Descartes Underwriting

Chicago Mercantile Exchange sells weather and agriculture derivatives since 1999, allowing clients to protect against price volatility and natural disasters indirectly. Moreover, the market has been selling Catastrophe bonds and other Insurance-Linked Securities that allow insurance alternatives to manage climate risks to mention a few types of protection. So why Descartes Underwriting has been on the rise with several million in funding from top investors in the Insurtech ecosystem such as Alma Mundi Ventures?

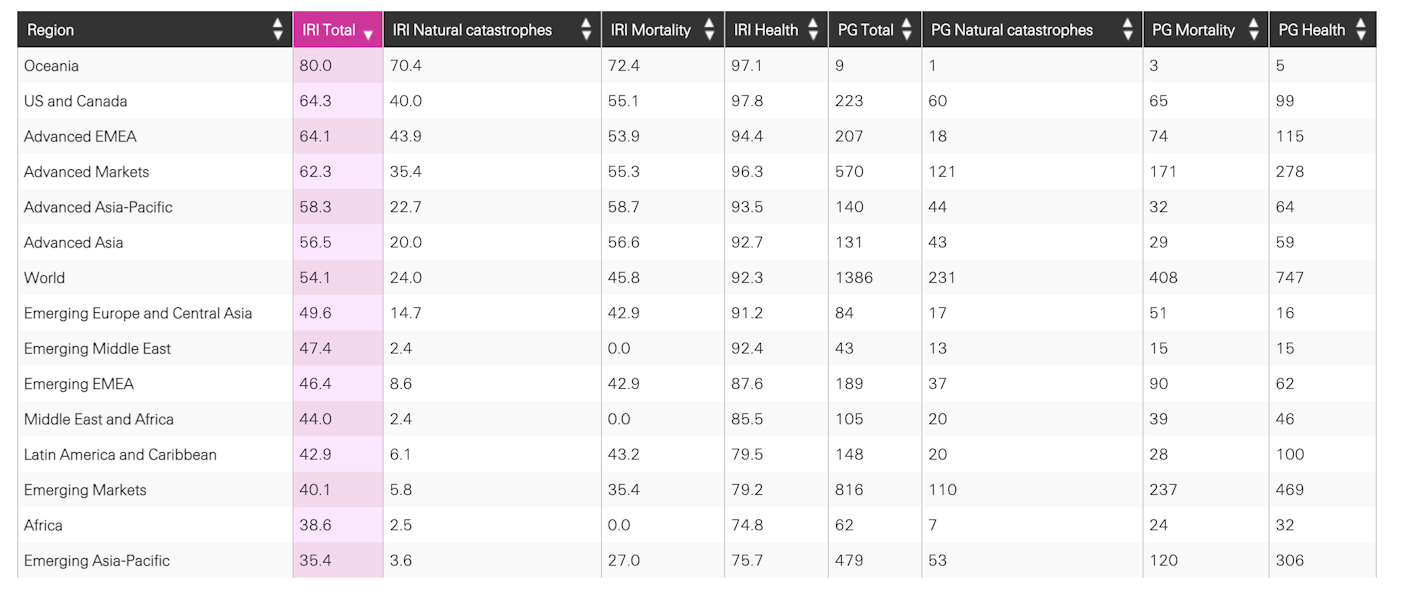

The complex nature of CME and other financial products oblige clients to perfectly assess their risks and operates seamlessly in the financial market, making them increase operational costs and less efficient hedge positions given the standardized products in this sector. Therefore, the personalization of coverages makes one of the main sell points for Climate risk Insurtechs. In fact, the protection gap from natural disasters reached a total of 230 billion in 2020 according to Swiss Re.

There are some essential differences between Descartes and financial instruments, which can address this billion Dollar Gap market. The first difference is the relationship between the end customer and the counterpart that takes the risk. While in the capital markets, this relationship is cold and distant, Descartes Underwriting position itself as a supportive partner that analyzes in detail the exposure of clients and tailors coverages with their risk demands, which revolutionizes the customer experience in this segment. Furthermore, the automatic triggers that activate the claim and payments create a frictionless experience and help efficiently clients when they need the most, providing liquidity within 7-14 days post-event and offering a fundamentally different approach to claims proceeds than traditional insurance policies.

The second difference is related to the future possible change in the insurance industry when the Insurer will be the one that knows the risk better. To illustrate this point, we do not have to go too far, since Tesla's insurance offering has been raising flags throughout the industry for a while.

Descartes is a result of this change, an extension of this awareness that is already in place and all insurance players know it. In order to know the risk better, Descartes invests in technologies that go beyond the traditional Climate Risk coverages.

This effort is essential to create personalized policies with efficient pricing models that are the unique approach to staying ahead of other types of coverage. Indeed, data collection and analysis are one of the most challenging operational achievements, as pointed out by US Commodities Futures Trading, climate risk is not trivial: "climate risk analysis requires a different set of evolving methodologies, tools, and data sets to account for the many assumptions, inherent uncertainties, and longtime horizons". Hence, the high investments made by Descartes in technological partnerships and innovative data usage from governments, satellites, and sensors are justified as a competitive advantage. For instance, at the end of 2021 Descartes Underwriting and ICEYE, a Finish satellite imagery solutions startup that launched several satellites through SpaceX’s Falcon 9, announced a partnership to monitor floods.

Also, Descartes Underwriting has other features that support its success, the company is founded by experienced insurers and data scientists who provide parametric insurance solutions globally, covering natural catastrophes across all sectors in over 60 countries. Its policies are written on A-rated securities, and they partner with top-rated (re)insurers, allowing them to deploy up to $200M in capacity per contract with more than 200 clients and a mid-size ticket of $100+ M, which means whichever pricing structure Descartes is using the company has upgraded the potential of an Insurtech reach in terms of regions and Capital.

Finally, its move from being an MGA that only supports Carriers to starting Descartes Insurance in France is a clear sign that it believes in knowing risk better than traditional carriers. In the future, when Descartes becomes a full-stack carrier, it would join a list of Full Stack Startups that also bet on their better knowledge of customers' needs and/or risks, which would weigh more on the side of disruption than incremental innovation, especially for new demands and risks. We could extrapolate the logic to another branch of insurance, where data ownership is allowing non-insurance players to explore the protection sector.

Therefore, the climate risk transference has changed radically within a few years and Descartes Underwriting is one of the leading actors. The levers of success of this Insurtech were fundamentally the same as seen in early discussions of Insurtech Innovative businesses with coverage personalization, data collection, improved risk-price analysis, and enhanced customer experience.

However, the exponential growth of the company does not mean that from a macro perspective, Climate risk is being directly addressed, but it is being managed instead. Clearly, the rise of Descartes is one step in the right direction, it is a result of both climate risk not being covered efficiently by the financial market and the money moving to solve this rising issue and for the right or the wrong reasons, this is a piece of good news.

Header photo by Matt Palmer on Unsplash

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email