Unlocking Opportunity: Lower Market Caps Propel Insurtech M&A Surge

Prospects for Insurtech M&A deals

The insurance industry is undergoing a profound transformation, propelled by the rise of technology and the emergence of innovative Insurtech companies. Within this dynamic environment, the surge in mergers and acquisitions (M&A) activities among Insurtech firms is reshaping the competitive landscape and driving strategic realignments across the sector.

At the heart of this trend is the convergence of various factors, including the lower market capitalization of publicly traded Insurtech companies. The broader downturn in valuations across the tech industry has affected Insurtech firms, creating conditions conducive to increased M&A activity. The recalibration of market expectations has prompted strategic reassessments among both Insurtech startups and established players, catalyzing a wave of consolidation and partnership formation.

For insurance carriers, the downturn in valuations represents a strategic opportunity to acquire Insurtech capabilities at more favorable prices. The allure of integrating advanced technologies and digital solutions into traditional insurance operations has never been stronger. As a result, Insurtech companies have become attractive targets for corporate entities seeking to enhance their competitive positioning and adapt to evolving market dynamics.

Geographic preferences

The partnership between insurance and Insurtech has evolved significantly in recent years, driven by advancements in scalable integration technology. Beyond the realm of digital sales, Insurtech innovations are now permeating traditional offline distribution channels, particularly in areas such as underwriting and risk segmentation. This expanded scope of collaboration underscores the transformative potential of Insurtech solutions in redefining traditional insurance processes and enhancing customer experiences.

Despite the challenges posed by the COVID-19 pandemic, Insurtech M&A activity has remained resilient, buoyed by the growing interest of insurers in augmenting their capabilities along the value chain. European investors have demonstrated a heightened appetite for acquiring US-based Insurtech firms, reflecting a broader trend of cross-border collaboration and investment in the sector.

Industry preferences

Within the realm of Insurtech, certain segments have emerged as particularly attractive targets for M&A activity. Companies specializing in insurance enablement, such as Descartes Underwriting and AgentSync, have garnered attention for their innovative solutions and market potential. Descartes Underwriting, with its focus on climate risk modeling and data-driven risk transfer, stands out as a prominent player in the Insurtech landscape. The company's parametric model, designed to address the challenges of climate change insurance, has positioned it as a leader in the field and a desirable acquisition target for firms looking to diversify their offerings and enhance their risk management capabilities.

Similarly, AgentSync's innovative solutions have positioned it as a key player in streamlining compliance and licensing processes within the Insurtech ecosystem. As regulatory requirements become increasingly complex, the demand for solutions that automate and simplify compliance procedures has grown substantially. AgentSync's platform addresses this need, making it an appealing acquisition target for companies seeking to strengthen their compliance capabilities and streamline operational workflows.

The logic behind Insurtech M&A deals often revolves around strategic considerations such as vertical integration and market expansion. Vertical mergers enable companies to enhance their upstream or downstream business models by integrating new technologies and capabilities. In the case of AgentSync, its expertise in compliance and licensing solutions positions it as a strategic asset for acquirers seeking to fortify their presence in the Insurtech ecosystem.

Horizontal mergers, on the other hand, aim to consolidate market share and gain a competitive edge within specific segments of the Insurtech industry. By combining complementary strengths and resources, companies can achieve economies of scale and accelerate their growth trajectories. For example, companies like Descartes Underwriting represent attractive targets for acquirers looking to tap into new revenue streams and expand their market reach.

Why companies do not acquire lemonade?

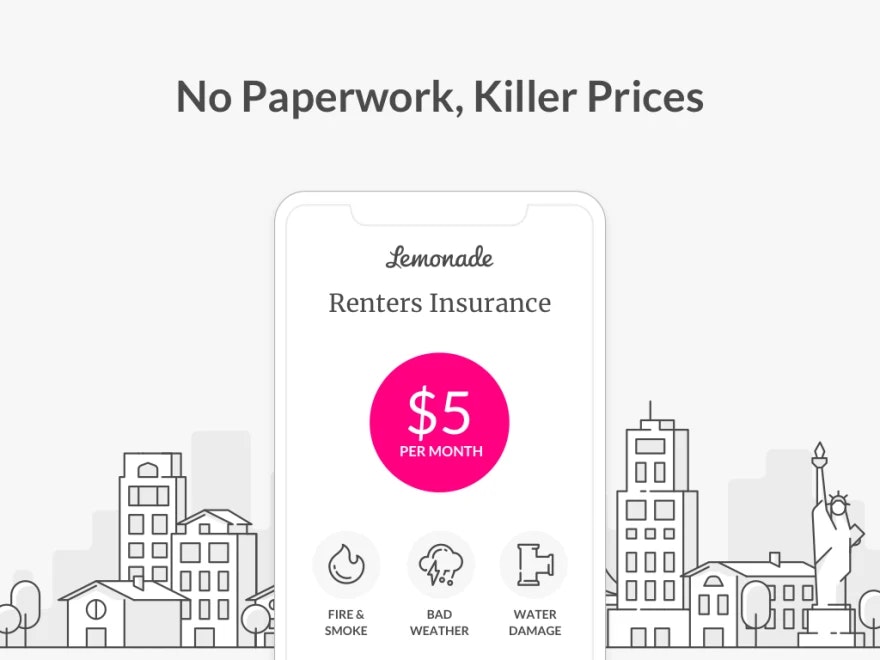

However, not all Insurtech companies are equally positioned for acquisition. Companies like Lemonade present unique challenges for potential acquirers due to their distinctive brand image and strategic vision. Lemonade's peer-to-peer insurance model, characterized by its pink and white webpage, and emphasis on social impact, sets it apart in the industry. The company's long-term commitment to technological innovation and profitability further distinguishes it from other players in the market.

¨The brands are masculine, the fonts are harsh and they’ll either use dark navy or dark red for their colours. We went with a very feminine style with pink as our leading colour. And that not only created a contrast in terms of the look, but also the tonality, which is much more caring. ¨

-- Daniel Schreiber, CEO of Lemonade

Despite its success, Lemonade's strategic focus and commitment to its core values make it less susceptible to acquisition. The company's emphasis on long-term sustainability and social responsibility aligns with the evolving expectations of consumers and investors alike. As such, Lemonade represents a testament to the transformative potential of Insurtech and the broader shift towards a more inclusive and customer-centric insurance industry.

In conclusion, the surge in M&A activity within the Insurtech sector reflects the evolving dynamics of the insurance industry and the growing importance of technology-driven innovation. As companies seek to adapt to changing market conditions and capitalize on emerging opportunities, strategic partnerships and acquisitions will continue to play a pivotal role in shaping the future of insurance. By embracing innovation and collaboration, Insurtech companies can unlock new avenues for growth and create value for customers, shareholders, and stakeholders alike.

Insurtech Global Outlook - NTT DATA

Header photo by Nejc Soklič on Unsplash

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email