Riding Together in a Smart Way

Moving smart, moving fast. This is the only road towards changes, and so how the automotive and the insurance industries have been trying for the last years to overlook a new way of driving, where what matters is not only the vehicle, but the wide range of possibilities around the car concept.

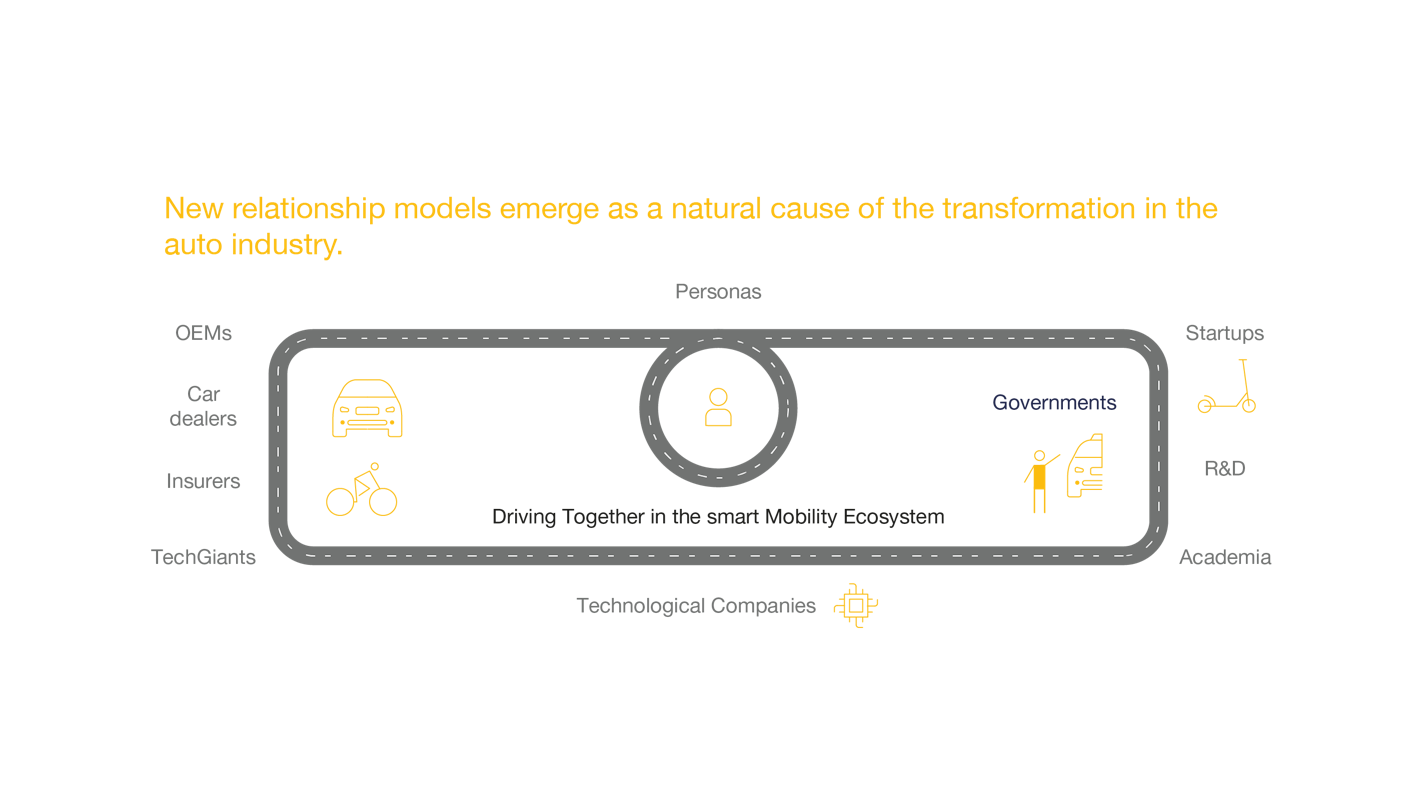

New ideas on how to move from point A to point B see the light of day thanks to the collaboration of not only the OEMs (Original Equipment Manufacturers), but of the entire ecosystem around mobility and the Auto industry. Toyota Connected and NTT DATA recently announced a business alliance, with the objective of increasing the functions and services of the Mobility Service Platform (MSPF) offered globally by Toyota Motor Corporation to expand connected car markets and countries, increase software development capabilities, and broaden operations.

Smart mobility is not going anywhere, it is here to stay. It is important to highlight the ease with which companies in the sector have been able to adapt to the current COVID-19 crisis the world is experiencing, in which the way we are moving now is not the same as before. New trends have become popular in these times to guarantee social-distancing, such is the case of the last-mile – any distance that is too close to drive but too far to walk. These mobility spaces can be solved by the use of bikes, electric scooters, mopeds and other micromobility solutions.

The Auto insurance has not lagged behind in the ongoing mobility transformation. Before COVID-19 arrived, it had already seen new models such as Usage-Based Insurance (UBI), Pay As You Drive (PAYD) or Pay How You Drive (PHYD), were gaining traction is a matter of not only focusing on the car coverage, but also on the vehicle movement and personas. In a mid-term projection, Auto insurance will insure everyday life events putting in the center personas and not the vehicle, becoming increasingly more personal.

Mobility comes with flexibility, in the vehicles to be used, in the schedules, in the journeys and their frequency. However, there is always a common point: the person who is moving. The insurance will evolve towards this new framework to cover the risks of a person or a group during the different trips. The vehicle is the axis that supports this offer but not the only one; we must take into account the increasingly real possibility of not being the owner of the vehicle but only a user of it.

Auto insurance policies will change, will not only offer the vehicle’s coverage, but also to the vehicle’s movement and personas.

From NTT DATA we envision that smart mobility is helping bridge different relevant actors to coexist in an ecosystem environment where relationships are increasingly liquid and where collaboration is necessary to offer the best mobility options adapted to personas and cope with unexpected events where the way of moving can become radically different.

Header photo by Samuele Errico Piccarini

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email