How LATAM Insurtechs Operate in High-Insecurity Areas

Low Growth and Inequality Shadow LATAM Society

Before I traveled and stayed in Latin American (LATAM) countries, I always imagined this land as reminiscent of Gabriel García Márquez's "Cien Años de Soledad." However, upon arrival, I found the reality to be far more dramatic than I had envisioned.

In the city centers, tall buildings dominate the skyline, while poor people walk the streets in the sweltering 30-degree heat. Museums brim with gold and jewelry, yet homelessness and armed drug dealers are prevalent. In such a country, how can people feel secure?

As I traveled through the streets, I noticed insurance companies with massive logos atop high-rises. This sparked an idea: I should research what is happening here in the insurance sector and how it might change in the future.

The LATAM economy is often characterized by sluggish growth and persistent inflation, significantly influencing investment in Insurtech. Low economic growth, coupled with high inflation rates, presents one of the greatest challenges for economists. For instance, Mexico's economy heavily relies on its relationship with the United States, serving as a crucial link between the US and other Latin American countries. The emergence of advanced Insurtech firms in the North American market poses a significant threat to the growth prospects of the local Insurtech market in LATAM.

Growing Investment and Emerging Startups

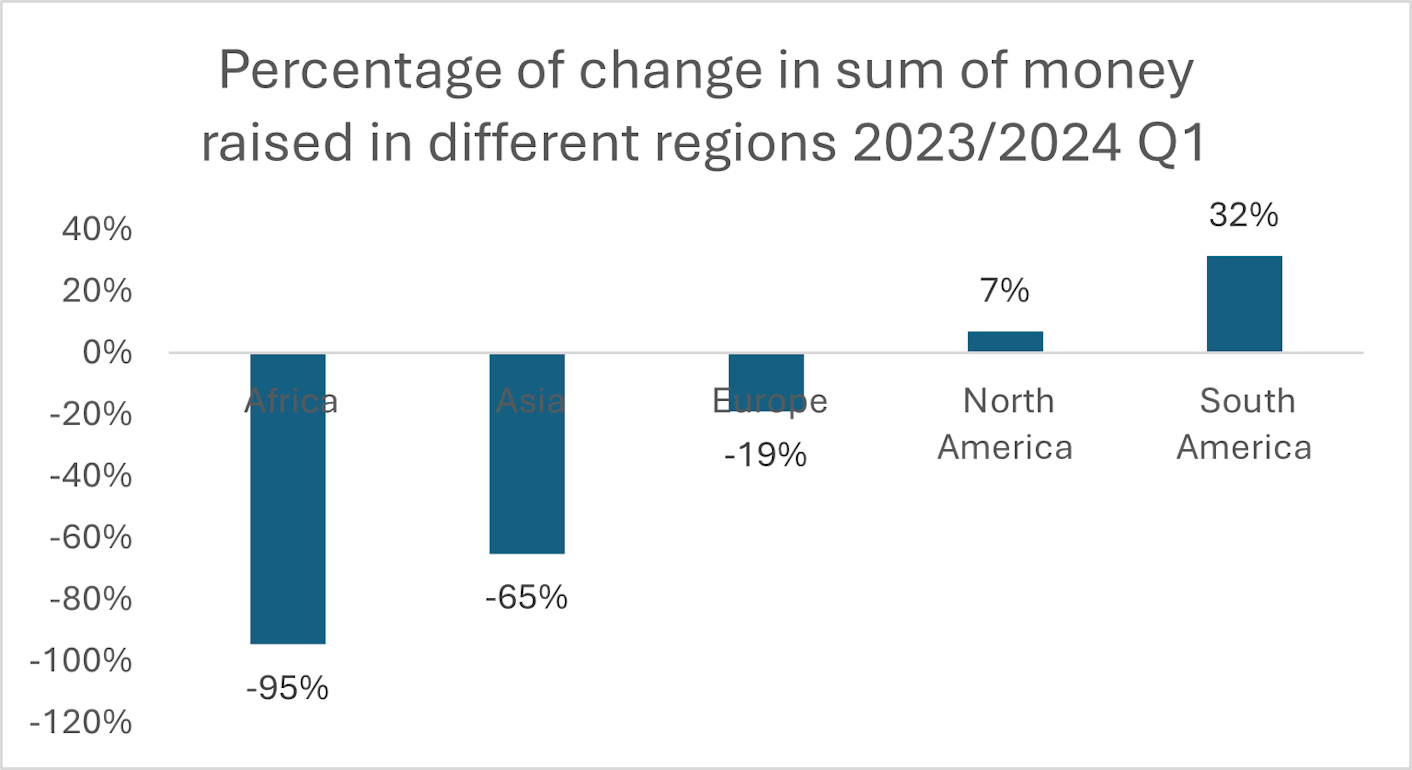

In the first quarter of 2024, we observed a growing trend in investment in LATAM countries. This trend has sent positive signals to the market about the emergence of Insurtech startups in the region, highlighting their significant potential and the numerous opportunities they present.

The government and local economy have limited capacity to provide social welfare, making insurance companies vital for risk mitigation. Traditional markets focus primarily on health and pension insurance, closely linked to social well-being. However, new business models are also showing great promise in the market, such as:

Embedded Insurance: Guros (guros.com), which integrates insurance seamlessly into other products and services.

AI-driven No-Code SaaS: Renova (renova.world), which offers advanced, customizable software solutions without the need for coding expertise.

Telematics: Airbag Technologies (airbagtech.io), which uses technology to monitor and improve driving behavior, reducing risks.

American and LATAM Insurtech companies are fiercely competing in the LATAM insurance market.

Case Studies: MetLife, Sura, and Betterfly

MetLife: Insurance and Employee Benefits | MetLife

Founded in New York, MetLife has expanded its business empire into LATAM countries. For the MetLife 2024 Qualifying Longevity Annuity Contract (QLAC) Poll, MetLife surveyed 250 U.S. plan sponsors to assess their understanding of longevity and other risks faced by defined contribution (DC) plan participants in retirement. The survey aimed to evaluate their interest in offering retirement solutions to help participants generate retirement income. Specifically, it sought assess plan sponsors' knowledge about longevity issues, including the average life expectancies of their DC plan participants.

Sura: Seguros SURA

Established in Colombia, Sura adopts a comprehensive approach, targeting both B2C and B2B2C models. It operates two business branches: one focused on personal insurance and the other on enterprise sectors. Sura's distinctive strategy enables it to capture a broad client base across different market segments. The company collaborates closely with local hospitals and medical institutions, providing top-notch medical services and insurance solutions to enterprises and individuals alike.

Betterfly: Betterfly: La mejor plataforma de beneficios para empresas

Betterfly plans to use the proceeds from its recent fundraising round to further develop its platform and forge key partnerships with insurance carriers and strategic players in the financial services, healthcare, and wellbeing sectors. Additionally, Betterfly aims to expand its presence across Latin America, beginning with Brazil, where it will commence operations in the coming months. This strategic expansion is poised to enhance Betterfly's footprint in the region, offering innovative solutions to meet the evolving needs of Latin American consumers.

Insurtech Global Outlook - NTT DATA

Header photo by Leon Overweel on Unsplash

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email