Embedded Insurance, Favourite Buzzword for Insurtech Innovators

The embedded insurance market, which was notably substantial in 2022, is on the cusp of unlocking a trillion-dollar opportunity by 2033.

Embedded insurance is fast becoming a favorite buzzword among Insurtech entrepreneurs and insurance innovators.

Embedded Insurance offers an important opportunity to help close the protection gap and grow the value of the insurance industry to the world. It provides a new approach to collaborate and innovate with third-party brands, of all sizes and groups, to help them grow their business, and create compelling protection solutions for the end users. Embedded insurance can be compared to a shopping mall where every customer can enter the mall to find their insurance coverage.

The industry is experiencing a notable shift towards embedded life and health insurance, marked by a growing trend where these insurance services are seamlessly integrated into various products and services. This shift is driven by a desire for enhanced customer experience, convenience, and personalized coverage. By embedding life and health insurance into non-insurance products or services, such as financial products, wellness programs, or digital platforms, the industry aims to make insurance more accessible and relevant to individuals' lifestyles. As life and health needs become more digital, the industry expects more tailored embedded insurance options.

How Embedded Insurance Benefits to different parties

Customers- find relevant policies

Embedded insurance is crucial for customers as it seamlessly integrates insurance services into non-insurance products, offering a convenient and tailored experience. Customers benefit from a more streamlined and cost-effective process, with personalized coverage options based on their specific needs. This approach not only enhances trust and loyalty through a unified and seamless experience but also allows for immediate coverage and personalized solutions that meet customers.

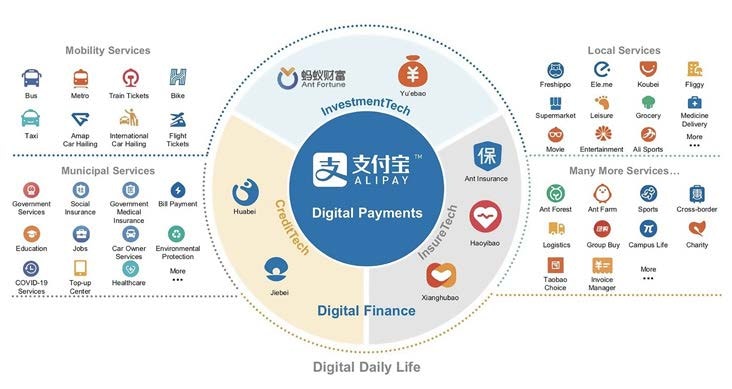

Ant Group Supper App

Source: Ant Group IPO filing 2020

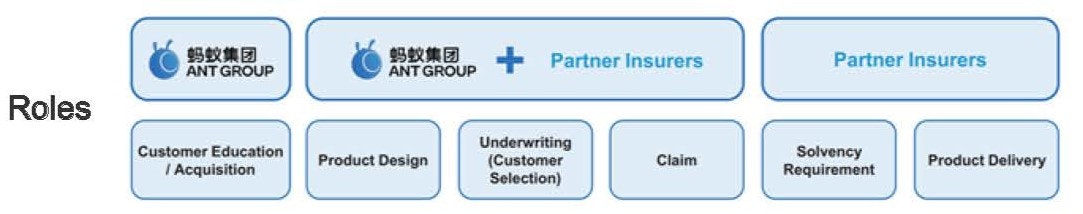

Ant Group manages a digital financial services platform in China with an enormous user base due to the ubiquity of Alipay and the Super app they’ve created around it. In terms of insurance, they spotted a large underserved market in low-income rural areas that traditional insurers were ignoring.

Rather than trying to resell existing insurance products from one or two partners they created their own Insurtech platform to connect demand with supply in a new way.

Ant Group focuses on understanding the needs of its consumers, educating them about the value of insurance, and then designing compelling solutions for them with its suppliers.

Its insurance partners take on most of the underwriting and regulatory risk and deliver products to Ant’s specifications. It now offers 2000 customized, affordable, and flexible life and non-life products from 90 different insurance suppliers.

Insurers -no code strategy

For insurers, embedded insurance is significant as it opens new distribution channels and enables them to reach a broader customer base. By integrating insurance seamlessly into various products and services, insurers can enhance their market presence and create innovative solutions. This approach facilitates efficient underwriting through the utilization of contextual data, leading to more accurate risk assessments and pricing. Additionally, embedded insurance often fosters partnerships with non-insurance companies, allowing insurers to diversify their offerings and stay competitive in a rapidly evolving market. Overall, embedded insurance presents insurers with opportunities for growth, increased efficiency, and the ability to adapt to changing customer expectations.

Embea H&L embedded insurance

Embea, has successfully concluded its seed funding round, securing a total of €4 million. The funding was led by Atlantic Labs, a seed fund based in Berlin, and Astorya.vc, specializing in investments in European InsurTech startups. Established in 2022, Embea plans to utilize the funds to expand its Embedded Life Insurance platform across Europe and diversify its range with new insurance products.

Breaking away from the conventional approach of purchasing insurance through brokers or dedicated websites, Embea is at the forefront of the growing trend of embedded insurance. This innovation allows individuals and families to obtain life insurance coverage seamlessly with just a few additional clicks during non-insurance activities, due to it is easy to understand, 100% digital process, and fast payout.

With the no-code embedded checkout technology, the integration process is streamlined and swift, taking only a few days. Embea enables these players to enhance their platforms by offering life insurance. Embea insurance offers financial protection against the three most common, critical illnesses: Cancer, stroke, and heart attack.

