Why Inflation Does Not Scare new Health Insurtechs?

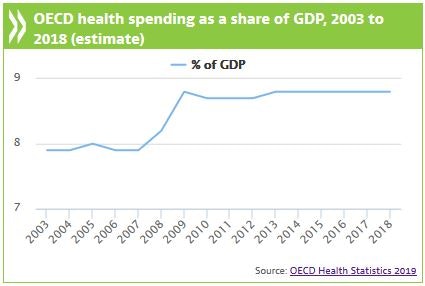

The surge in healthcare costs within advanced economies has spurred insurers to renegotiate contracts, yet the recent decrease in health spending as a percentage of GDP (from 9.7% in 2021 to 9.2% in 2022) does not necessarily signal reduced healthcare costs. Instead, countries like Switzerland and the USA anticipate health insurance increases of 8.7% and 6.5%, respectively, in the coming year. Health inflation, influenced by factors such as technology-driven productivity gains, austerity policies, and drug price hikes, appears to be a lagging variable catching up with the Consumer Price Index (CPI). The persistent pressure of an aging population further complicates the trajectory of health prices.

Amid these challenges, health insurtechs emerge as key players striving to avoid uncertainties within the insurance industry.

Employees Benefits

In the last Insurtech Global Outlook Report, we analyzed companies that care, including the main Insurtech players in healthcare in the last year. The highlighted companies include Alan Health, Betterfly, and YuLife which lead this segment in terms of money raised, reaching almost 1 B USD in total funding.

These three companies can support some of our conclusions in this post. Firstly, the common features between them can give us a glimpse into the internal KPIs, followed by the expansion of their operations to rank the importance of certain added services and products. Nevertheless, there is the assumption that these are successful companies on the right path to profitability or break even.

In the late 2010s and beginning of 2020s, the insurtech world's attention was focused on Oscar Health, Clover, and Bright Health. The promise that they could indeed disrupt the whole health insurance world was soon adjusted by low stock performance and financial metrics. In 2023, both the health insurtechs and VCs learned from past leaders, that deliver healthy financials and compete equally in the health insurance industry is close to impossible.

Commonalities

Since the partial failure of what we can call the first wave of innovation, the healthy new actors seem to understand its best strength: the customer experience. This goes beyond the frictionless claims or digital sales, the enhanced customer experience includes the ownership not only of customers' data but also their pains ultimately designing a much better value proposition. Moreover, the three mentioned leaders (Alan, Yulife, and Betterfly) seem to drop the insurance business altogether by complementing the offer with several other pillars or aiming for a 100% loss ratio, making insurance a piece of a much more complex puzzle: the Health.

