Reimagining Insurance Risk Assessment with Digital Twins

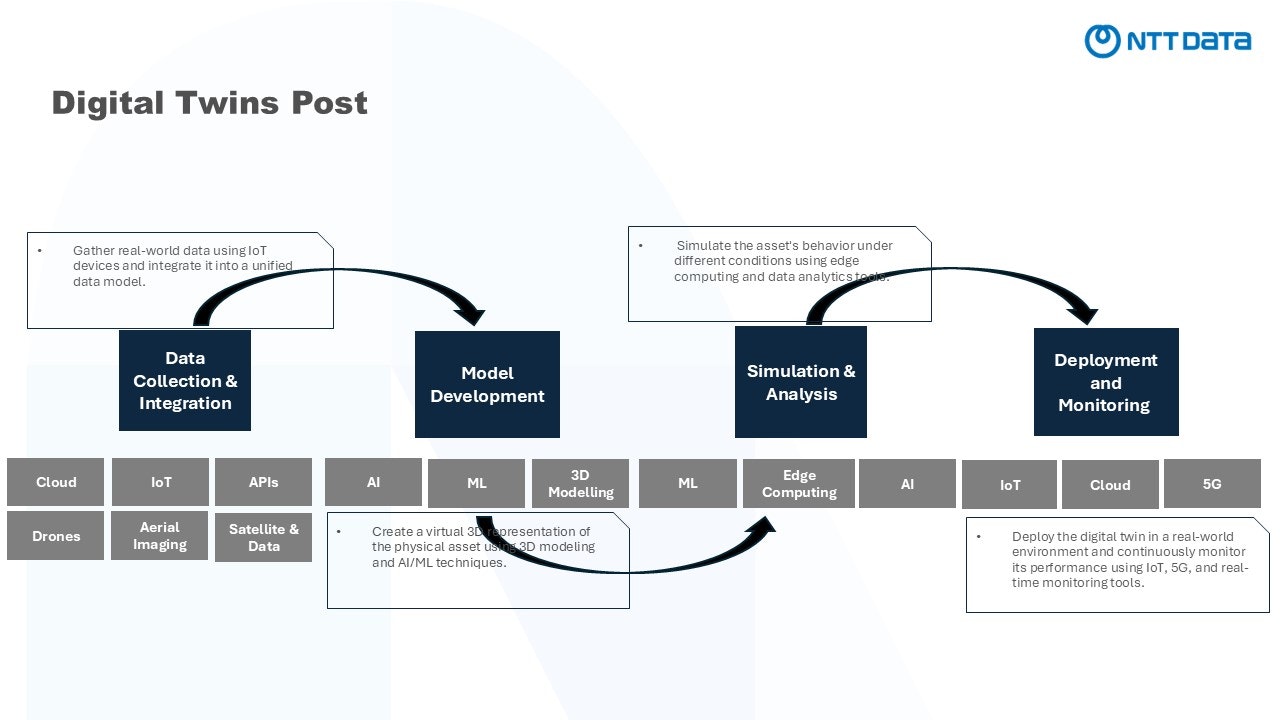

A Digital Twin is a virtual representation of a physical object, system, or process, designed to simulate, analyze, and optimize its real-world counterpart. Integrating real-time sensor data, historical information, and predictive analytics, digital twins provide actionable insights to enhance performance, improve efficiency, and identify opportunities for optimization.

