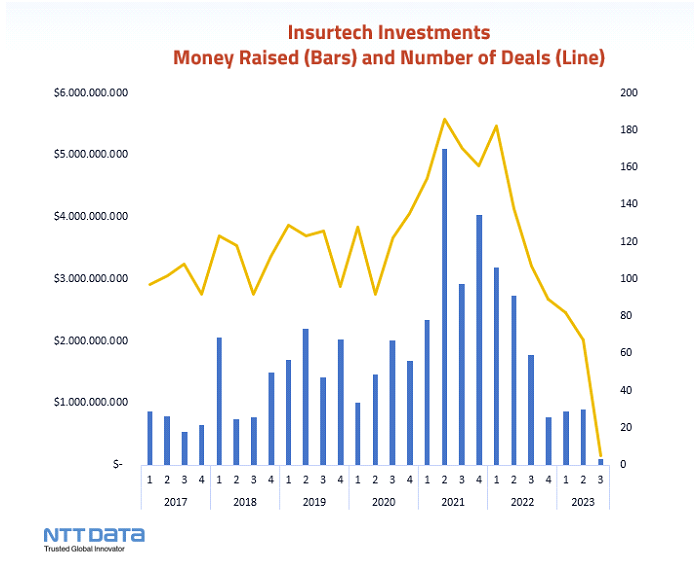

InsurTech Industry in Transition: Investment and Emerging Trends

Data sourced from crunchbase

Key points:

High interest rates increase borrowing costs for investors and reduce investment demands.

The market's growth stage transitions from existence to survival, leading to a rise in PE deals and a decrease in seed round investments compared to the previous year's H1.

Thriving market leaders with a significant consumer base become more attractive to investors.

Advancing technology and market leaders create high barriers to entry for startups.

The investment landscape in North America and Europe underwent changes in the first half of 2023, influenced by various factors.

Macroeconomic variables affect investment climate

Macroeconomic variables can have a significant impact on the investment trend, particularly changes in interest rates. The cost of capital for both investors and startups can be affected, as higher interest rates lead to increased borrowing costs for investors, making funding more expensive. As a result, insurTech companies are now facing a completely different landscape, which is pushing them to adapt at a rapid pace.

Increasing interest in the PE deals

Data sourced from crunchbase

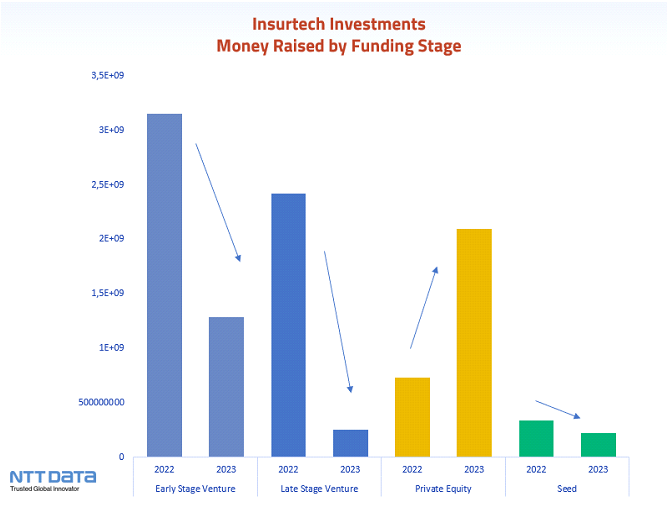

The increase in the size of Private Equity (PE) deals is primarily driven by post-IPO and PE activity. This shift in investment trends has resulted in a decrease in the scale of seed round and venture stage investments when compared to private equity, leading to an overall reduction in funding amounts. In general, PE rounds are for more mature companies seeking significant capital and strategic partnerships, while VC rounds are for early-stage startups aiming for rapid growth and support in their initial stages. PE rounds are now more prominent, attracting more mature companies seeking substantial capital and strategic partnerships.

During the first half of 2023, numerous companies have emerged in the PE stage, aiming to expand their markets and enhance their competitive edge through funding initiatives. One such company, SageSure, a managing general underwriter focusing on coastal residential and commercial property markets, successfully secured an impressive $250,000,000 in funding. Likewise, Gravie, an insurance company offering brokerage and insurance coverage services, also raised a substantial amount of funding, reaching $179,000,000. This capital injection presents an opportunity for Gravie to further expand its service offerings and solidify its position in the market. Both companies' funding achievements exemplify the growing interest and potential in the InsurTech industry, as companies seek to innovate and adapt to meet the evolving demands of the insurance market.