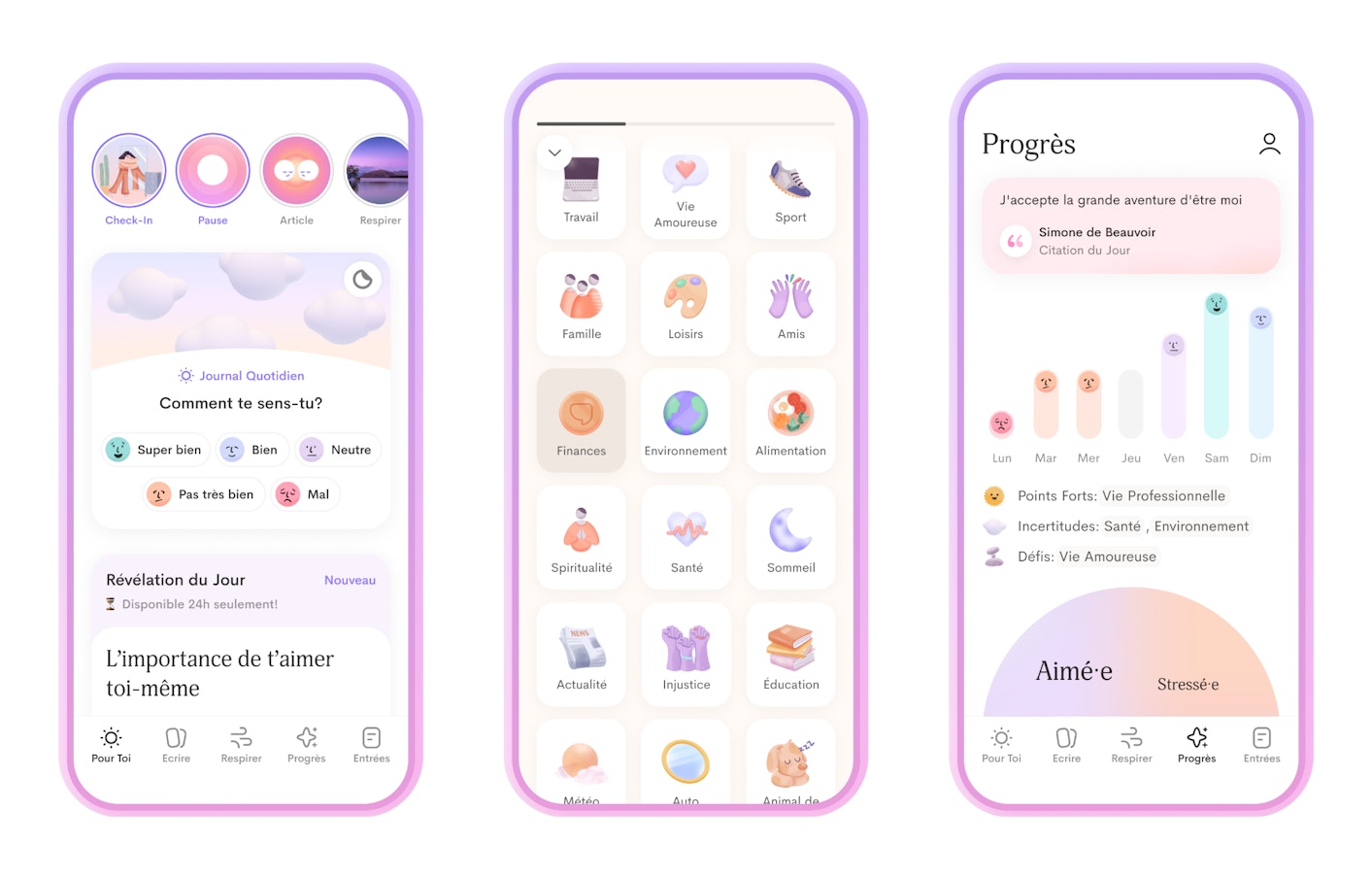

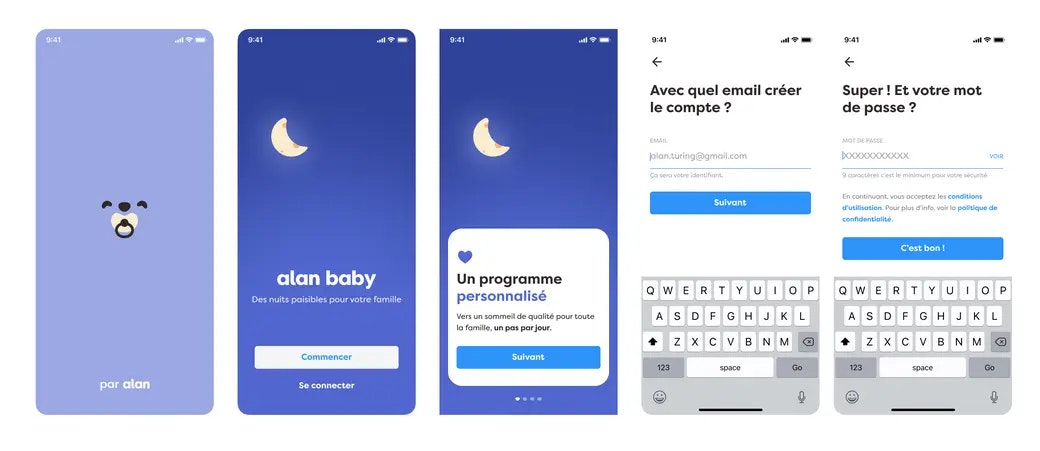

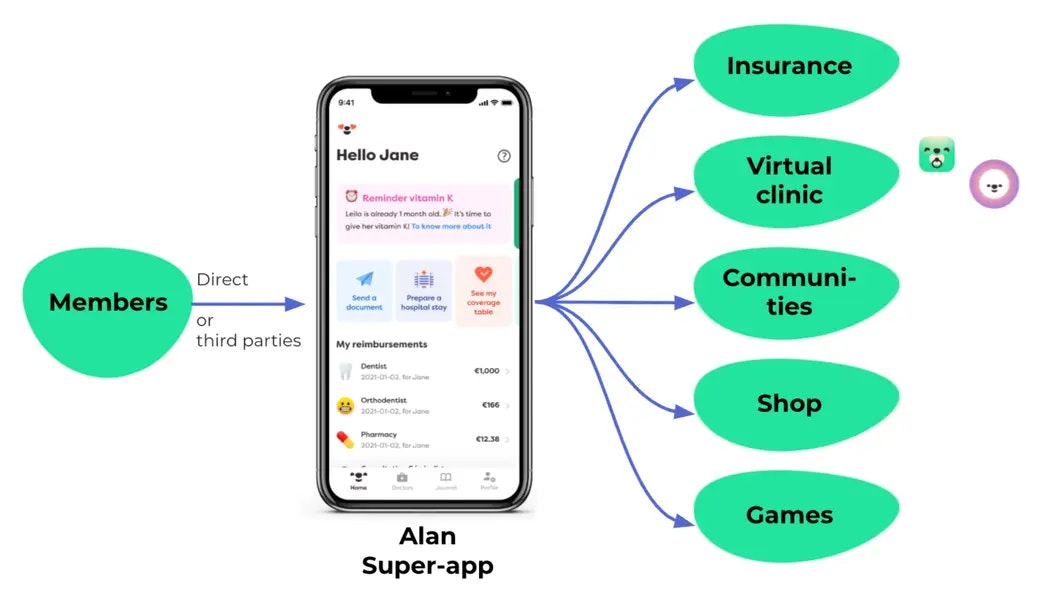

The first commonality: is the enhanced value proposition. These new players tend to talk about health and holistic care, which means in short three pillars: Mental, Body, and Financial health. By solving these three customer pain points, new players are looking much leaner and more innovative compared to Oscars of the past. To illustrate this point let’s look at Alan's new services and products in the past 3 years.

