Rebranding Betterfly: Putting wellbeing first

Betterfly is a Chilean Insurtech company that changed its name from Burn to Give to Betterfly in 2020. The new name alludes to the butterfly effect and reflects the company's focus on providing value beyond insurance. Betterfly has three main pillars of wellness: mental, body, and financial, and believes that enhancing one variable can lead to improvement in the others, ultimately generating social well-being.

The company's broader mission is to empower organizations and employees to improve their health and well-being while making an impact in their communities. Betterfly's unique approach to employee well-being rewards good habits with life insurance coverage that grows every day and converts every healthy activity into a charitable donation.

In other words, the company emphasizes prevention and well-being first, followed by life insurance. This shift in value proposition reflects a broader trend across industries and lines of business, as companies become more customer-centric and redesign their offerings to provide more value to customers.

Betterfly has had great success with this pivot, accumulating a total of 200 million USD in investment from different investors such as Alma Mundi, Bio Ritmo, QED Investors, Softbank, and JP Morgan in 2022. The company has expanded into seven different markets across Latin America and Europe, including Brazil, Colombia, Ecuador, Mexico, Peru, Chile, and Spain. It achieved unicorn status, valued at 1 billion USD, in the same year.

Betterfly currently employs around 500 people, has 2,500 clients, and has increased its revenue by 20x since 2018. Life insurance coverages account for 25 million USD of this revenue.

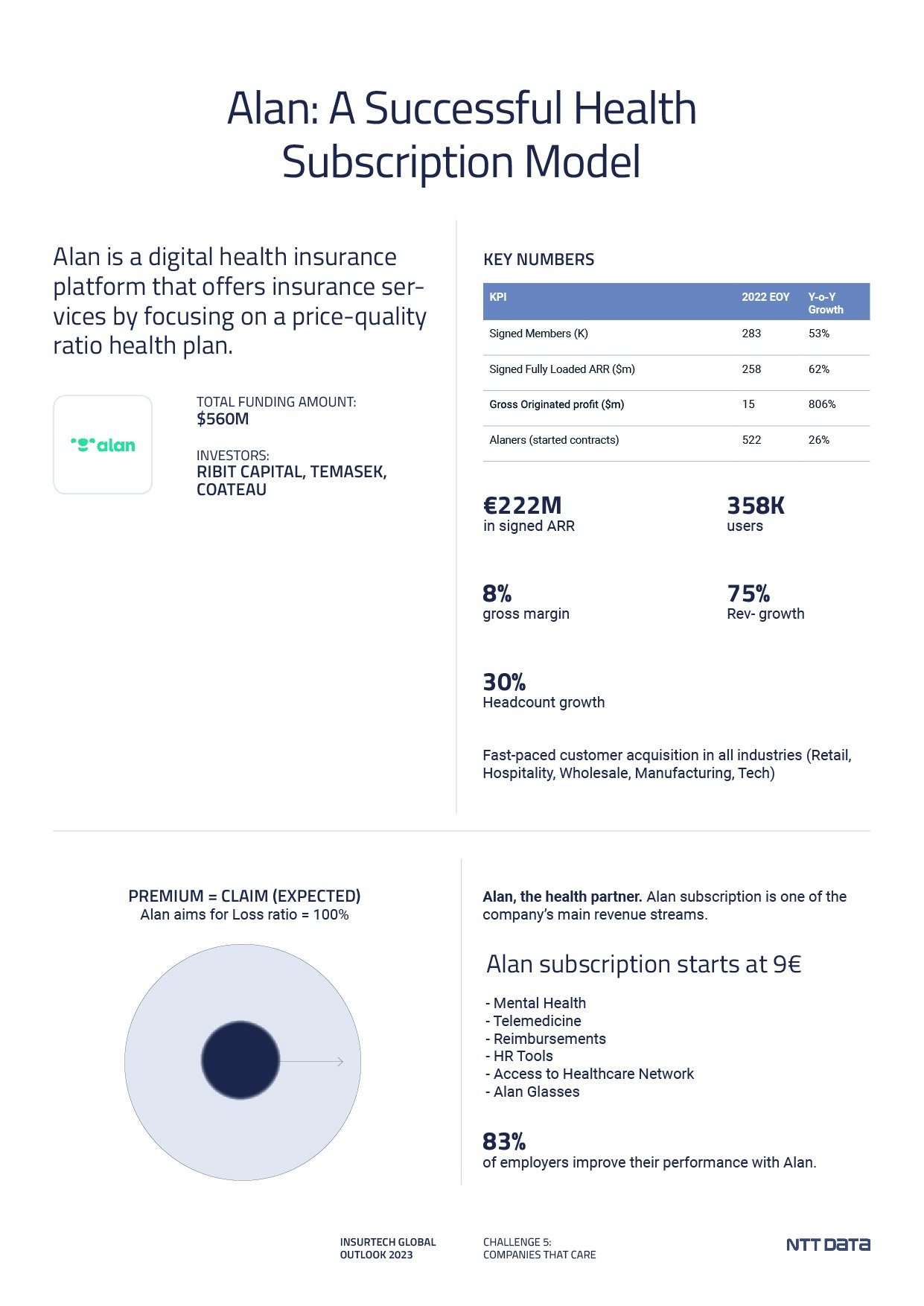

The timing for employee benefits platforms could not be better, with promising business growth and several successful cases in Europe and the USA. French Insurtech Alan is one example of an Insurtech with a broad value proposition that positions insurance as a complementary product within a comprehensive offering of services for clients and end customers to improve productivity, wellness, mental health support, and more.

Other examples of Insurtechs with relatively large growth in funding in 2022 include Sana Benefits, Yulife, Cobee, and Nayya. The value delivered by these companies to their clients surpasses that of standard corporate health and life insurance for all stakeholders.

Insurtechs in this sector sell to the HR departments of their clients, who do not have to deal with multiple partners for each benefit created. Users can personalize the way they receive benefits from their employer by choosing the weight in each category, including insurance, and can experience a better allocation of these resources. There is no one who knows better how to use this budget than the users themselves. Partners can offer products and services by connecting with the Insurtech platform and activating new revenue streams.

The performance of these companies is not measured in loss ratio, but in revenue and active users on their platforms. Since Insurtechs' loss ratio has received a lot of criticism and skepticism throughout the industry, the approach taken by employee benefits startups might be the way to go. Both insurers and Insurtechs are facing the challenge of expanding and selling, and should learn from Betterfly by redesigning their value proposition and finding new ways to create value for all stakeholders.

The rise of insurtechs with a strong focus on employee wellbeing and benefits platforms is transforming the insurance industry, creating new ways to generate value for all stakeholders. Companies like Betterfly, Alan, Sana Benefits, Yulife, Cobee, and Nayya are leading the way by offering personalized and comprehensive employee benefits packages that go beyond traditional insurance products. By focusing on prevention and wellbeing first, these insurtechs are attracting the attention of investors, achieving impressive growth rates, and creating positive social impact.

Their success serves as a reminder to the insurance industry that a customer-centric approach and a willingness to innovate and create new value propositions are essential for growth and long-term success.

Header photo by Sean Stratton on Unsplash

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email