable practices, and providing incentives for maintaining and repairing items to increase their lifespan.

•Incentivizing Sustainable Practices: Offer incentives for policyholders who choose sustainable repair and replacement options. This could include discounts on premiums, reduced deductibles, or other financial benefits to encourage environmentally friendly choices during the claims process.

•Collaboration Across the Value Chain: Collaborate with various stakeholders in the automotive and repair industries to create a circular value chain. This involves working closely with manufacturers, repair shops, recycling facilities, and other partners to ensure a seamless and sustainable flow of materials and components.

•Data and Technology for Traceability: Leverage technology, such as blockchain or other traceability solutions, to track the lifecycle of products and materials. This transparency ensures that recycled or refurbished components meet quality and safety standards, providing assurance to insurers and policyholders.

•Educating Policyholders: Educate policyholders about the benefits of circular economy practices and how their choices during the claims process can contribute to sustainability. This can include providing information on repair options, recycling initiatives, and the environmental impact of different choices.

By integrating these circular economy principles into insurance claims processes, the industry can contribute to a more sustainable and environmentally conscious approach to handling damaged or lost assets. This shift aligns with broader efforts to create a more circular and resource-efficient economy.

Header photo by Josh Power on Unsplash

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email