Alan Clinic

Alan Mind

Alan Baby

(Alan's baby shut down in 12 months, but the history of the app is another insightful source of what these new insurtechs are looking at)

Alan Glasses

And more

It will not be a surprise if there is a checkbox list with all customers’ pain points and a team trying to solve them. Betterfly and Yulife look the same, with several product tests with a comprehensive portfolio of services that indicate the customer-centric approach.

That brings us to the second commonality. The Health Sector has multiple stakeholders like insurance companies, Health Care Providers, Doctors, Nurses, Governments, Regulators, Vendors, Providers, and finally end customers. With such a structure, there is little capacity to be a customer-centric insurtech when the daily operations involve compliance with changing game rules, inflation pressure to mention one of several exogenous variables, and improvement of heavy actuarial business with negative cash flows. That is exactly what new players perceived that a traditional health Insurtech is an insurance-centric business, while a health platform is a customer-centric business. The latter is more likely to have the freedom and agility enough to be called an innovative startup.

Strategic Expansion

As these Insurtechs execute their expansion geographically and in terms of products/services, certain key variables emerge as crucial:

Cultural Alignment: Ensuring a seamless expansion involves understanding and aligning with the language and culture of the target market. All three companies have chosen markets with similar languages/cultures.

-Betterfly: Brazil, Colombia, Ecuador, Spain, Mexico, Peru, and Chile

-Alan: France, Belgium, and Spain

-Yulife: UK, USA and South Africa

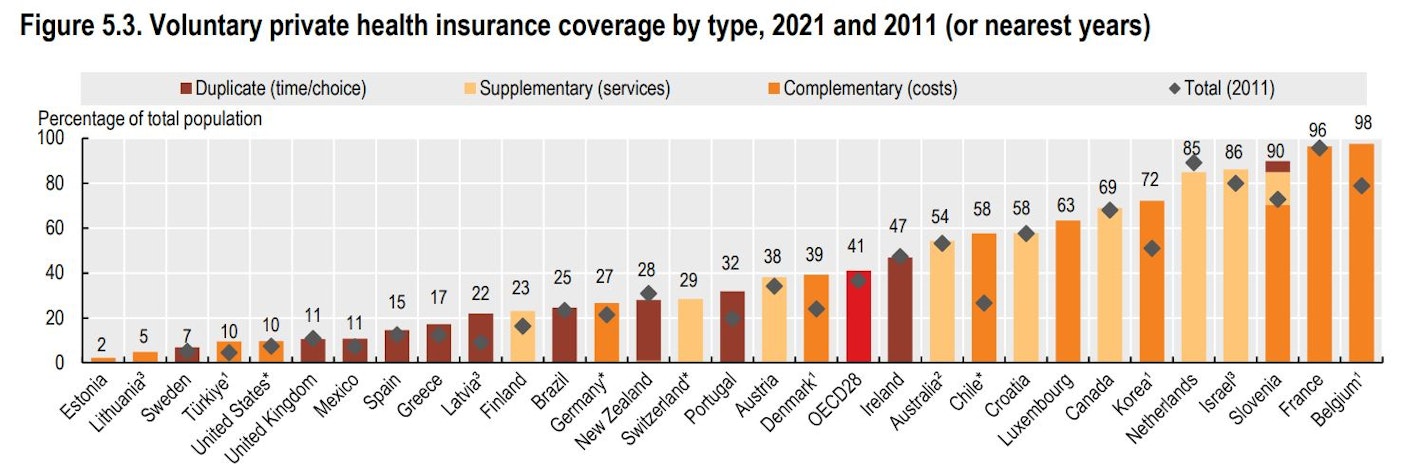

Insurance Dynamics: Recognizing the distinction between compulsory and voluntary private health insurance is essential for compliance and market penetration.

Mental Health and Well-being: The incorporation of services addressing mental health and overall well-being reflects a holistic approach.

Therefore, we cannot analyze these insurtechs solely with insurance metrics, the core business in new health Insurtechs is not insurance. Perhaps the NPS is more important than the loss ratio and the expenditure on voluntary private health more relevant than health inflation, either way, Health Insurtech Leaders nowadays is fundamentally different from past years.

Header photo by Wesley Tingey on Unsplash

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email