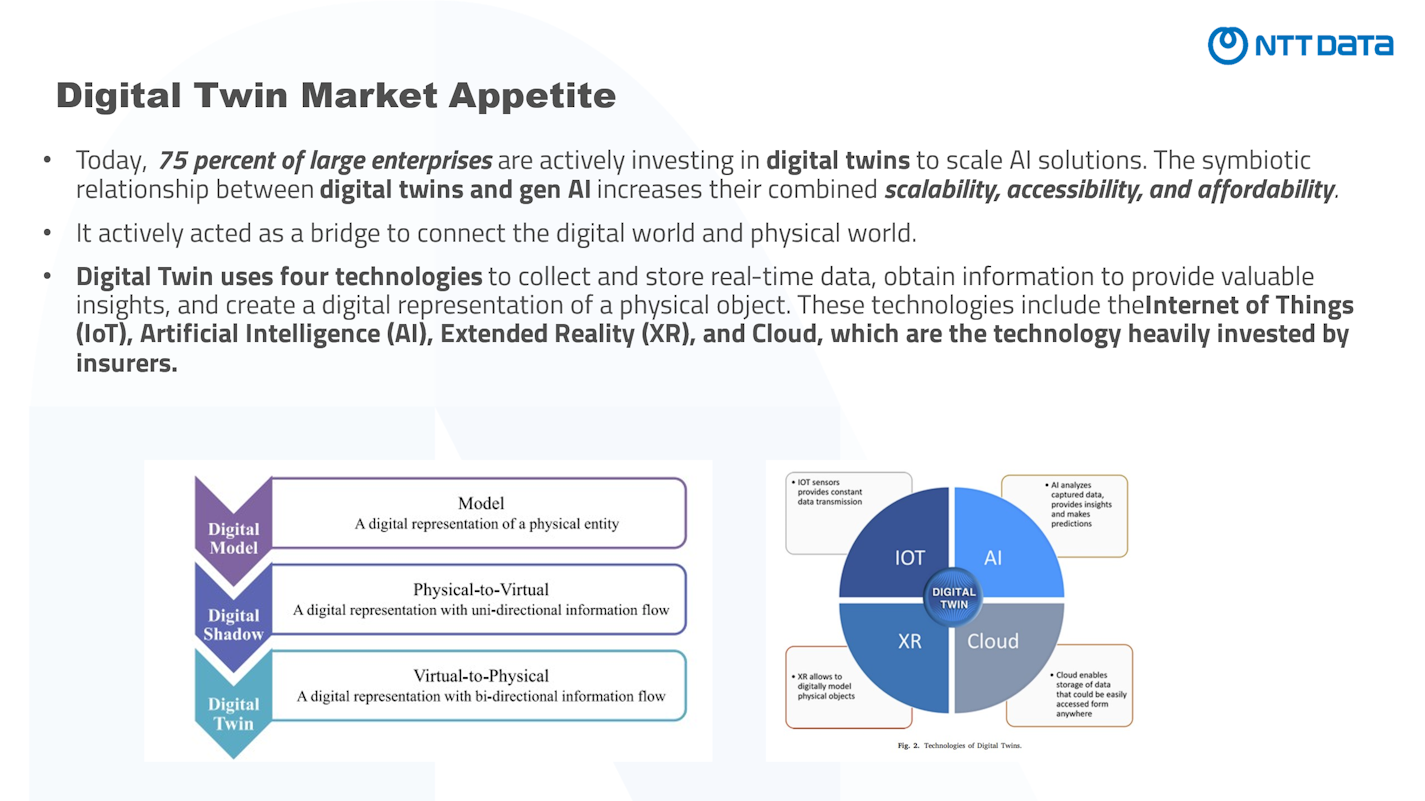

Emerging Technologies including digital twins are driving significant advancements in productivity and efficiency, promising to elevate global economic growth and wealth creation. While these technologies hold transformative potential for the future, some have already demonstrated proven traction within the insurance sector.

In 2023, Munich Re and Ergo evaluated digital twins, categorizing them under "Adopt" in their technology outlook—indicating the necessity of leveraging this technology to its full potential. In 2024, digital twins and their underlying technologies have reached new levels of maturity. These advancements are unlocking innovative use cases, particularly in addressing emerging risks, positioning digital twins as a critical enabler for the insurance industry's ongoing evolution.

Features of Digital Twin

Key Features of Digital Twin:

Integration with Real-World Data: Sensors and IoT devices provide continuous data from the physical entity to the digital twin.

Simulation and Analysis: Enables testing different scenarios, predicting failures, and optimizing operations without disrupting the actual system.

Dynamic Updates: The digital twin evolves with its physical counterpart, reflecting changes and updates in real-time.

AI and Machine Learning: Often enhanced with these technologies for predictive analytics and decision-making.

In essence, a digital twin bridges the gap between the physical and digital worlds, enabling smarter decisions and proactive strategies.

Challenges in insurance risks assessment

1. Data Limitations

· Data privacy and security: Digital twins require a lot of detailed and sensitive data, which can be vulnerable to cyberattacks.

· Accuracy: Digital twins are only as accurate as the data that they are based on. If the data is inaccurate or incomplete, the digital twin will be inaccurate as well.

· Technological complexity: Digital twins are complex systems that require specialized expertise to create and maintain.

· Ethical concerns: Digital twins can be used to collect and analyze personal data, which raises ethical concerns about privacy and discrimination.

· Incomplete or inaccurate data: Gaps in historical data or errors in data entry can lead to flawed assessments.

· Lack of standardization: Different formats or sources of data make it difficult to integrate and analyze.

