New Era of Wellness in L&H Insurance: Health as a holistic concept

In the new world of life and health insurance, the focus is on making healthcare easy and top-notch. A big step forward is giving mental health the same importance as physical health, making it easier for people to get mental health support. This approach shows a modern way of dealing with mental health concerns.

At the same time, insurance companies are embracing a responsive and comprehensive strategy to cater to the diverse healthcare needs of their members. This dynamic marks a transformative chapter in mental health coverage. Although the mental health landscape is undergoing significant evolution, the market response has been relatively limited. This post will delve into two compelling case studies, providing valuable insights on how insurance can play a vital role in advancing mental health care.

Case of Headway - bridge the gap between therapists and clients

Headway, established in 2019, addresses a critical issue in mental health care in the United States. Despite one in four people having a treatable mental health condition, a significant barrier to access is the cost, as many therapists do not accept insurance.

Headway has pioneered a software-enabled network of therapists who accept health insurance, revolutionizing access to affordable and quality care. With a mission to make therapy more accessible, the platform powers over 500,000 appointments monthly. Headway's success is evident in its substantial funding, having raised over $225 million, including a recent Series C round in October 2023, securing $125 million and reaching a valuation of $1 billion, according to Reuters article. The support from notable investors like a16z, Thrive, Accel, GV, and Spark Capital underscores the significance of Headway's vision in transforming mental health care accessibility.

Headway's primary services play a pivotal role in addressing critical gaps between mental health therapists and clients. Serving as a bridge, the platform effectively reduces information and cost barriers. Clients benefit from easy access to service providers specializing in various topics, including pandemic-related anxiety, family challenges, and career-related stress. The platform's unique approach allows clients to save an average of 75% on services, positioning Headway as a standout player in the insurance market. With a client-centric business model, Headway demonstrates a commitment to making mental health services more accessible and affordable for individuals.

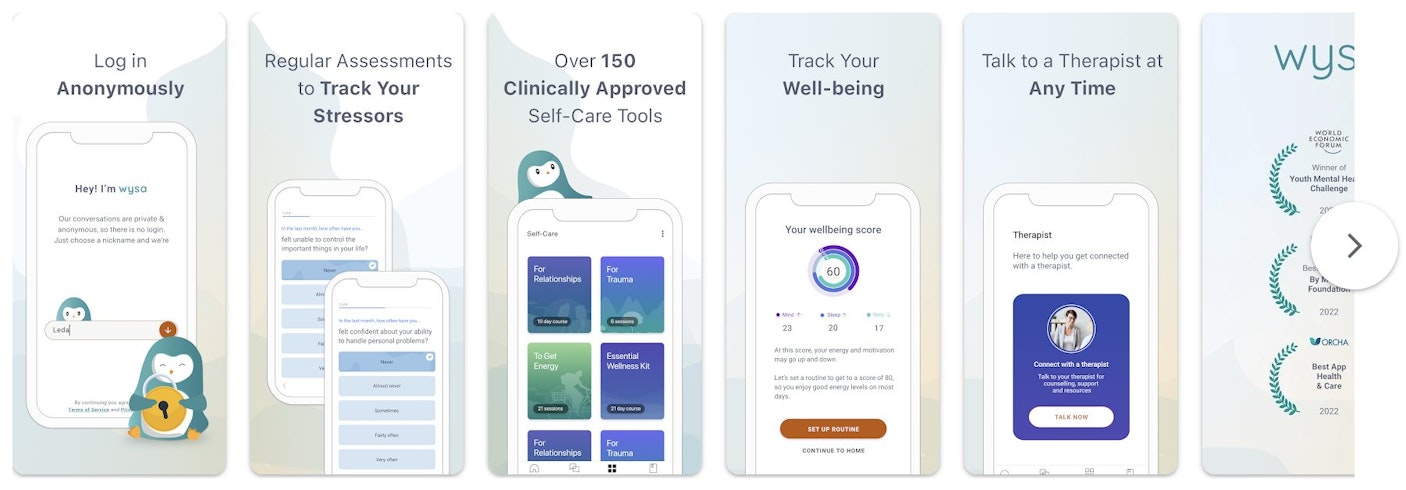

Case of Wysa Assure: AI-enabled responsive early-stage mental health support app tailored to the insurance industry

In August 2023, Swiss Re Reinsurance Solutions and Wysa launched Wysa Assure, an AI-based mental health support app. It is the first insurance-specific mental health app that measures an individual’s risk score.

Wysa has helped over 6 million people through 550 million AI conversations across 95 countries. The Wysa Well-Being score is calculated by combining what is recorded about the user’s mood with fitness app data on activity and sleep. Through the incorporation of Swiss Re’s scoring mechanism, Wysa Assure users can quantify their mental health status for improved monitoring, while insurers benefit from a comprehensive reporting suite equipped with data to enhance their portfolio management.

Central to the design of Wysa Assure is an AI chatbot, built on cognitive behavioural therapy principles, that is clinically proven to improve symptoms of depression and anxiety. The app prioritises user anonymity in compliance with data protection laws and to encourage customers to feel comfortable to open up.

Australian insurer MLC Life Insurance is the first partner to bring Wysa Assure to market through its Vivo program. Wysa Assure seamlessly integrates self-care modules and MLC Life Insurance’s broader Vivo support networks. Vivo has an extensive range of products and app features including stress-relief programmes and therapeutic techniques, as well as exercises and a wellbeing score to help users keep focused on their mental and emotional health. The purchase process is done 100% by agents, accessible to all, and it is available at no additional cost as it is included as part of every MLC Life Insurance policy.

In essence, the care services offered by Wysa Assure are completely virtual, for both its free version and premium version. Every Wysa app user has access to self-care options in the form of an unlimited chat with the AI chatbot, which is completely free. Users looking for extra support can also subscribe to a premium version to book one-on-one sessions (text-based or audio-video-based) with a coach and get access to the entire library of tools. However, in extreme cases, there are built-in crisis escalation pathways to human care that can be triggered during AI conversation with the user, or by the user selecting an SOS feature.

In conclusion, as people's needs for both physical and emotional well-being change, smart insurers have a chance to grow by offering more options. Especially for insurers working with businesses, providing strong mental health coverage as part of employee benefits is a valuable addition. Many companies now understand how crucial mental health is for their employees' well-being and work performance.

By creating a supportive environment that eliminates barriers to access and encourages proactive mental health care, many disorders can be effectively managed at an early stage, thus reducing the long-term impact on individuals and potentially lowering overall healthcare costs. Moreover, in a market where consumers are becoming more conscious of their mental well-being, offering comprehensive mental health services can provide a significant competitive advantage for insurers in attracting and retaining policyholders.

Header photo by Jackson David on Unsplash

Subscribe to Our Newsletter

Get the latest insights about Global solutions for leading insurers on your email