Leading InsurTech companies with strong market power

The evolution of the InsurTech industry has been remarkable, moving from its early existence stage, which saw the rise of prominent American Insurtech leaders around 2015, to the current survival stage in 2023. In this survival stage, established companies like Oscar and Lemonade exhibit greater maturity and shift their emphasis from rapid growth to expanding their business operations and consolidating their market position.

As the industry advances, investors are now more inclined to fund established companies with stronger market power, who have successfully passed the initial stages of growth. This shift in investor focus reflects a growing interest in supporting and investing in companies that have demonstrated their ability to thrive and adapt in the competitive InsurTech landscape.

High entrance barrier for startups

The InsurTech industry poses significant challenges for young startups due to technology and intense competition. Startups without sufficient resources to implement advanced technology struggle to enter the market, while established insurance companies actively invest in or partner with small startups, making it harder for new entrants to gain traction. Accelerant and Incline serve as examples of the technology barriers facing new players. Accelerant, a data-driven InsurTech provider, secured $150,000,000 to enhance its risk exchange platform and attract insurance partners. Meanwhile, Incline, a leading insurance program market services firm, obtained $125,000,000 to improve touchless claims management and invest in cutting-edge risk mitigation technologies. These funding efforts reflect the industry's dynamics and the need for innovative solutions to thrive in this competitive landscape.

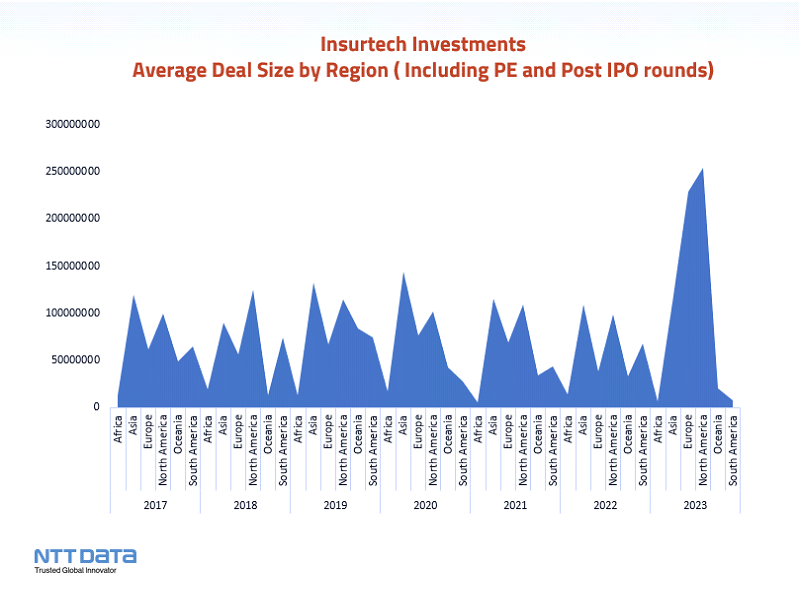

Investment landscape changes in North America and Europe

The investment landscape in both North America and Europe experienced significant changes in the first half of 2023. Notably, there was a remarkable doubling of the average deal size in these regions, primarily due to the increasing engagement of Post IPO and private equity transactions. This shift has resulted in larger deals becoming more prevalent, signifying a substantial transformation in the investment landscape across both continents.

During this period, Alera Group, a financial services firm based in the USA, specializing in employee benefits, property and casualty insurance, and wealth management programs, successfully raised $100,000,000 in funding. This substantial investment likely facilitated the enhancement of their employee benefits offerings and potentially enabled them to forge partnerships with other firms to expand their market reach.

Data sourced from crunchbase

InsurTech companies are also gaining traction in emerging markets. In Brazil, the focus is on life insurance, digital health, and PAYD solutions, with companies like Sami, Iza, and Justos revolutionizing the sector. Nigeria stands out as an InsurTech hub in Africa, concentrating on distribution, risk management, and insurance infrastructure, led by firms like Curacel, Trade Lenda, Paddy Cover, and Area. In Oceania, attention is on climate risk and brokers platforms, with companies like Reask and Simfoni making strides. Together, these emerging markets contribute to a growing InsurTech sector, offering innovative solutions tailored to regional insurance needs and creating opportunities for further industry expansion.

Header photo by Adi Goldstein on Unsplash

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email