2. Prediction complexity

P&C insurance and climate changes: Increasing frequency and severity of natural disasters like hurricanes, floods, and wildfires make risk prediction and pricing more complex.

Cybersecurity Threats: With rising cyberattacks, P&C insurers are entering cyber insurance markets, but lack historical data for accurate risk modeling.

Innovative solutions with digital twins

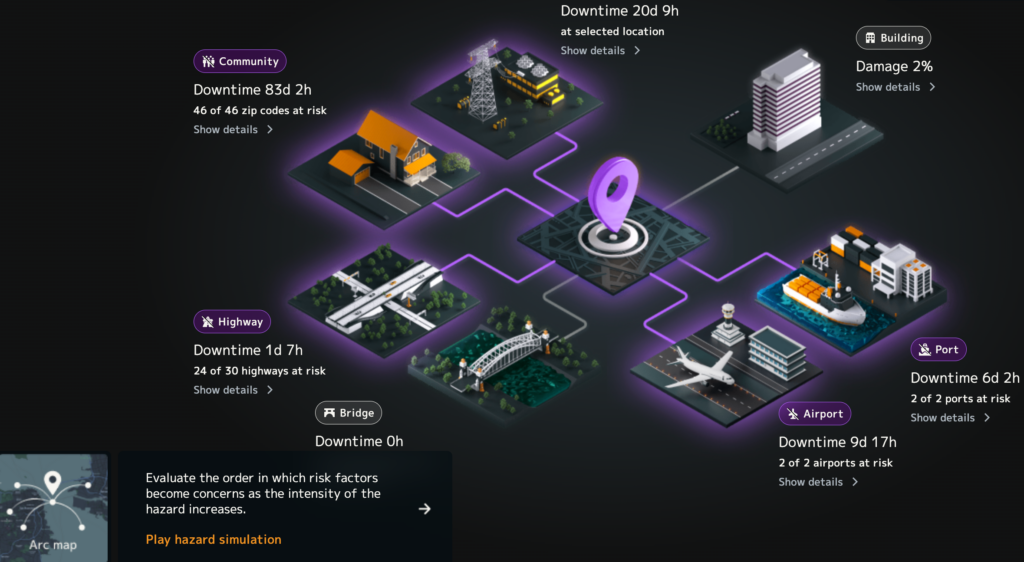

One Concern, an AI-driven physical risk company, and Swiss Re, a leading global reinsurer, have announced a strategic partnership aimed at enhancing the underwriting and management of natural catastrophe-related business interruption risks.

Through this collaboration, One Concern’s Business Interruption Risk Scores and Metrics DNA products will be integrated into Swiss Re’s CatNet® platform. CatNet® offers users a comprehensive tool to assess and visualize natural hazard exposures worldwide, combining hazard data, loss estimates, exposure details, and insurance information with interactive maps and satellite imagery for a holistic risk evaluation.

ZestyAI leverages artificial intelligence, including computer vision, to create digital twins for every building across North America. These models incorporate over 200 billion property insights, capturing details that influence a property’s value and risk profile, including vulnerabilities to natural disasters. The solution aims to enhance risk assessment and decision-making for P&C insurers.

The insurtech maps rooftops in the U.S. with three-dimensional precision, gathering granular data on roof size, materials, and surrounding vegetation density. By integrating additional datasets—such as building permits, real estate transactions, climatology, and historical loss records—ZestyAI delivers highly accurate property intelligence.

This information is seamlessly integrated into insurers’ underwriting workflows through an API-based platform, enabling better risk selection and management. The platform emphasizes often-overlooked perils like wildfires, hail, and storms, providing a comprehensive approach to property risk analysis.

The future insurance with digital twins

The future of insurance is poised to be revolutionized by digital twin technology, offering unprecedented precision and personalization in risk assessment and policy design. By creating virtual replicas of physical assets, individuals, and environments, insurers can simulate real-world scenarios, predict potential risks, and optimize coverage in real time. This dynamic modeling enables proactive risk management, allowing insurers to anticipate and mitigate losses before they occur.

Coupled with advancements in AI, IoT, and edge computing, digital twins empower insurers to integrate real-time data seamlessly into underwriting and claims processes, enhancing efficiency and accuracy. As this technology evolves, it will drive the development of tailored insurance products, improve customer experiences, and strengthen resilience against emerging risks like climate change and cybersecurity threats. Digital twins are set to transform the industry, shifting its focus from reactive to predictive and preventative solutions.

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email