Small and Medium Startups- bridge the protection gap

A significant protection gap exists for small business owners in the United States. According to a survey conducted by LegalZoom, only 9% of entrepreneurs indicated having business insurance at the inception of their businesses. Embedded insurance benefits small startups by simplifying the acquisition of essential coverage, seamlessly integrating it into business processes. This streamlined approach, tailored to industry needs, is cost-effective and transparent, allowing startups to efficiently access the target customer.

Next Insurance Partnered with LegalZoom

LegalZoom is the number one brand in online business formation according to small business owners and is a leading online platform for legal and compliance solutions in the United States. With its mission to democratize law, LegalZoom operates across all 50 states and over 3,000 counties in the United States and has more than 20 years of experience navigating complex regulations and simplifying the legal and compliance process for its customers.

Next Insurance provides seven types of insurance policies, offering businesses the flexibility to design coverage that suits their needs. As a prominent digital insurance provider for small businesses in the US, Next Insurance has joined forces with LegalZoom to introduce embedded insurance services for SMEs and micro-businesses.

This collaboration aims to assist small business owners in establishing and safeguarding their businesses online. Among the offerings, NEXT's fully embedded insurance solution, NEXT Connect, allows small business owners to swiftly receive a quote for business insurance and purchase a customized plan without navigating away from the LegalZoom platform.

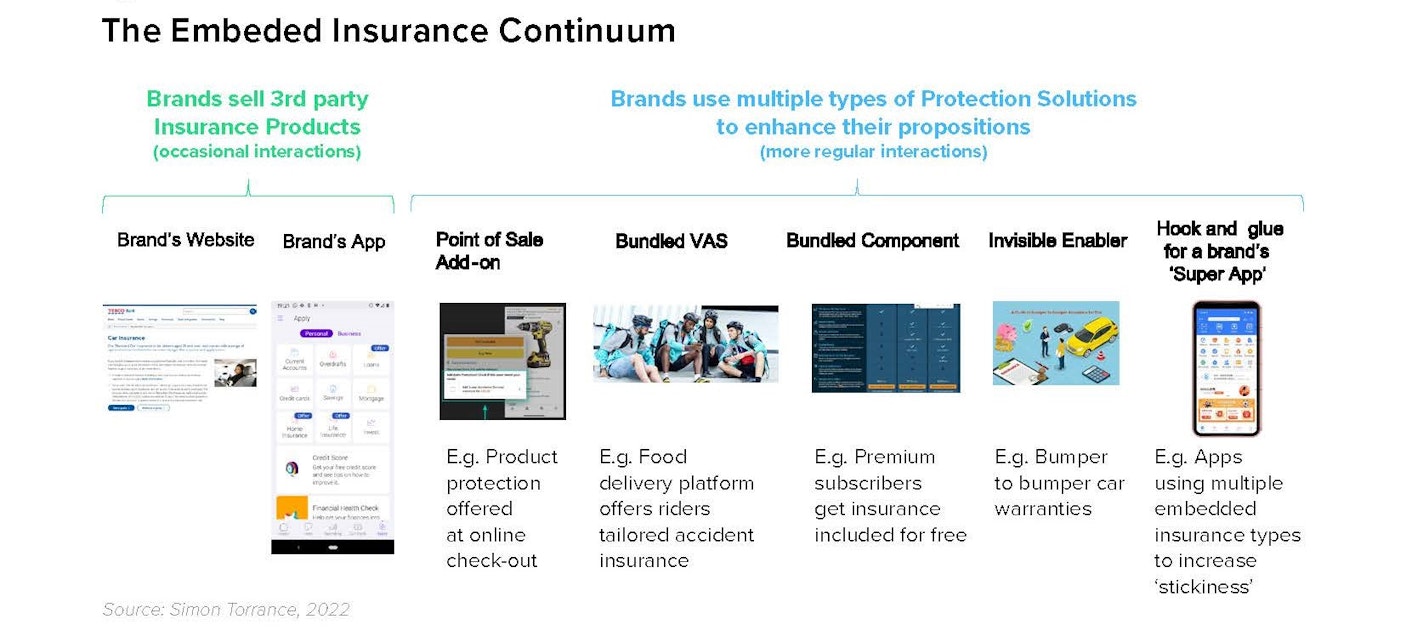

Embedded Insurance Continuum with New Product Approach

Key trending technologies include Artificial Intelligence (AI) for hyper-personalization, analyzing data to suggest suitable coverage, and continuously adapting recommendations based on user interactions. This makes the insurance experience more intuitive and user-centric. Cybersecurity is crucial in embedded insurance to protect personal and financial data, ensuring the robustness of security to maintain user trust in the digital realm.

Marsh has developed an embedded micro-cyber insurance program to protect consumers from cyber risks such as cyberbullying, identity theft, and online violations. This program, offered by organizations like a consumer electronics manufacturer, provides coverage for various personal cyber risks during a promotional period, with an option for a small monthly fee thereafter. The coverage includes protection against cyberbullying, viruses, extortion, online money theft, identity theft, online account theft, failure to deliver goods purchased online, and legal costs related to cybercrime.

The embedded micro-cyber insurance program aims to boost consumer confidence, strengthen brand loyalty, and differentiate products in the competitive marketplace. It caters to a vast market, including millions of students worldwide. The program not only benefits consumers by managing their cyber risks but also offers advantages to manufacturers, such as product differentiation, increased sales, opportunities to sell other coverages, strengthened brand loyalty, visibility on cyber claims data, online cyber awareness training, and valuable data insights.

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email